US dollar wavers ahead of US retail sales data

The US dollar wavered in overnight trading after Joe Biden announced a $1.9 trillion stimulus package that was relatively smaller than expected. The package will have provision for a $1,400 stimulus check, which will push the total to $2,000. It will also have $400 billion to fight the coronavirus pandemic and funds for state and local governments. Other funds will go towards vaccine distribution and unemployment insurance. The congress has already provided more than $4 trillion in stimulus, which has pushed US public debt to more than $27 trillion.

The dollar will react to the US retail sales numbers that will come out in the afternoon session. Economists expect the data to show that sales dropped by 0.2% in December due to the lockdowns. They fell by 1.1% in November. They also see the core retail sales falling by 0.1% on a MoM basis. Other vital numbers that will come out are the New York Empire State manufacturing index, industrial production, and producer price index. These numbers will come a day after Jerome Powell issued a dovish statement.

The British pound is still hovering at the highest level in three years ahead of the important economic numbers. The Office of National Statistics (ONS) will deliver the GDP numbers in the morning hours. It will deliver the November industrial, manufacturing, and construction production data. It will also release the November trade data. Elsewhere, in Sweden, the statistics office will release the monthly inflation numbers.

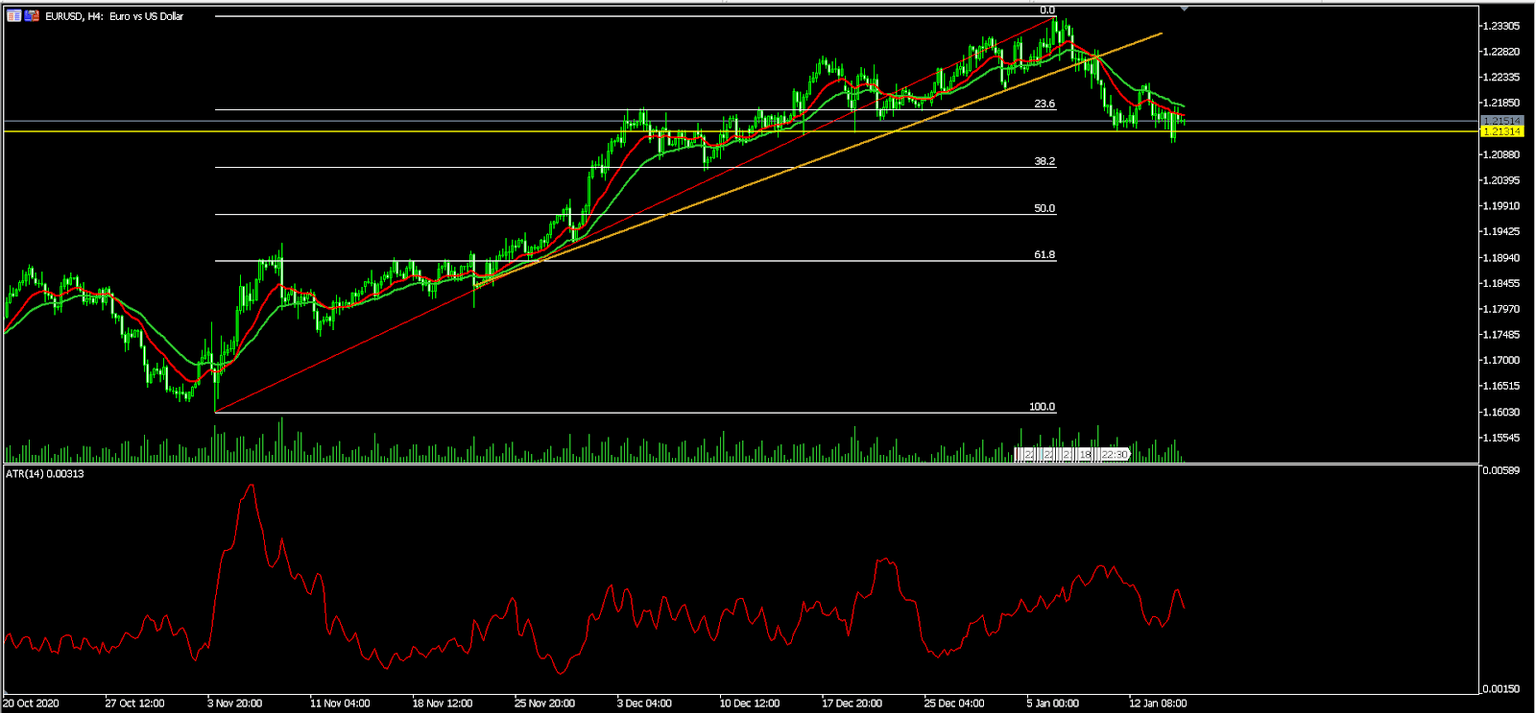

EUR/USD

The EUR/USD had a bearish breakout yesterday after it dropped below the previous support at 1.2131. It then moved back up after the dovish statement by Jerome Powell. On the four-hour chart, the pair is still slightly above the 23.6% Fibonacci retracement level. It is below the 25-day and 15-day exponential moving averages while the average true range is also wavering. Therefore, the pair will possibly resume the downward trend as traders eye the 38.2% retracement at 1.2066.

GBP/USD

The GBP/USD pair rose to an intraday high of 1.3683. On the daily chart, the pair is approaching the upper side of the ascending channel. It is also being supported by the 15-day and 25-day exponential moving averages. However, the MACD and RSI are also revealing a bearish divergence. This means that the pair may turn around next week as bears eye the lower side of the channel at 1.3425.

EUR/GBP

The EUR/GBP pair dropped to the lowest level in months after the hawkish statement by Andrew Bailey. On the four-hour chart, the pair is below the 50-day and 25-day moving average while the RSI is slightly below the oversold level. Also, the two lines of the Relative Vigour Index (RVI) have made a bullish crossover. Therefore, while the bearish trend will likely continue, there is also a possibility of a bullish turnaround.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.