US Q2 GDP Preview: Economy to continue to expand at strong pace, eyes on FOMC

- US economy is expected to grow more than 8% in Q2.

- Weakening activity in the service sector could weigh on growth.

- FOMC's policy outlook is likely to remain the primary market driver.

The US Bureau of Economic Analysis (BEA) will release on Thursday, July 29, its first estimate of the annualized Gross Domestic Product (GDP) growth for the second quarter. Investors expect the US economy to have expanded by 8.6% following the 6.4% growth recorded in the first quarter.

FOMC to stay focused on inflation and employment

In its final estimate of the Q1 GDP, “the increase in real GDP in the first quarter reflected increases in personal consumption expenditures (PCE), nonresidential fixed investment, federal government spending, residential fixed investment, and state and local government spending that were partly offset by decreases in private inventory investment and exports,” the BEA noted while adding that imports also increased during that period.

Consumer spending amid economic reopening and vaccinations is likely to play an important part in the US economic performance in the second quarter. However, the service sector seems to have lost some momentum in the last month due to the heightened concerns over the coronavirus Delta variant and this situation could weigh on the growth.

The ISM Services PMI edged lower to 60.1 in June from 64 in May and the Markit Services PMI declined to the lowest level since February at 59.8 in July’s advanced reading. Meanwhile, the Federal Reserve Bank of New York's latest Nowcasting Report showed that the economy is expected to expand by 3.2% while the Atlanta Fed’s GDPNow for Q2 stood at 7.6%.

Even if the Q2 GDP data arrives weaker than expected, it would be surprising to see a significant reaction from the markets as the Fed remains focused on inflation expectations and the labour market. Unless there is a large divergence, the USD is likely to move in accordance with the tone of the FOMC’s policy statement and Chairman Jerome Powell’s remarks on the policy outlook.

Market participants will look for clues regarding the timing of asset tapering in the FOMC’s Monetary Policy Statement. In case policymakers voice their willingness to adjust purchases before the end of the year, this could be seen as a hawkish stance and provide a boost to the greenback. On the other hand, the FOMC could opt out to adopt a cautious tone amid coronavirus Delta variant fears and reassure markets that they will continue to support the economy while refraining from providing a timeline on asset tapering. A dovish tilt in the policy outlook could hurt the USD in the second half of the week.

Federal Reserve Preview: Three reasons why Powell could pause, pummeling the dollar.

Fed Interest Rate Decision Preview: The horns of an inflation dilemma.

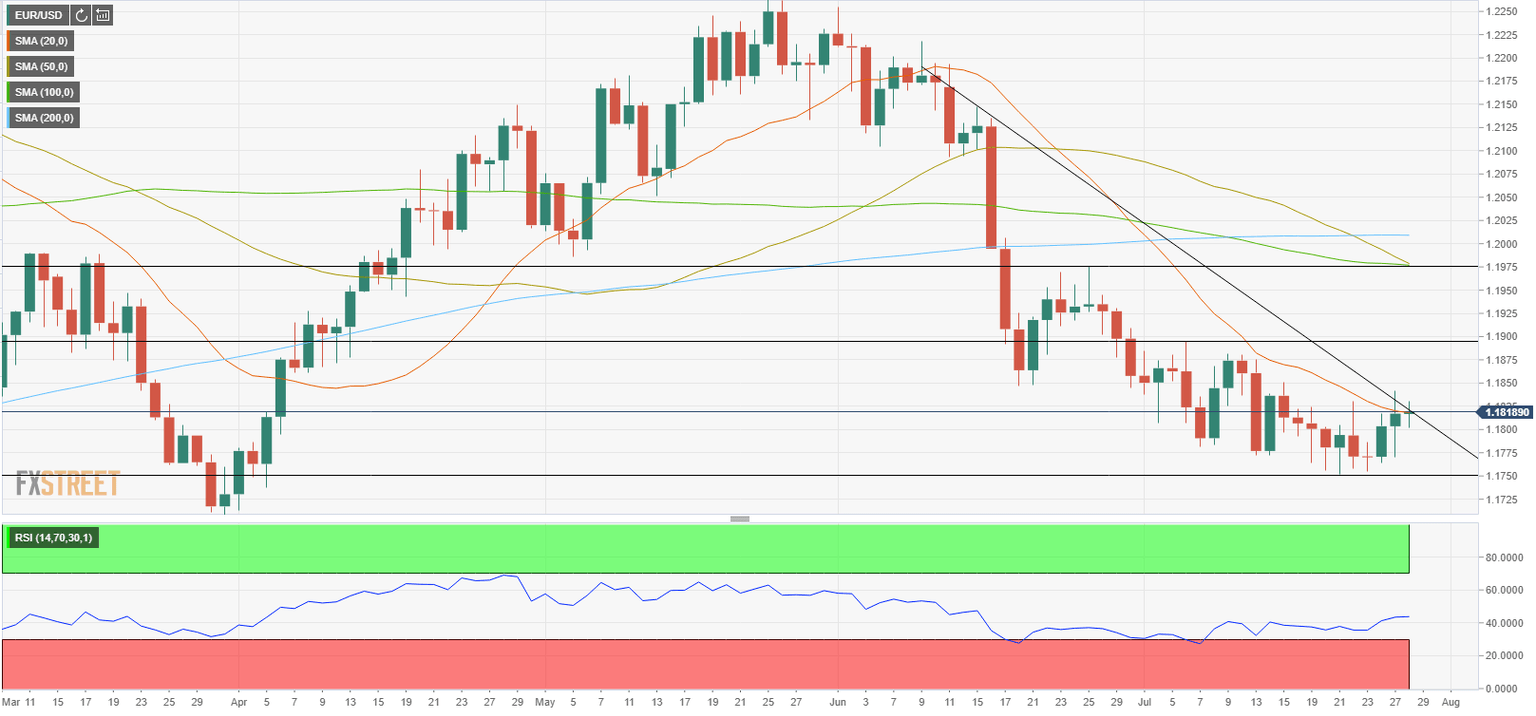

EUR/USD technical outlook

As mentioned above, the FOMC's policy stance is expected to be the main market theme in the second half of the week. Even if the Q2 GDP beats expectations, a dovish Fed statement could limit the USD's gains and vice versa. Having said that, violation of key technical levels could attract investors and cause sharp movements in the EUR/USD pair.

On the downside, key support seems to have formed at 1.1750 and a break below that level could bring in additional sellers and drag EUR/USD to new 2021 lows below 1.1700. On the other hand, the pair is holding near the descending trend line coming from early June around 1.1830. This level is also reinforced by the 20-day SMA. A daily close above that hurdle could open the door for a new leg up toward 1.1900 (psychological level, July 6 high) ahead of 1.1980 (100-day SMA, 50-day SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.