US Dollar Weekly Forecast: Tariffs, payrolls and a cautious Fed

- The US Dollar Index regained some composure and bounced off lows.

- Concerns over the US economy should keep the US Dollar under pressure.

- A de-escalation of US-China trade jitters underpinned the change of course.

The US Dollar finally caught a break after a steep and extended decline.

After shedding roughly 9% from its early March highs, the US Dollar Index (DXY) managed to snap a four-week losing streak, rebounding from troughs just beneath the key 98.00 level (April 21).

The Greenback’s rebound was driven by easing fears over the US-China tariff dispute, coupled with President Trump's decision to abandon the idea of removing Federal Reserve (Fed) Chair Jerome Powell — a move that had weighed on investor sentiment.

However, the recovery in the US Dollar contrasted with continued weakness in US Treasury yields, which slipped back toward multi-day lows across the curve.

Are tariffs biting back?

There were no fresh announcements regarding the imposition of new tariffs by the White House during the week. However, all the attention shifted to just the opposite: the tangible prospect that President Trump could lower his shocking 145% tariffs on US imports of Chinese goods. The eventual timing of the decision as well as the size of the cut remains, unsurprisingly, unknown so far.

President Trump said he's ready to lower tariffs on Chinese goods — and claims Beijing’s eagerness for a “fair deal” is the reason. He told reporters Wednesday that trade talks are “active” and moving in the right direction.

The problem? China says none of it is true.

So, looking at the bigger picture: Trump’s sudden tariff shift fits a pattern. Facing market meltdowns, backlash from business leaders, and even rumblings from MAGA-world heavyweights, Trump has been slowly retreating from his most radical economic moves. In fact, he ditched his universal tariff threat after markets tanked, he backed off trying to oust Fed Chair Jerome Powell after signs of investor panic, and he claimed "major concessions" from Canada and Mexico — only for it to emerge that they were mostly cosmetic.

Back to tariffs, it is worth recalling that they could be a double-edged sword: Initial price shocks may be brief, but persistent trade barriers risk fueling a second wave of inflation, dampening consumer spending, crimping growth, and even reintroducing deflationary threats. If the pressure mounts, the Fed may be forced to shift its current cautious stance.

Fed remains prudent, Powell flags rising stagflation risks

The Fed kept its benchmark interest rate unchanged at 4.25%–4.50% during its March 19 meeting, opting for a cautious approach amid mounting market volatility. Officials cut their 2025 GDP growth forecast to 1.7% from 2.1% and slightly raised their inflation outlook to 2.7%, underlining concerns that the economy could be tilting toward a stagflationary scenario.

Fed Chair Jerome Powell struck a measured tone at his post-meeting press conference, saying there is "no immediate need" for further rate cuts. However, he warned that newly imposed tariffs were "larger than expected" and admitted that simultaneous spikes in inflation and unemployment could threaten the Fed’s dual mandate of price stability and maximum employment.

Speaking recently at the Economic Club of Chicago, Powell highlighted early signs of a slowdown, including tepid consumer spending, weakening business sentiment, and a surge of pre-tariff imports that could weigh on economic growth. He reiterated that monetary policy would remain steady as officials monitor how recent economic shocks ripple through the economy.

Federal Reserve officials this week signaled a cautious approach to monetary policy as they assessed the potential economic fallout from the Trump administration’s newly announced tariffs:

Chicago Fed President Austan Goolsbee said that if the effects remained limited to the 11% of the economy tied to imports, the broader fallout could be modest. In addition, Minneapolis Fed President Neel Kashkari echoed the uncertainty, noting it was too soon to judge how tariffs might influence short-term interest rates — a view reportedly shared across the Federal Open Market Committee (FOMC).

Fed Governor Adriana Kugler warned that the tariffs were "significantly larger than expected" and likely to push prices higher, reinforcing the need to keep borrowing costs steady until inflation risks subside. She also flagged the broader influence of the administration’s policies on inflation and employment, while Cleveland Fed President Beth Hammack, said recent market moves did not merit central bank intervention but left the door open to adjusting policy by June if incoming data justified it.

Fed Governor Christopher Waller, meanwhile, argued that it would likely take until the second half of the year to fully understand the tariffs’ economic effects, suggesting no immediate need to shift the Fed’s current monetary policy stance.

Inflation fears mount as Dollar weakens

Mounting concerns over a potential US economic slowdown are weighing heavily on the Greenback, with fears of stagflation, a toxic mix of sluggish growth and stubborn inflation, gaining momentum. The US Dollar’s latest struggles come amid the drag from tariffs, faltering domestic momentum, and a dip in investor confidence.

Inflation continues to run above the Fed’s 2% target, as reflected in latest CPI and PCE data. A surprisingly resilient labour market has complicated the Fed’s path, defying expectations for a sharper economic slowdown.

Meanwhile, consumer inflation expectations are shifting higher. According to the New York Fed’s latest Survey of Consumer Expectations, Americans now anticipate prices to climb 3.6% over the next year, up from 3.1% in February, the highest reading since October 2023. Longer-term inflation expectations, however, stayed steady or edged lower, suggesting that consumers still have faith in the Fed’s ability to eventually rein in price pressure.

