US dollar pressure expected to ease

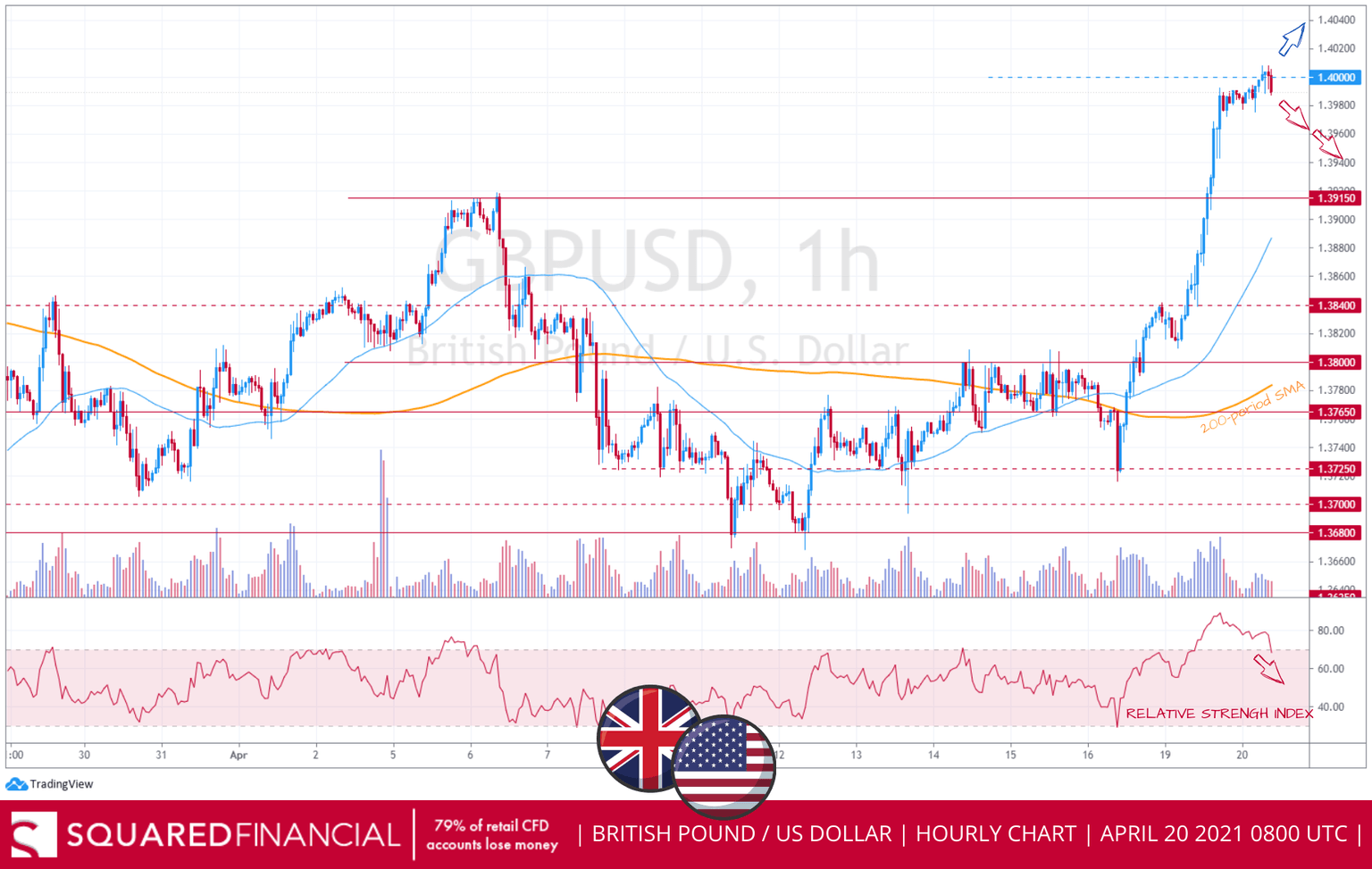

Unemployment in the UK dropped to 4.9%, the NSO stated in its report earlier this morning, surpassing market estimates and giving the British Pound a nudge higher following two days of strong bullish momentum that propped up Sterling nearly 300 pips in 3 days. CPI on Wednesday, and Retail Sales on Friday, will keep GBP in focus.

