US stock markets hold within short term consolidation patterns [Video]

![US stock markets hold within short term consolidation patterns [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Nasdaq/nasdaq-marketsite-times-square-nyc-2001-39895830_XtraLarge.jpg)

Emini S&P December futures holding both support at 4500/4490 & strong resistance at 4550/60 as we form a downward sloping channel.

Shorts at 4550/60 worked perfectly as prices collapsed from 4566 to my target & support at support at 4500/4490 as predicted, with a low for the day exactly here. Can't do better than that!

Shorts at 4550/60 can retarget 4500/90. If we continue lower this week however look for 4465/60 & 4450. Eventually we could retest the 3 month trend line at the lower end of the range at 4400/4380.

Holding support at 4500/90 can target resistance at 4550/60 of course.

Nasdaq December futures we wrote: are stuck in the middle of a 2 month triangle consolidation pattern from support at 15360/330 up to resistance at 15730/770. Trade the range & wait for a breakout.

In fact these levels almost exactly matched Friday's high & low for the day. Trade the levels while we wait for a breakout.

A break below 15290 today is a sell signal targeting 15240/230, perhaps as far as 15130/100.

A break above 15800 can target 15850/860 & 15910/930.

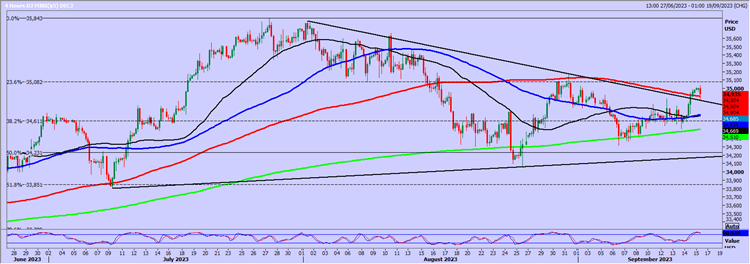

Emini Dow Jones December fooled me with the break above the upper trend line resistance at 35120/160 before collapsing back below 35070.

On Friday we lost all of Thursday's strong gains. We have traded is a volatile sideways consolidation for a month. At this stage I must wait for a clear pattern or trend to identify a low risk opportunity.

Author

Jason Sen

DayTradeIdeas.co.uk