US Dollar Weekly Forecast: Fed’s rate path and trade to dominate sentiment

- The US Dollar Index reached its fourth consecutive week of gains.

- Renewed trade optimism underpinned the US Dollar’s bounce.

- Some degree of scepticism remains around the US-China trade truce.

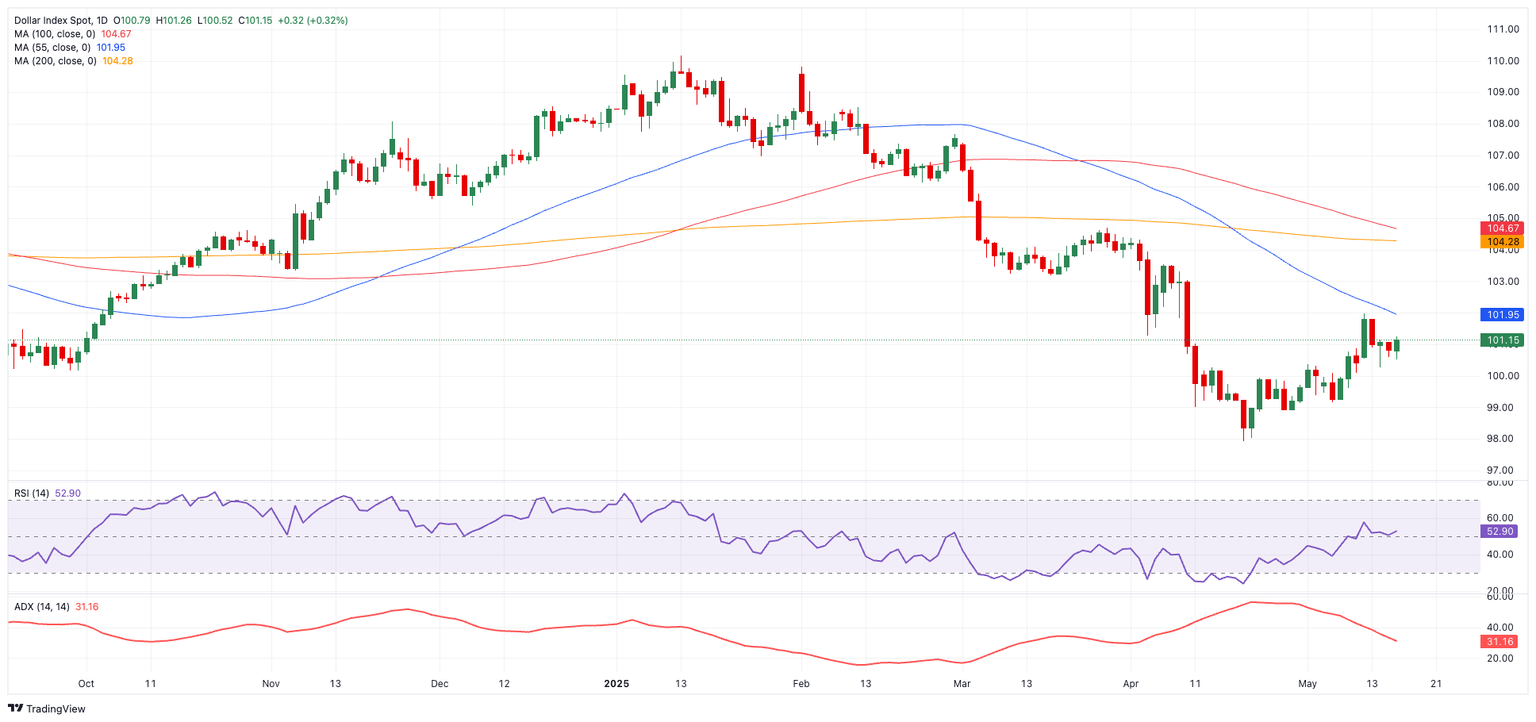

The US Dollar (USD) notched a fourth straight weekly gain, extending its steady rebound from the multi-year lows reached in mid-April just below the 98.00 support level reached on April 21. The US Dollar Index (DXY) pushed further above the closely watched 100.00 mark, climbing as high as the boundaries of the 102.00 barrier earlier in the week.

After falling nearly 9% in its steep March-April decline, the Greenback has regained ground in recent weeks. A key recovery driver has been a shift in US-China trade rhetoric, with tensions easing and eventually morphing into a 90-day trade truce between the two superpowers.

The US-China trade agreement reinforced the already ongoing recovery in both the Greenback and investors’ sentiment following another trade deal, this time with the US and the UK as main players.

