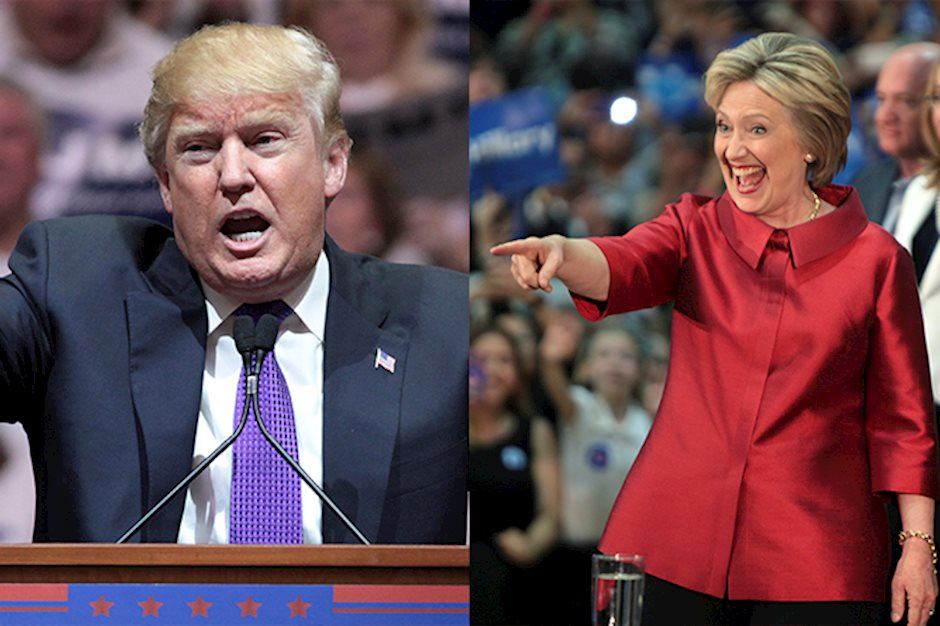

US Presidential Election: Final Debate Aftermath

With the dust having settled after Wednesday’s final US presidential debate of the 2016 campaign between Donald Trump and Hillary Clinton, the results have become rather apparent. Although Trump came out relatively stronger and more steadfast than usual during the first half of the debate, his remarks and demeanor quickly deteriorated in the latter half, leaving many to declare Clinton as the clear winner.

The key highlights of the night had nothing to do with economic or foreign policy issues. Rather, they were focused on Trump’s continued claims of widespread conspiracy against his campaign, as well as his inability to commit at this time to full acceptance of the election outcome if Clinton ultimately emerges as the victor. Trump continued to stress his view that the media is corrupt and the whole election process is rigged and fraudulent. These claims followed his response to questions regarding his acceptance of the election outcome when he said, “I will look at it at the time. I'm not looking at anything now, I'll look at it at the time.” Trump’s rather clear refusal to commit to such acceptance shocked many as a mostly unprecedented affront to the democratic process, and likely cost him even more support from both his base and with undecided voters.

The rest of the debate covered the same policy ground as usual, with both Trump and Clinton throwing out stinging insults and jabs at each other. On economic policy and taxes, Trump stressed that he would renegotiate "horrible" trade deals like NAFTA, as well as cut taxes "massively," and said that US economic growth and jobs are severely lagging. Clinton focused on raising the minimum wage, debt-free college opportunities, and significantly higher taxes on the wealthy. She also stated that “Obama saved the economy.” On the issue of immigration, heated discussion highlighted Trump’s hard line on border control, while Clinton was cornered on her past comments supporting open borders.

Overall, however, the policy issues did little to draw attention away from Trump’s comments on the election process itself. As a result, Trump was largely unable to secure the positive debate performance that he needed so badly in order to keep his chances of an election victory afloat. After the debate, on Thursday, Trump even furthered his position on possible non-acceptance of the election outcome by saying at a rally, “I will totally accept the results of this great and historic presidential election if I win.”

Prior to the debate, the outlook for a Trump victory had already become much more pessimistic, as Clinton had been leading in the polls by an increasingly larger margin, especially in swing states and those considered “toss-ups.” After the debate, the situation is likely to have become even worse for Trump, and will be known better in the days ahead. As for Clinton, her lead in the polls and debate victories are arguably much less about any popularity or likeability she may have, as she has also been very lacking in these areas among the general voting public. Rather, the progressively widening lead she is enjoying has much more to do with how she is seen as a dramatically more stable alternative to the potential unpredictability and volatility of a Trump presidency.

As the prospect of this Trump volatility continues to decrease, financial markets have begun to shrug off what has been previously seen as a high-risk event in the November 8 election. Equity market volatility has remained low and flat in the aftermath of the debate, while the US dollar has continued to rally and safe-haven gold prices remain depressed for the time being. The Mexican peso, which has been projected to benefit significantly in the event that Trump fails to win the White House, surged to a new one-month high against the US dollar on the heels of the debate, and could continue to recover in the event of a Clinton victory.

Overall, if the US presidential pendulum continues to swing towards Clinton, the election less than three weeks from now could increasingly become a business-as-usual, non-event. In this case, equity markets and the US dollar are likely to remain supported, as gold continues to lag in anticipation of the next major risk event in December’s highly anticipated Federal Reserve decision.

Author

James Chen, CMT

Investopedia

James Chen, Chartered Market Technician (CMT), has been a financial market trader and analyst for nearly two decades.