US Michigan Consumer Sentiment December Preview: For once consumer attitudes may not matter

- Sentiment forecast to slip to 76.5 in December from 76.9.

- November NFP at 245,000 were lowest since recovery began in May.

- Initial Claims reverted to trend at 712,000 in latest week.

- Market and the dollar will be unaffected by sentiment numbers.

American consumers are getting another dose of the pandemic blues. Lockdowns, slowing job growth and government demands for canceling family holidays are threatening to bring attitudes back to the misery of April.

The preliminary Michigan Consumer Sentiment Index is expected to fall to 76.5 in December from 76.9 in November. If the forecast is accurate attitudes at year end will be closer to the April low of 71.8 that the October post-closure high of 81.8. In February consumer optimism was 101, the highest in two years and the second highest since the financial crash of over a decade ago.

Nonfarm Payrolls

Employment and the ability to find a job is the most essential ingredient of consumer outlook. Nonfarm Payrolls added 245,000 jobs in November, just over half the 469,000 forecast and the lowest total of the pandemic era. Through November only 55.4% of the 22.16 million NFP jobs lost in March and April have been replaced.

While the unemployment rate (U-3) has fallen from 14.7% in April to 6.7% last month, its narrow criteria for jobless status presents an unduly optimistic picture. The Labor Department requires that for the U-3 rate an individual had to have actively looked for work in the prior month. A broader definition in the U-6 or underemployment rate, including discouraged workers who have sought employment in the past year, is 12%. It is considered by many a better representation of the labor market.

Initial Claims

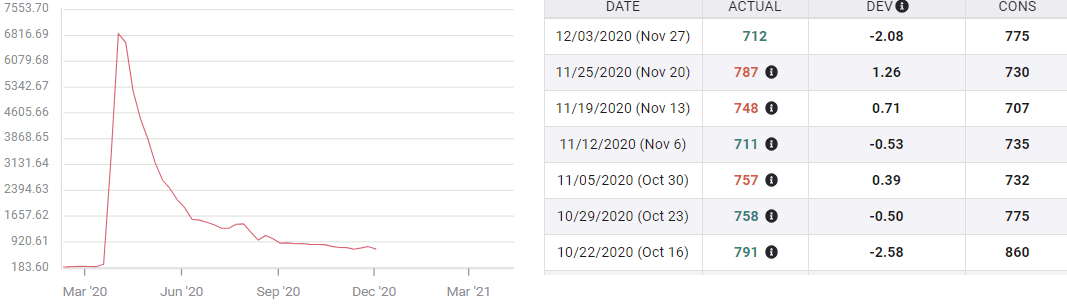

Initial Jobless Claims reversed their recent two week increase to 778,000 dropping back to 712,000 in the November 27 week, missing the pandemic low by 1,000. In context this is progress, however slow. But from a wider social point of view it means that more people were laid off in one week, and in every week of November and every other month since late March, than had ever been cashiered in a single week before. At the height of the 2009 recession 669,000 filed for unemployment benefits on March 28.

Initial Claims

The improvement in the labor market has been substantial but it has not been enough to return consumer spirits to levels of the three years prior to this.

Conclusion

Consumer sentiment has not correlated well well with Retail Sales in the unusual circumstances of the pandemic.

American consumers had continued to spend in spite of widespread unemployment through October. The eight-month average for Retail Sales from March to October of 0.89% is as good as any that for a similar period is the last decade. November's Sales figures will be reported on December 16 and a 0.1% decline is currently forecast after October's 0.3% increase.

The May Michigan Index was 72.3, just off April's low but Sales jumped 18.2%. In July sentiment fell back to 72.5 from 78.1 but Sales rose 0.9%. In October sentiment hit the pandemic high of 81.8 and Sales increased just 0.3%, down from 1.6% in August.

Consumer sentiment has responded to the emotional vagaries of the pandemic without providing much insight to household spending. That disconnect will remain in December.

Markets are firmly focused on the pending recovery in the New Year. That also will not change.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.