US Inflation Preview: Five scenarios for trading the Core CPI whipsaw within the SVB storm

- Economists expect the United States to report an increase of 0.4% in the Core Consumer Price Index.

- Any deviation of 0.1% can make a difference in the market reaction.

- The collapse of Silicon Valley Bank has considerably diminished the chances of a 50 bps rate hike next week.

What a difference one week makes – from over 50% for a 50 bps increase to borrowing costs to speculation of a halt to any increases in interest rates. The United States Consumer Price Index (CPI) report, to be published on Tuesday, March 14 at 12:30 GMT, has the final word in setting expectations for the Federal Reserve (Fed) upcoming meeting in March 22. It will be messy.

Here is how markets are positioned ahead of the critical release.

Silicon Valley Bank and the US CPI

Federal Reserve Chair Jerome Powell opened the door to re-accelerating the pace of rate hikes in his first testimony last week, sending the US Dollar higher, before clarifying no decision had been made. The Fed remains data-dependent.

And the data was somewhat encouraging: Friday's Nonfarm Payrolls showed a slower pace of wage growth – only 0.2% vs. 0.3% expected. The world's most powerful central bank is focused on core inflation that originates from higher wages. The second critical data report is the upcoming CPI report.

Yet before diving into Consumer Price Index, I want to discuss the importance of Silicon Valley Bank's collapse to market positioning and rate hike calculations. The Fed's increases of borrowing costs are supposed to discourage consumers and businesses from taking out loans, thus reducing spending and pushing inflation.

When a bank goes under, lending becomes even harder everywhere else. Other institutions may reject borrowing or set harsher conditions that fewer would accept. SVB's collapse is set to result in tightening financial conditions – reducing the need to raise interest rates.

The dramatic news reduced centered expectations around a 25 bps rate hike – but the last CPI report matters for the Federal Reserve's projections about future moves. Markets are set to move.

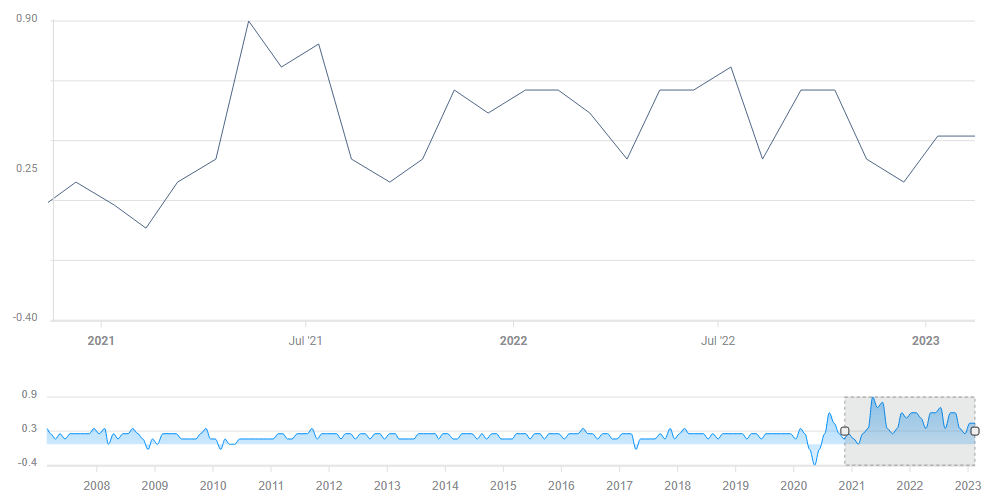

As in previous months, the focus is on Core CPI MoM – the most recent change to prices of everything excluding volatile food and energy costs. Economists expect a repeat of last month's 0.4% increase.

Source: FXStreet

Five scenarios for market reactions to the February CPI report

1) Within expectations: A 0.4% is relatively high and would temporarily weigh on stocks and buoy the US Dollar – but it would mostly shift the focus back to the banks. Any trade based on CPI is unlikely to hold.

2) Small beat: A 0.5% read would already guarantee a move – for longer than a few seconds – in favor of the Greenback and against stocks. However, I would argue that if markets seem cheerful at the moment due to good news related to banks, such a move would only serve as an opportunity to take the other direction. If the mood is downbeat, the release would just add insult to injury.

3) Small miss: If the US reports a 0.3% increase in Core CPI, it would cheer markets and weigh on the US Dollar. Nevertheless, if markets are worried about the banks around the release, we could see them retreat shortly afterward. The CPI would only serve as a distraction from the main theme. If the mood is positive, the CPI report would be the icing on the cake.

4) Big beat: A read of 0.6% or higher would already down the market and send the US Dollar up – no ifs, no buts. It would embolden the Fed to tighten despite worries about banks. CPI would return to center stage at that point. The trade would be with the trend.

5) Big miss: A material slowdown to 0.2% Core CPI MoM or lower would be excellent news to consumers, the Fed and markets. Regardless of bank issues, we would see stocks surge and the US Dollar fall. The trade would be to follow the trend.

Final thoughts

Market volatility is extreme after the collapse of Silicon Valley Bank (SVB) and concerns about further failures. While the US CPI release is set to add to this volatility, it is essential to take the bank story into account when approaching the release. Trade with care.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.