Stock prices in London, however, are seen opening lower this morning, tracking weak trading in the US and Japan overnight, despite the strong jobs report. US Equities had a mellow Monday, with every major index closing lower, weighed down largely by weakness in tech stocks, as investors are once again worried about a rise in inflation and renewed coronavirus infections that prompted some countries to reimpose lockdown measures. The Nikkei225 dropped 2.5% as the pandemic remains a constant threat.

We expect further short-term volatility today, as traders balance the impact of inflation with increasing optimism over strong corporate earnings.

It is surprising to see the US Dollar's continued weakness despite rising US bond yields, and we expect EUR and GBP to give back some of their recent gains. Gold has already retreated from yesterday's peaks at $1790, now back to our key support level at $1770 an ounce.

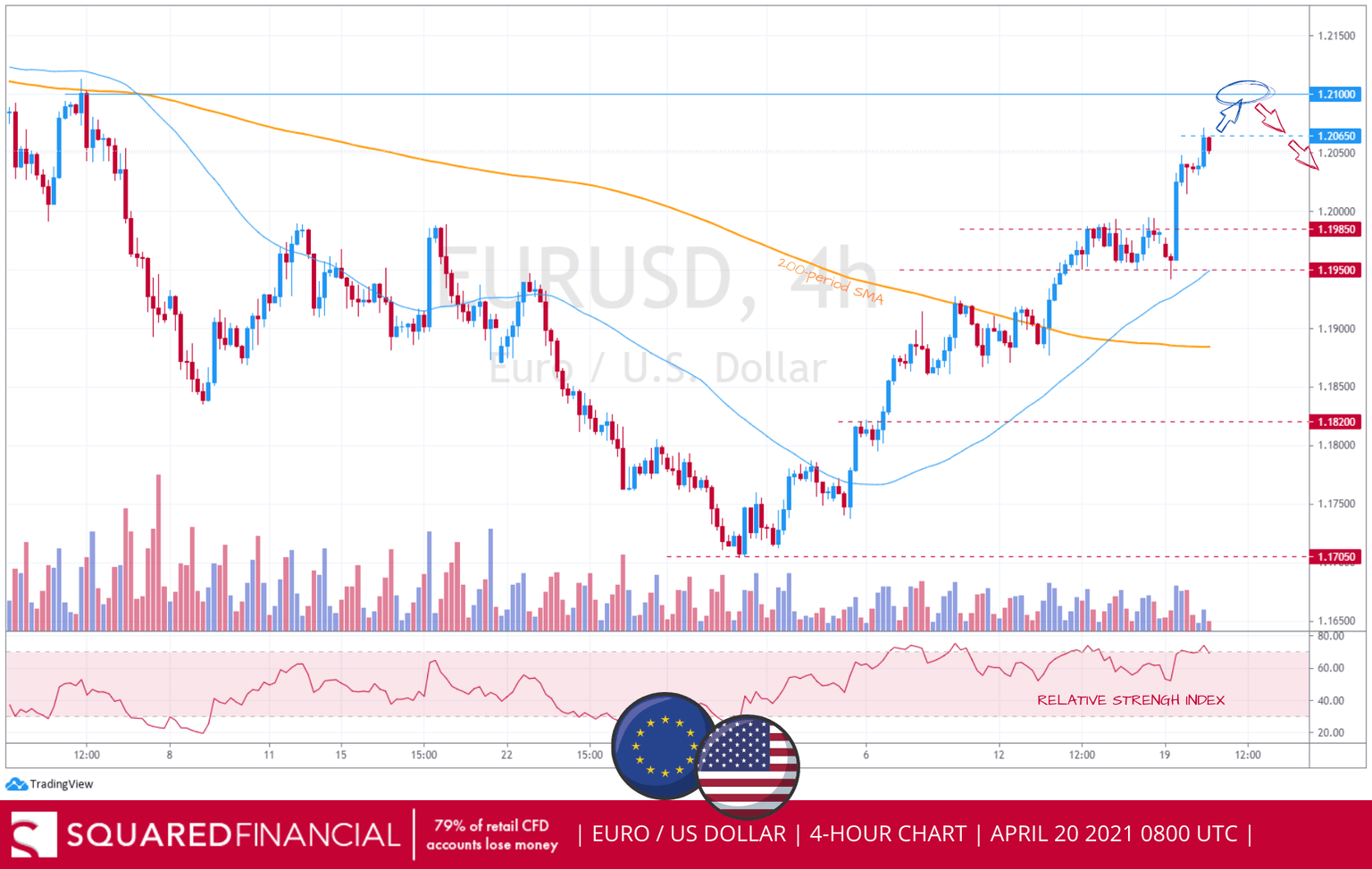

EURUSD had topped out twice last week ahead of 1.2000 so appeared to have formed a double top and attracted technical sellers. The break back through 1.2000 will have been stop-loss driven and EURUSD was chased up to a high of 1.2048. The US 10-yr yield recovered to 1.6% yesterday, which could signal the end of the painful position reduction and that US yields should now be able to push higher in line with the stronger US data and USD should be able to recover.