For now, the combination of elevated inflation fears, ongoing uncertainty around tariffs, and deteriorating fundamentals is likely to keep the US Dollar under pressure, with volatility expected to remain a dominant market theme in the weeks ahead.

What’s next for the Dollar?

The US labor market will dominate the economic agenda next week with April’s Nonfarm Payrolls report emerging as the key highlight. Additional labour market signals will come from the ADP private payrolls report, weekly Initial Jobless Claims, and the JOLTS Job Openings survey.

Beyond the jobs data, flash estimates of Q1 GDP and fresh readings from the ISM manufacturing and services indices are also expected to keep investors focused on the strength of the US economy.

DXY technical landscape

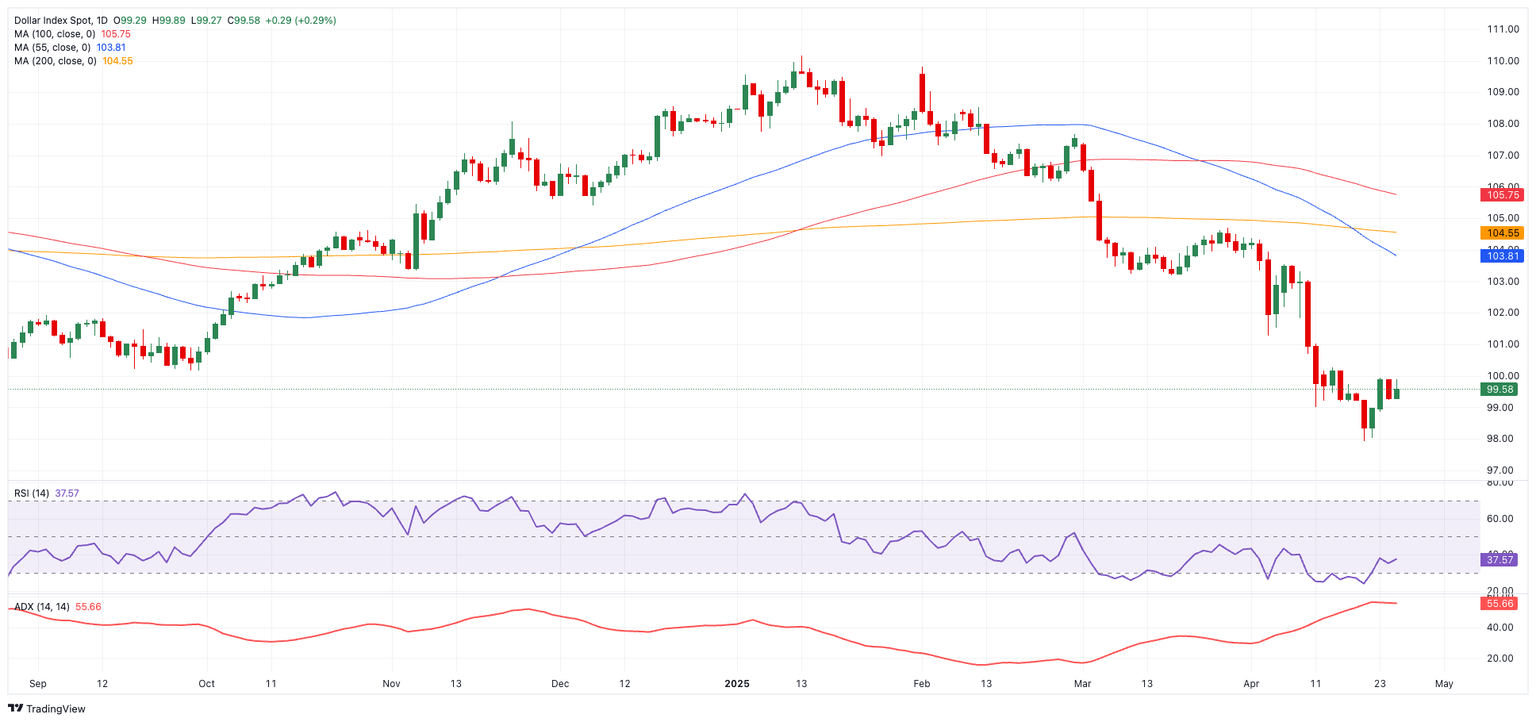

The bearish outlook for the US Dollar Index (DXY) remains firmly intact, with the index continuing to trade below both its 200-day and 200-week Simple Moving Averages (SMAs), currently at 104.53 and 102.67, respectively.

Key support levels are in focus at 97.92, the 2025 bottom set on April 21, and 97.68, the March 30, 2022 pivot. On the upside, a potential bounce could retest the psychological 100.00 barrier, prior to the interim 55-day SMA at 103.97 and the March 26 high at 104.68.

Momentum indicators reinforce the bearish bias. The Relative Strength Index (RSI) has retreated to around 36, while the Average Directional Index (ADX) has surged above 54, signaling a strengthening downward trend.

DXY daily chart

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.