US Dollar Index outlook: Pullback faces headwinds from important technical support

US Dollar Index

The dollar holds in red for the third consecutive day, weighed by escalation of US-China trade conflict and recent dovish remarks from Fed chair Powell that add to strong expectations for two Fed rate cuts by the end of the year.

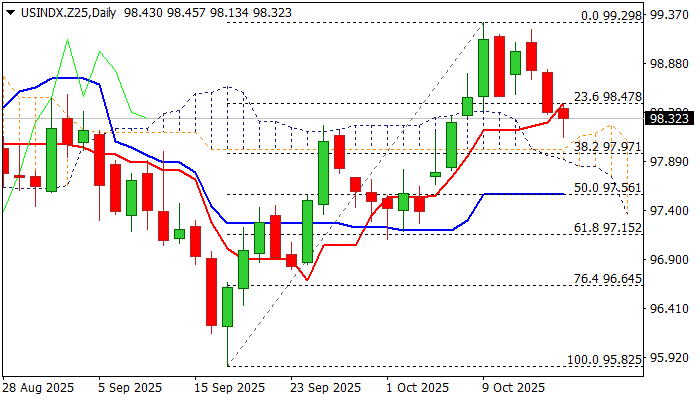

Pullback from a multiweek highs (99.22/29) where larger bulls from new 2025 low (95.82) got trapped at Fibo 76.4% of 100.04/95.82 descend, faced headwinds from 98.00 support zone (top of thickening daily Ichimoku cloud/Fibo 38.2% of 95.82/99.29 upleg).

Reaction at these points is likely to define near-term direction, with sustained break lower to sideline bulls and open way for deeper correction and expose targets at 97.56 (50% retracement/daily Kijun-sen) and 97.15 (Fibo 61.8%) in extension.

Conversely, failure at 98.00 would generate initial signal that pullback is running out of steam, though bounce and close above daily Tenkan-sen (98.48) will be a minimum requirement to generate initial reversal signal and point to scenario of healthy correction before broader bulls regain control.

The second scenario is supported by predominantly bullish technical picture on daily chart, however, dollar’s action will also depend on behavior of the largest index components – Euro and Japanese yen.

The single currency holds positive stance and remains mainly intact from deepening political crisis in France, while USDJPY started to gain traction after a two-day drop.

Res: 98.48; 98.82; 99.00; 99.29.

Sup: 98.00; 97.79; 97.56; 97.15.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.