US Michigan Consumer Sentiment February Preview: The ocular proof

- Consumer outlook expected to rise to 80.8 in January.

- Employment recovered to 49,000 in January from -227,000.

- Dollar's New Year improvement banking on a US recovery.

American consumer sentiment has been stalled for the past four months blocked by ebbing job creation brought on by rising viral counts and business closures.

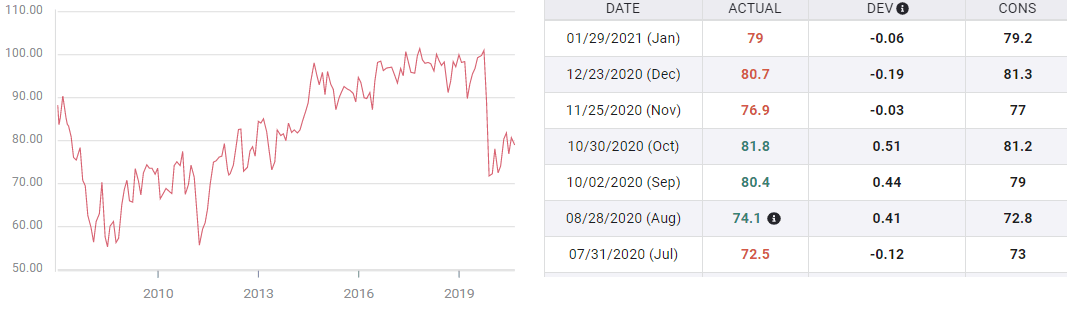

The Michigan Consumer Sentiment Index is forecast to rise to 80.8 in February from 79 in January. It would be the best pandemic result since the brief high of 81.8 in October. The index remains far from its February level of 101 and from the second half 2020 average of 97.6.

Michigan Consumer Sentiment

Employment and sentiment

Consumer sentiment is tied to the labor market. When jobs are plentiful and new work is easy to find, American are happy. Retail Sales and consumption in general are derivatives of consumer attitudes not the source.

The year before the pandemic saw the lowest American unemployment in half-a century and consequently the highest sustained consumer sentiment reading in twenty years.

February's unemployment rate of 3.5% (U-3) was the lowest in 49 years, the jobless claims average of 211,400 came at the end of two years of unprecedented success for the labor market.

Unemployment Rate, U-3

FXStreet

The Consumer Sentiment recovery in October, mentioned above, after July's low of 72.5 was based on the promising pandemic and labor markets pictures at the end of the third quarter. That optimism was not borne out and the impact on sentiment was predictable.

Initial Jobless Claims and Payrolls

Under the goad of the December lockdown in California, the Union's largest state economy, and elevated restrictions elsewhere, claims rose from 740,5000 in November to 837,500 in December. Payrolls followed the lead falling from 336,000 to -227,000, the first outright loss of employment since April.

The very modest NFP recovery in January to 49,000, a total still to be revised, was not sufficient to inspire a change in sentiment. When the final accounting for January is released on March 5 with the February payrolls, it may end up on either side of zero. The adjustment to December subtracted 87,000 to -227,000 and the addition to November added 91,000 to 336,000.

Nonfarm Payrolls

FXStreet

Conclusion

The US consumer is behaving logically.

Until job creation resumes on a scale large enough to make a dent in the 11.1% underemployment rate and return many of the 10-12 million idle to work, consumer attitudes will remain depressed. Having been disappointed once by the aborted recovery in the fourth quarter, people are likely to wait for sustained evidence that the labor market and the economy are healing before they start to regain their optimism.

Currency traders are in the same position. They are waiting for proof that the US has surmounted the fall and winter pandemic and returned to strong labor market growth. Lower claims may assist that notion but it will take several weeks of declining layoffs to cement the information into conviction.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.