Adding to the Dollar’s support this week was a broad-based rise in US Treasury yields, which climbed to multi-week highs across the spectrum. While the Greenback’s ascent remains measured, the firmer yield environment has provided a steady tailwind, especially after the Federal Reserve (Fed) left interest rates unchanged on May 7, with Chair Jerome Powell striking a predictably hawkish tone.

Trump throws markets a bone with trade pivot

Following weekend talks in Geneva, the White House announced a new trade agreement with China, offering a rare moment of relief for global markets and breathing life into risk sentiment. The accord marks a temporary de-escalation in tensions between the world’s two largest economies, which had threatened to spiral into a full-scale trade rupture.

At the heart of the issue were proposed tariffs exceeding 100%—a level that would have effectively amounted to a trade embargo on Chinese goods. The economic fallout of such a move would have been significant, not just for the United States but for the global economy. That’s why Monday’s announcement, delivered by Treasury Secretary Scott Bessent, was widely viewed as a critical, albeit fragile, breakthrough.

Under the terms of the deal, China will still face a 30% increase in tariffs—comprising a 20% levy tied to its alleged role in fentanyl exports, and a 10% baseline set on the newly declared “Liberation Day.” These come on top of the average 10% tariff rate inherited from the Biden era. However, the remainder of the proposed tariffs will be paused for 90 days. In exchange, Beijing has agreed to suspend its retaliatory duties on US imports.

The US Dollar and broader market sentiment had already been buoyed in recent days by another trade development: a new framework between Washington and London. That agreement, though more limited in scope, provides the US with improved market access and streamlined customs processes for exports to the UK, while Britain receives partial tariff relief on autos, steel, and aluminium.

Still, analysts were quick to temper expectations. Many described the UK deal as a series of reciprocal concessions rather than a transformative shift in trade policy. Importantly, the United States will retain a 10% baseline tariff on most British goods, reinforcing the view that post-“Liberation Day” protectionism is here to stay.

The apparent softening of President Trump’s trade posture is the latest in a series of tactical retreats from earlier hardline positions. In recent weeks, he has backed off sweeping tariff threats following a sharp sell-off in equity markets, toned down criticism of Federal Reserve Chair Jerome Powell, and trumpeted trade victories with Canada and Mexico that were later seen as largely symbolic.

Looking at the broader issue, economists caution that even scaled-back tariffs remain a drag on growth. While some initial price pressures may ease, persistent trade barriers risk fueling secondary inflation, eroding consumer demand, and weighing on economic momentum. Should downside risks intensify, the Federal Reserve may be forced to reconsider its current wait-and-see approach.

Powell plays it safe, markets watch and wait

The Fed kept interest rates unchanged on May 7, as widely anticipated, but warned of mounting risks to both inflation and employment in the coming months.

In its post-meeting statement, the central bank noted that the economy "continued to expand at a solid pace," while attributing weaker first-quarter growth largely to a surge in imports as consumers and businesses sought to get ahead of newly imposed tariffs.

Speaking at a press conference, Fed Chair Jerome Powell described the US economy as fundamentally sound but acknowledged growing uncertainty. He said future rate decisions would be guided by incoming data, with the policy path potentially including rate cuts or an extended pause.

"The outlook could include cuts or holding steady," Powell said, underscoring the Fed's shift to a more flexible stance as trade tensions and global headwinds cloud the domestic picture.

Earlier in the week, Federal Reserve officials struck a cautious tone, pointing to the growing challenge of assessing the US economy in light of shifting trade policies and lingering inflation pressures. While recent data has shown some signs of progress, policymakers are emphasising the need for patience and further clarity.

Governor Adriana Kugler acknowledged the Fed's struggle to gauge the underlying strength of the economy, attributing the difficulty in part to rapid changes in trade policy. She noted that households and businesses had rushed to import goods earlier in the year, complicating efforts to read current economic momentum.

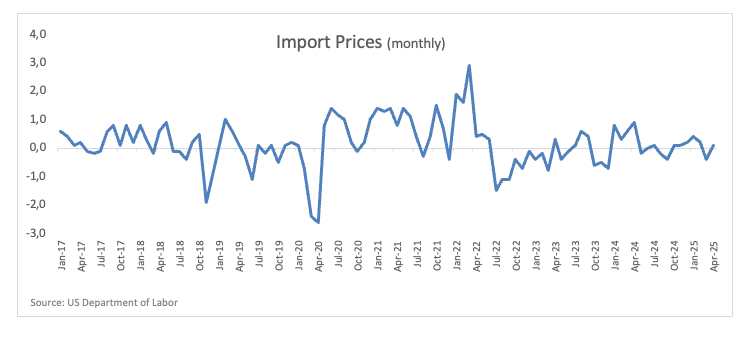

Chicago Fed President Austan Goolsbee said that while April’s consumer inflation figures appeared relatively subdued, they do not yet reflect the full impact of the recent rise in US import tariffs. He added that more data will be needed before the Fed can draw firm conclusions on the path of inflation and economic activity.

