US Dollar Weekly Forecast: Tit-for-tat tariffs and a tired Dollar

- The US Dollar Index (DXY) kept its negative mood for yet another week.

- Stagflation concerns continued to hurt the mood around the Greenback.

- Chair Powell reiterated the Fed’s prudent stance and its focus on inflation.

The US Dollar (USD) endured another punishing week amid a combination of steady trade war tensions, political noise, and macro uncertainty.

Indeed, the US Dollar Index (DXY) retreated for the fifth consecutive week, extending the recent breakdown of the psychologically key 100.00 mark and maintaining its business in the area of three-year troughs near the 99.00 support.

The ongoing weakness in the Greenback also came in tandem with the accelerated losses in US Treasury yields across various time frames.

Tariffs spark market turmoil

The sour mood has gathered steam after the White House announced a jaw-dropping 145% tariff on Chinese imports, which was followed by retaliatory measures from Beijing, which slapped 125% levies on US goods starting April 12.

This exchange stoked fears that a full-blown global trade war is brewing, with investors increasingly pricing in slower growth and higher inflation in the US.

It is worth recalling that President Trump’s new trade blueprint imposed a baseline 10% tariff on all imports, with additional country-specific surcharges. While the administration later temporarily exempted non-retaliating nations—it did keep China in the crosshairs, doubling down on punitive duties.

These tariffs could be a double-edged sword: initial price shocks may be brief, but persistent trade barriers risk fueling a second wave of inflation, dampening consumer spending, crimping growth, and even reintroducing deflationary threats. If the pressure mounts, the Fed may be forced to shift its current cautious stance.

Policy caution in a fog of uncertainty

The Federal Reserve (Fed) kept rates steady at 4.25%–4.50% at its March 19 meeting, opting for caution amid mounting volatility. Officials downgraded 2025 GDP forecasts to 1.7% from 2.1% and nudged inflation estimates higher to 2.7%, highlighting fears of a stagflationary backdrop.

Fed Chair Jerome Powell has taken a careful line. At his subsequent press conference, he said there’s no immediate need for further cuts, but called the new tariffs “larger than expected.” He acknowledged the risk of simultaneous inflation and unemployment spikes, a combo that could jeopardize the Fed’s dual mandate.

Earlier in the week, at the Economic Club of Chicago, Powell flagged signs of a slowdown: modest consumer spending, weakening sentiment, and a rush of pre-tariff imports weighing on GDP. He reiterated that the policy would remain steady as the Fed watches how recent shocks unfold.

In addition, other central bank voices echoed caution:

- Christopher Waller (Board of Governors) called the tariffs a “significant shock” and warned they could force the Fed to cut rates—even if inflation stays elevated.

- Raphael Bostic (Federal Reserve Bank of Atlanta) said tariff uncertainty has put the economy on a “big pause” and advised keeping rates on hold until the outlook clears.

- John Williams (Federal Reserve Bank of New York) argued that the policy is well-positioned for now, though he admitted tariffs will likely lift inflation, slow growth, and raise unemployment.

Trump vs. Powell: Round two

Adding to the drama, President Trump reignited tensions with the Fed, saying Powell’s removal “could not come fast enough.” In a Truth Social post, Trump claimed Powell should have slashed rates long ago and urged him to act now.

His comments came just a day after Powell reaffirmed the Fed’s independence in Chicago, an assertion backed by widespread support on Capitol Hill.

Inflation fears on the rise

The growing weakness in the US Dollar reflects mounting concerns over a potential economic slowdown, with fears of stagflation—a toxic mix of sluggish growth and elevated inflation—gaining traction. The latest blow comes from the newly imposed tariffs, fading domestic momentum, and fading investor confidence.

While inflation continues to run above the Fed’s 2% target—as reflected in both CPI and PCE data—the surprisingly robust labor market has complicated the picture, defying expectations of a sharper slowdown.

Inflation expectations among consumers are also shifting. According to the New York Fed’s latest Survey of Consumer Expectations, Americans now anticipate prices to rise by 3.6% over the next year, up from 3.1% in February—the highest reading since October 2023. The increase is largely driven by concerns over steeper costs for essentials like food and rent, even as expectations for gasoline and housing price gains remain relatively contained. Notably, longer-term inflation projections remained steady or edged lower, suggesting consumers still trust the Fed to bring price pressures under control over time.

For now, this mix of elevated inflation fears, persistent uncertainty around tariffs, and weakening fundamentals is likely to keep the dollar on shaky ground, with volatility remaining a key theme in the weeks ahead.