The theme of US outperformance in the recovery should still hold, especially against EU and Japan which are still struggling with the virus and will have an ultra-loose monetary policy for the significant future. EURUSD has taken out the 100dayMA at 1.2059.

Short CAD into tomorrow BoC still makes sense, as the market has priced too much optimism into the Canadian economy given the sharply deteriorating virus situation and therefore we expect the BoC to be more cautious than the market expects.

The People's Bank of China left interest rates unchanged as expected. The Chinese Central Bank has now kept its prime rate at 3.85% for 12 months in a row. USDCNY back below key 50-day SMA with a retest of February lows around 6.42 highly likely.

Our overview and outlook of key FX trading pairs and stock indices

EUR/USD

US bond yields rose yesterday but the US Dollar sank pushing EURUSD to our resistance at 1.2065 with momentum still showing strength after Germany reported a better-than-expected producer price index (PPI) earlier this morning as we approach a key important resistance level at 1.21.

GBP/USD

Unemployment in the UK dropped to 4.9%, the NSO stated in its report earlier this morning, surpassing market estimates and giving the British Pound a nudge higher. GBPUSD is currently attempting to move above the 1.40 level, following 2 days of strong upside momentum that propped up Sterling nearly 300 pips higher in 3 days. The hourly RSI, however, is signaling overbought conditions, and therefore we expect the momentum to start fading with 1.3915 as nearest support.