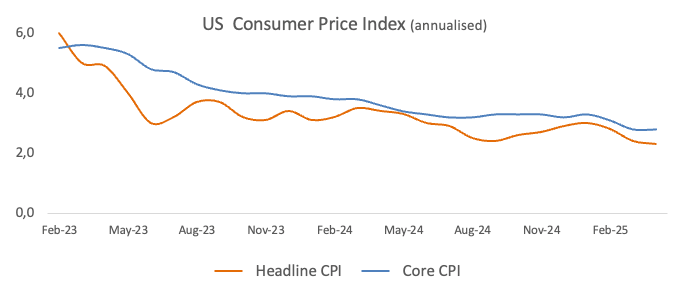

Vice Chair Philip Jefferson echoed a similar mix of optimism and caution. He said the latest inflation readings indicate continued, if uneven, progress toward the Fed’s 2% target. Still, he warned that the inflation outlook has grown more uncertain, with new tariffs posing an additional upside price risk.

Cooler prices, cooler heads on Fed rates

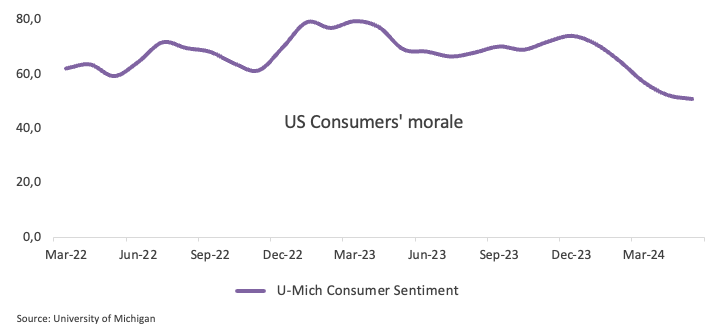

The US Dollar has found firmer footing in recent sessions, shrugging off some stagflation concerns that had weighed on sentiment. The combination of persistent inflation and slowing growth had sparked unease, but the Greenback staged a modest rebound, buoyed by signs of easing price pressures and subdued consumer sentiment.

Investors have now pushed back expectations for the Federal Reserve’s next rate cut to the third quarter, with September emerging as the most likely window. Still, April’s data showed inflation running above the Fed’s 2% target, complicating the policy outlook—especially with the labour market showing continued strength.

Adding to the dollar’s support, both short and long-term consumer inflation expectations have ticked higher, offering additional momentum to the currency.

For now, the dollar remains trapped in a volatile mix of sticky inflation, trade policy uncertainty, and softening macroeconomic indicators. Against that backdrop, markets are preparing for a choppy road ahead as policymakers tread carefully.

What’s ahead for the Greenback?

The spotlight next week will fall on a packed lineup of Federal Reserve speakers, with markets closely parsing their remarks for clues on the policy outlook. Preliminary data on US business activity—covering both the manufacturing and services sectors—will also be in focus, offering fresh insight into the economy’s health.

Beyond domestic indicators, the US Dollar remains sensitive to developments on the trade front. Any progress in US-China negotiations or signals of additional trade agreements could further sway sentiment and influence the near-term trajectory of the Greenback.

Techs on the US Dollar Index

The US Dollar Index (DXY) continues its cautious recovery, though it remains capped by key technical resistance levels. Despite recent gains, the index retains a bearish bias as it trades below both the 200-day and 200-week Simple Moving Averages (SMAs) at 104.25 and 102.79, respectively, a signal that downward pressure could persist in the near term.

A decisive break above the May top at 101.95 (May 12) could open the door for a move toward the 55-day SMA at 102.10, followed by a test of the more critical 200-day SMA at 104.25, just shy of the March 26 high at 104.68.

On the downside, renewed selling could bring the 2025 floor of 97.92 (April 21) back into focus, with the March 2022 trough at 97.68 also acting as a potential target.

Momentum indicators have now shifted their attention to a renewed bullish momentum, although they remain mostly mixed. The Relative Strength Index (RSI) has bounced above 52, while the Average Directional Index (ADX) remains elevated at 32, reinforcing the sense of a strengthening trend.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.