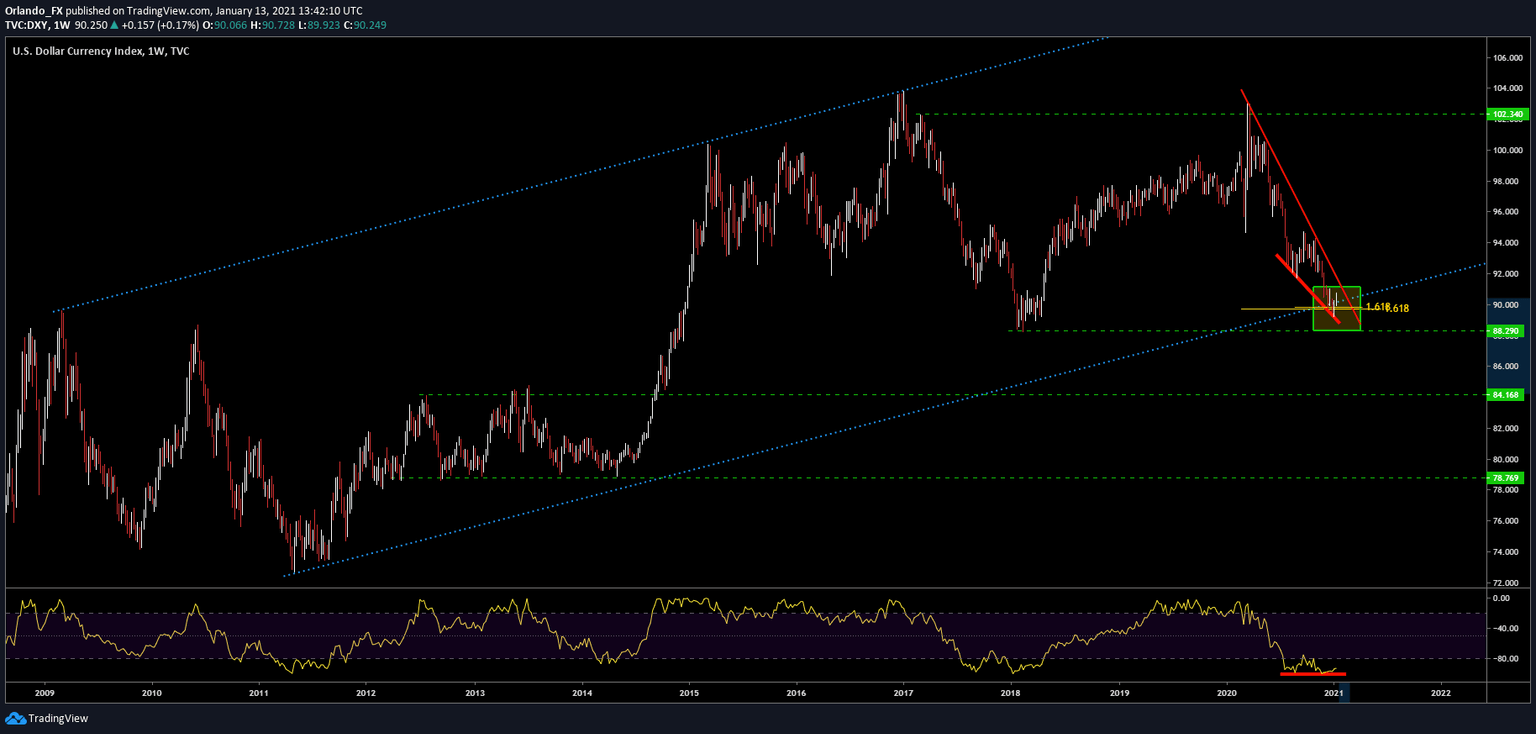

US dollar testing the make it or break it level

The DXY has been depreciating since the start of this round of QE in March to face the inevitable meltdown of the economy thanks to the Corona virus pandemic.

Currently the DXY is retesting the long term bullish structure started with the April 2011 lows but it's still 2% away from testing the previous lows. A retest of the previous lows would mean that this massive long term bullish structure would be invalid and we could see price dip another 7% to the 84.10 level where we could finally find some support.

On the other side we have that structure retest in confluence with shorter term bearish targets. These short term targets are the 1.618 of the 2 waves down of what seems to be a 3 wave corrective pattern to the structure retest.

Fundamentally speaking we are still bearish the USD but technically speaking we could see some strength should these levels hold.

Author

Orlando Gutierrez

Learn 2 Trade

Orlando has been involved in the financial markets for about 10 years. His focus is Global Macro and he is a strong believer that the best way to trade the currency markets is focusing on the big picture and holding on to big macro trends.