US Initial Jobless Claims Preview: Markets lose interest in layoffs

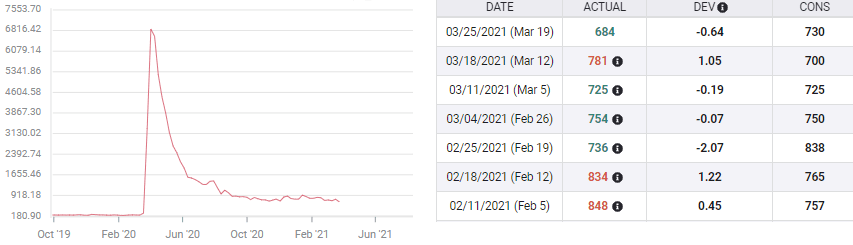

- Claims expected to fall slightly to 680,000 from 684,000.

- Continuing claims to drop to 3.775 million from 3.87 million.

- National employment projected to increase sharply in March.

- Economic data supporting US dollar, Treasury rates.

The slow and fitful return of many restaurants and bars to full operation and the continuing fallout from the lockdowns should keep US layoffs at high levels despite the improving economic picture.

Initial Jobless Claims are forecast to edge down to 680,000 from 684,000 in the March 26 week and Continuing Claims are predicted to slip to 3.775 million in the March 19 week from 3.87 million prior. Both projections would be pandemic lows.

Initial Jobless Claims

FXStreet

Nonfarm Payrolls and ADP

The loss of half-a million new jobs from November’s 264,000 to December’s -306,000, largely from California’s reimposed lockdown, has been made good with 545,00 new positions in January and February.

Nonfarm Payrolls

If the projected addition of 639,000 to March payroll pans out, the three month total of 1.184 million will have gone a long way to regaining the job creation pace of last fall.

Automatic Data Processing, the private payroll company, reported 517,000 new hires in March. Though slightly less than the 550,000 forecast, it was the highest number since last September and the February total was revised to 176,000 from 117,000.

Initial Claims

The improvement in unemployment claims since the New Year has been much more gradual than payrolls..

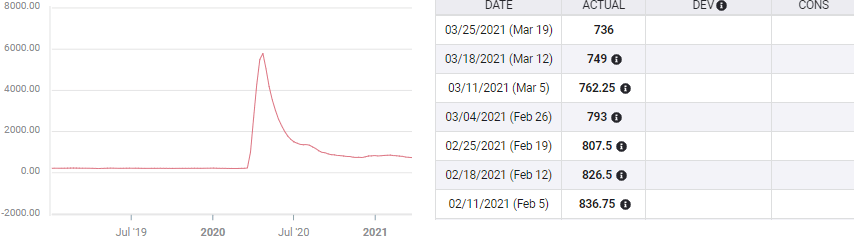

From the January high in the four-week moving average of 856,500 on the 29th, to the end of February at 793,000, claims had only dropped 63,500. Add three weeks and the four-week average is 736,000.

Initial Claims, 4-week moving average

Over the seven weeks claims fell 14%. If this week’s estimate of 680,000 is correct the average will drop to 717,500.

In two months, January to March initial claims will have fallen 16%.

In contrast payrolls will have jumped from 166,000 in January to 639,000 in March a 284% gain.

GDP and claims

First quarter economic growth in the Atlanta Fed GDPNow estimate is running at 4.7% annualized. The Federal Reserve projection for all of 2121 is 6.5%.

As optimistic as these guesses are, they bear more on Nonfarm Payrolls and the majority of the economy that has responded with expansion to the end of the lockdowns.

The sectors that remain under operational restrictions in many parts of the country, dining, drinking and hospitality, are the likely source of the continuing high levels of layoffs.

Until people feel comfortable in resuming their full range of normal activities, restaurants, bars and motels will continue to fail as they reach the end of their resources.

Unfortunately, that seems unlikely to change in the near future.

Conclusion

Markets have stopped trading on initial claims because the nexus of the recovery has moved on.

Claims no longer indicate the direction of the economy, but the residue of the lockdown debacle and the continuing struggles of the personal service sector.

Equities and the credit and currency markets are attending to the forward gauges of job creation and growth.

The American economy appears set for a strong if not record recovery, notwithstanding the individual tragedies of unemployment.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.