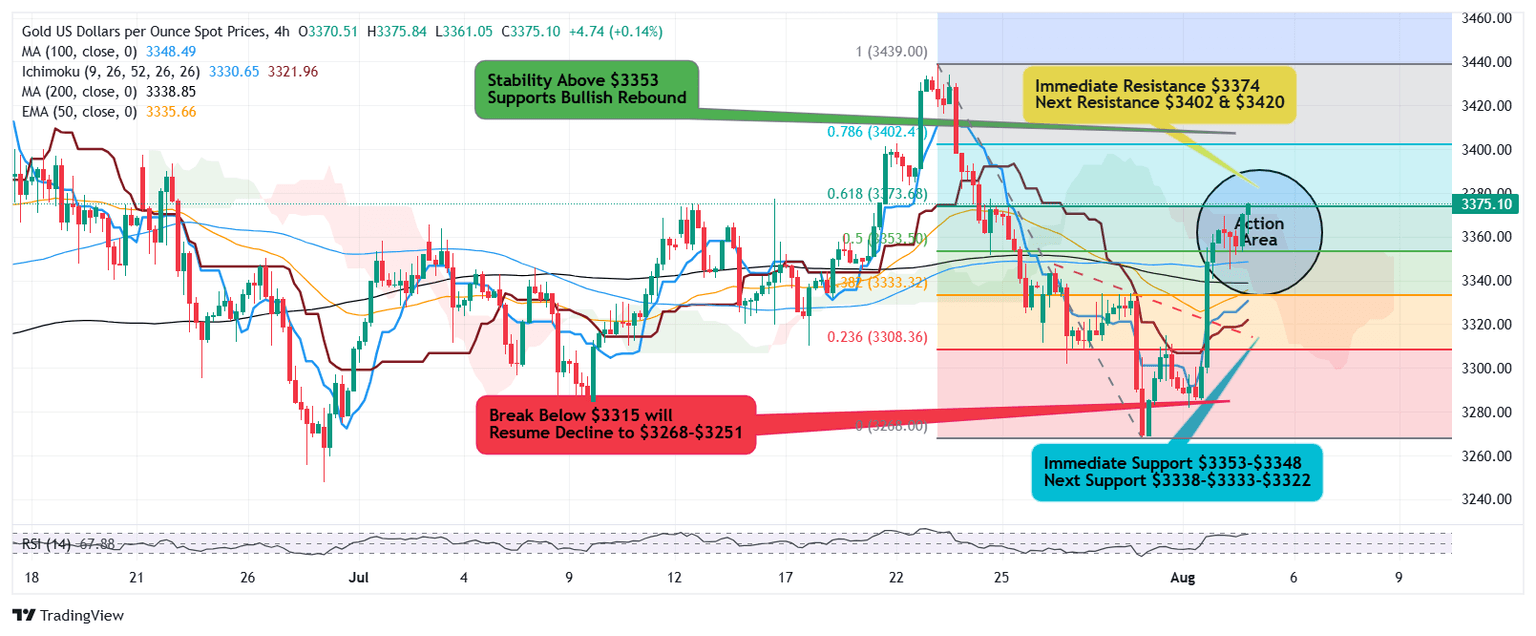

US tariff, disappointing jobs report boost Gold rebound – $3,420 next?

-

Significantly lower than consensus Jobs Report raise questions on US jobs markets.

-

Trump Tariff continues to haunt global trade and economic sentiments.

-

Weakening Dollar triggers Gold rush as safe haven demand increases.

-

Markets consider expectations of rate cut in September Fed meeting.

Dollar Index makes a sharp decline after climbing to 100 psychological benchmark and dropped back to 98.60 while next support 98.30 is crucial. The weakness in Dollar usually acts as tailwind to Gold which boosts demand for the metal as holding costs looks attractive.

Trump continues to drop Tariff bombs on one country after another raising global economic concerns as also causing unease on home front as it is ultimately going to add up to consumer prices back home, causing higher inflation in near future.

There is a growing optimism of a rate cut by Federal Reserve in its September meeting as worsening jobs markets raise concerns on economy and business environment already reeling under contraction and Fed's admission that inflation is yet to come under targeted range.

What's happening with Gold?

The recent drop in prices that dipped to $3268 on Thursday 30th August, scared retail buyers out and the institutional buyers swept the market liquidity reversing the immediate trend to bullish as the sharp rise in prices smashed through multiple resistances and todays New York opening witnessed yet another high of $3385

What's up next?

As Gold is trading a tad higher than 61.8% Fibonacci zone of $3374, bullish momentum prevails unhindered and is expected to extend advance towards next leg higher $3402 corresponding to 78.6% Fibonacci zone while major upside target sits at $3420 which aligns with an critically important order block on 4 hour time frame and could act as a supply channel ahead.

Any pullback towards support zone is a possibility as prices usually show retracement to breakout zone and resume the trend to join the prevailing rally. A retest of $3360-$3350 will witness buying again as next upside target sits at $3402

Note: Gold is in a clear Bullish momentum and pullback towards support zone should be considered as a buying opportunity.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.