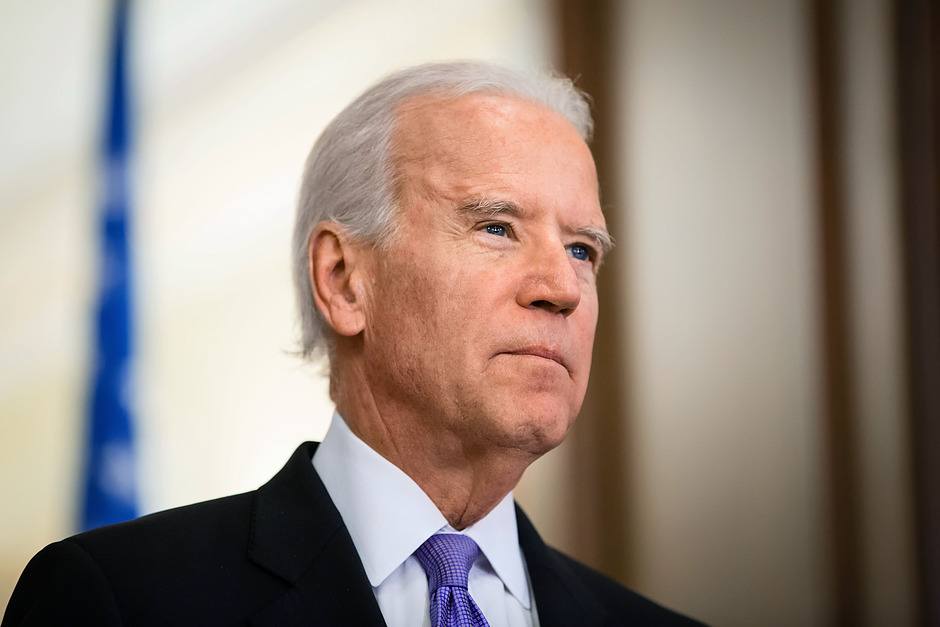

US stocks rally as Biden secures an infrastructure deal

US stocks rallied in the regular session and extended hours after President Joe Biden secured an infrastructure deal with Senators. The total cost of this deal will be $1 trillion, which is significantly lower than the $2.3 trillion he had proposed. This is a major win for the president, who promised to use his experience in Washington to secure bipartisan deals. The new package will have $109 billion for roads and bridges, $66 billion for rail networks, and $49 billion for public transit. Other key issues in the deal will be ports, airports, and electric vehicle charging stations.

US stocks also rose after the Federal Reserve released its stress test results in which all banks passed. The new report clears the banks to start boosting their payouts to shareholders after June 30. The statement said that banks would do well in an extreme scenario where the economy crashed, leading to an increased unemployment rate. In this case, the banks would have a capital ratio of about 10.6%, which is double their minimum. Some analysts expect that banks will return more than $200 billion to investors.

The New Zealand dollar rose against the greenback after relatively strong trade numbers from the country. Its exports rose from more than N$5.40 billion in April to more than N$5.87 billion in May. In the same period, imports rose from more than N$4.99 billion to $5.4 billion. This led to a trade surplus of more than N$469 million. These numbers show that the country’s economy is doing well, helped by the strong internal and external demand. Elsewhere, the US will publish its personal consumption expenses data later today. Analysts expect the figure to increase from 3.1% in April to 3.4% in May.

EUR/USD

The EURUSD pair rose to 1.1940 during the Asian session. On the four-hour chart, the pair is slightly above the 61.8% Fibonacci retracement level. Further, it has formed a bearish flag pattern that is shown in pink. It is also below the 25-day moving average while the money flow index (MFI) has risen to 47. Therefore, the pair will likely remain in this range today and possibly break out lower in the coming week.

NDX100

The Nasdaq 100 index rose to an all-time high of $14,430 after the Biden infrastructure deal. Investors also downplayed last week’s hawkish statement. On the four-hour chart, the index is substantially above the previous double-top pattern at 14,086. It is also above the 25-day and 50-day moving averages. It is also above the ascending red trendline. Therefore, the bullish trend will remain as long as the price is above the two moving averages and this trendline.

XTI/USD

The West Texas Intermediate (WTI) rose to a high of 74.47 ahead of an upcoming OPEC+ meeting. On the daily chart, the XTI/USD pair is above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved to the overbought level of 70. XTIUSD is a commodity based on West Texas Intermediate crude oil and it can be considered US Oil. The bulls power indicator kept rising. Therefore, the path of least resistance is higher ahead of next week’s meeting.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.