US GDP Sets a New Standard in the Third Quarter

- US GDP set a record at 33.1% annualized pace in the third quarter.

- Economy recovers quickly from 31.4% lockdown decline in quarter two.

- Performance easily surpasses 31% consensus forecast.

- Business and consumer spending propelled economy forward.

- Jobless claims fall to 751,000 the pandemic low.

- Dollar gains across the board on COVID-19 worries.

The US economy roared back from its lockdown collapse with the fastest growth on record even as rising COVID-19 diagnoses and the political stall on a new stimulus package threaten to undermine the fourth quarter.

Economic activity expanded at a 33.1% annual rate in the third quarter, topping the 31.4% negative record of the the third quarter's lockdown contraction, according to the Commerce Department on Thursday. The consensus estimate was for a 31% increase.

Gross domestic product, (GDP) is the widest measure of all goods and services produced in the country. The quickest previous expansion had been the 16.7% surge in the first quarter of 1950.

In a separate release initial jobless claims in the the third week of October dropped to 751,000, the lowest total since the historic rise began in March. Continuing claims fell to 7.756 million, also the lowest of the COVID-19 era.

Markets and the ECB

Equity markets responded to the improved economic news with modest gains after the COVID-19 related sell-off of the last four sessions. The Dow rose 0.52%, 139.16 points to 26,659.11 and the broader S&P 500 added 1.19% to 3310.11. Credit yields also rose on the data with the benchmark 10-year Treasury closing at 0.831% up 5 points on the day.

Currencies saw the dollar with its best daily performance since August. Against the euro the greenback gained three-quarters of a figure, ending at 1.1673 its highest finish since September 25.

European Central Bank President Christine Lagarde's dour assessment of the eurozone economy after the central bank kept its rates and bond purchase programs unchanged and the likelihood that the bank will have to increase its economic support as Germany and France return to partial lockdowns, sent markets scurrying for the safety dollar. The euro is just above its low close for the past three months at 1.1632.

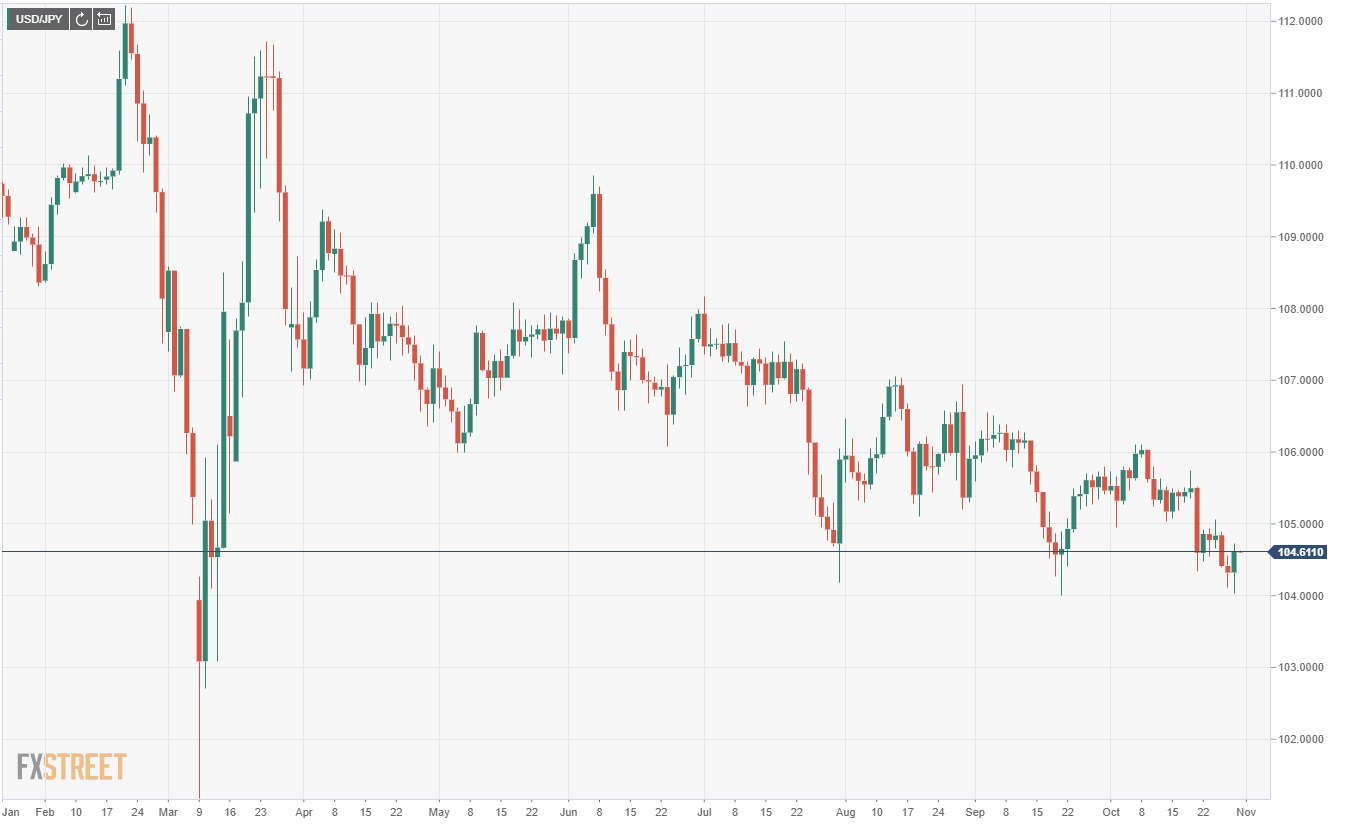

The dollar's increase versus the yen was more moderate and did not threaten the seven-month old descending trend. Due to the Japanese currency's preferred safe-haven status in Asia gains in the USD/JPY were limited to 30 points at 104.62.

The dollar also revalued against the sterling, Swiss franc, and the Australian, New Zealand and Canadian dollars.

Consumer and business spending

Economic growth in the US was bolstered by strong spending in the consumer sector and business investment.

The recoveries in Retail Sales, the Sales Control Group and Durable Goods Orders since April have replaced and then surpassed the declines of the two shutdown months despite the continuing high levels of unemployment and job losses.

Retail Sales gained 30% in the five months from May to September. Including the 22.9% loss of the shutdown months the seven month pace is a remarkable 1.01% average increase.

The Control Group receipts are 8.9.1% higher in the same seven-month period with a 1.27% average. Either performance would be excellent in a healthy consumer and labor market, in the midst of COVID-19 it is remarkable.

Durable Goods Orders have climbed 1.7% in the seven months from March which gives a weak 0.24% average monthly increase. But Nondefense Capital Goods, the business investment analog, is up 3.5% in the same period, a respectable 0.5% monthly rise.

Nondefense Capital Goods ex-Aircraft

Unemployment insurance and stimulus spending

Jobless benefits from Washington and the states have helped to maintain consumption but with the next stimulus bill stalled in election politics, the ability of consumers to maintain these essentially normal levels of spending will come under strain if another relief program is not passed.

Conclusion

The excellent recovery in the United States, much stronger than in the eurozone where quarterly growth is expected at 9.4% in the third quarter after the 11.4% drop from April to June, is threatened by the rising virus diagnoses in many American states.

In the US shutdown decisions are largely in the hands of the 50 state governors and though none so far have reimposed limits, the economic danger is clear and straight ahead.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.