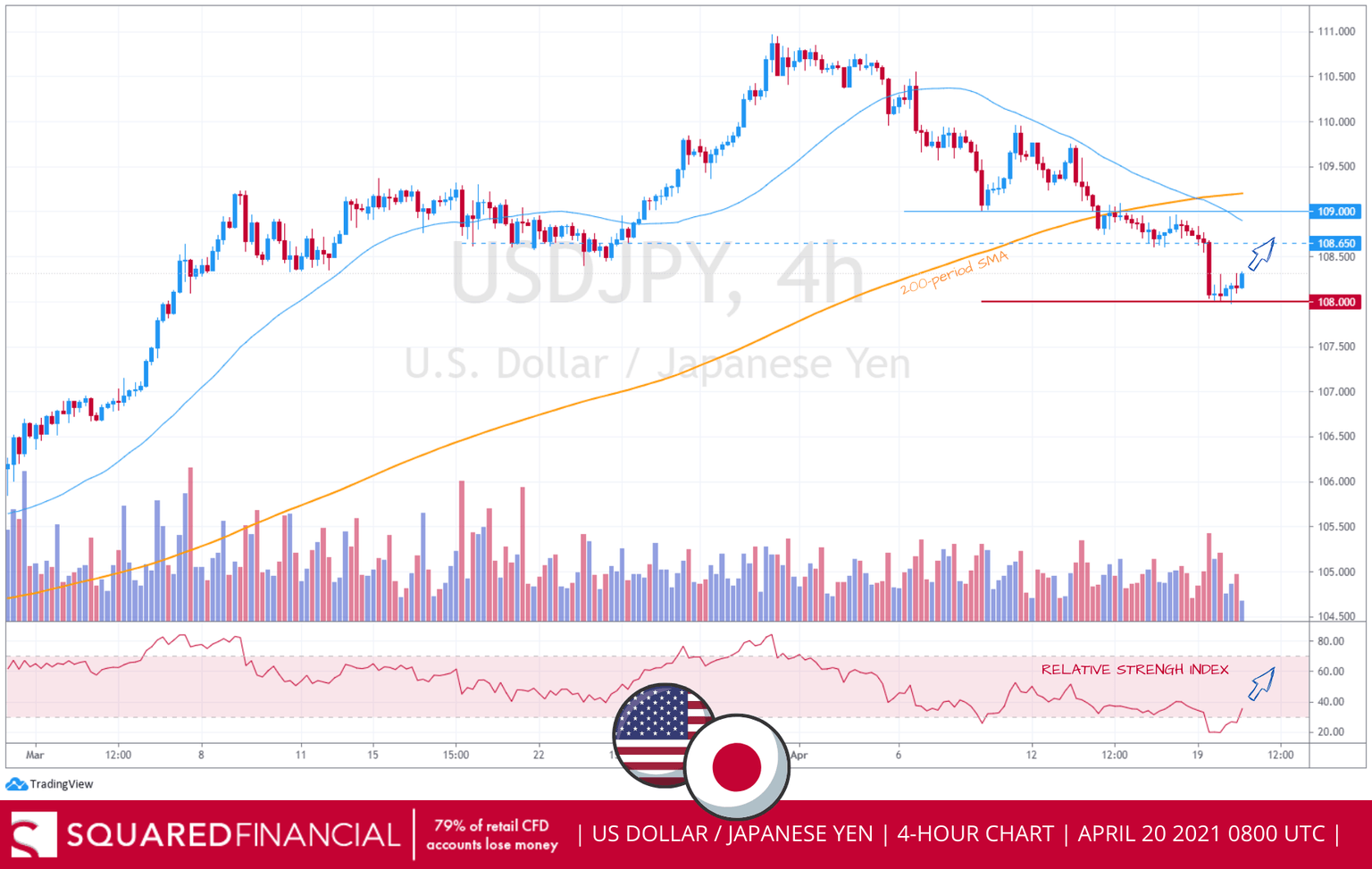

USD/JPY

Japan reported a surplus of 663.7 billion Yen in March as exports also posted the most robust surge in over 3 years, pushing the Yen lower this morning after the US Dollar was hit hard yesterday with the USDJPY currency pair plunging past our support at ¥108.60 yesterday to reach down to ¥108. USDJPY is now attempting a rebound back to the ¥108.65 now-turned- resistance, helped by the RSI indicator signaling strong upside momentum.

FTSE100

The FTSE100 fell back below the 7000-mark tracking weak trading in the US and Japan overnight, despite a better-than-expected jobless rate, released in the UK this morning. Technically speaking, the blue-chip index is expected to decline further to 6960 coincidings with the 200-period moving average, as the RSI signals more weakness ahead.

DOW JONES

The Dow Jones dropped to our support level at 34000 weighed down largely by weakness in tech stocks, as investors are again worrying about a rise in inflation and renewed coronavirus infections that prompted some countries to reimpose lockdown measures. However, US stocks bounced back with more short-term volatility expected today as investors balance the impact of inflation with increasing optimism over strong corporate earnings. 34250 remains the resistance to break for further upside, while near-term RSI indicates weakness with 34075 as support level.

DAX30

The German DAX retreated from the highs of the day, ending yesterday’s session in the red while the RSI momentum indicator continues to hover in overbought conditions, favoring a correction lower with 15360 support level needed to be breached to open the door to further downside with the 200-period SMA as closest support target.

GOLD

Gold touched the $1790 resistance level in yesterday’s session, only to end the day on a bearish daily candle after US10Y yields picked up, now back above the %1.60. Concerns over a spike in Covid-19 cases spurred some risk off demand on the yellow metal, only to be short-lived, with $1767 key support level to breach to favor further downside with $1760 and the 200 periods SMA as next targets in extension.

US OIL

The Libyan National Oil Corp declared a force majeure on exports, after production dropped by 1Mbpd due to delays in infrastructure repairs, lifting WTI Crude prices above $63.85 resistance level, now turned into support. Weekly API crude oil inventory data expected later today, with $64.40 as the closest resistance target on the upside.

Author

Rony Nehme

SquaredFinancial

Rony has over twenty years of experience in financial planning and professional proprietary trading in the equity and currency markets.