Dollar outlook: Volatile, vulnerable

With inflation still above target, tariffs roiling trade flows, and political noise blurring the policy picture, the US Dollar looks set for continued volatility. All eyes now turn to next week’s flash PMIs and speeches from Fed officials for clues on what comes next.

Tech levels: DXY under pressure

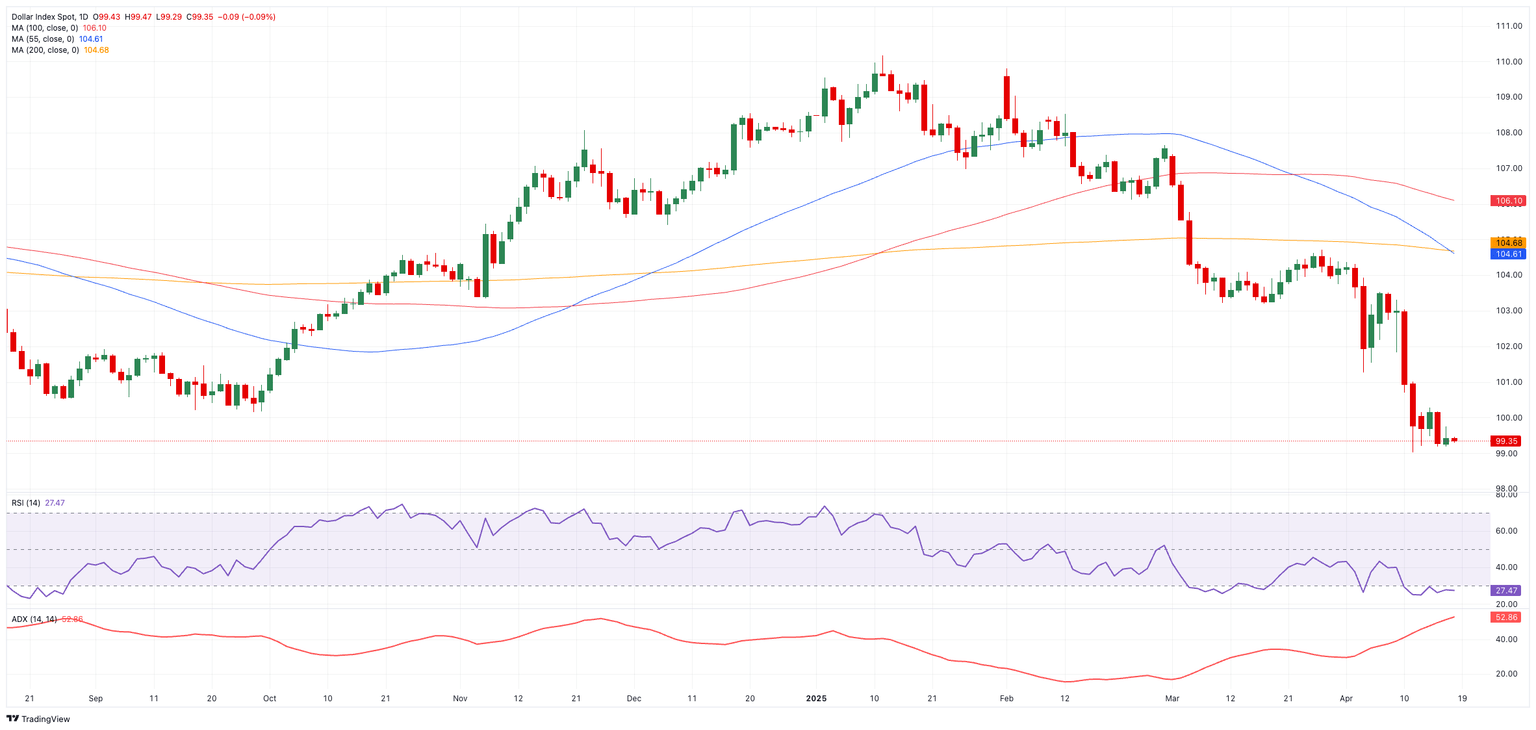

Technically, the DXY is trading below its 200-day SMA (104.63), flashing bearish signals.

Key support lies at 99.01 (2025 floor set on April 11) and 97.68 (March 30, 2022). A bounce could retest 104.68 (March 26), with resistance levels at the 55-day SMA (104.60), 100-day SMA (106.05), and 107.66 (February 28 high).

Momentum indicators keep pointing to extra weakness on the cards: the Relative Strength Index (RSI) has dipped to the oversold region around 27, and the Average Directional Index (ADX) above 52 points to a strengthening bearish trend.

With policy crosscurrents, trade tensions, and inflation risks all swirling, the US Dollar remains on the back foot… and the outlook is anything but clear.

US Dollar Index (DXY) daily chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.