US dollar in tight range ahead of US retail sales data

The Australian dollar declined slightly as investors reacted to mixed economic data from China. According to the Chinese statistics office, the unemployment rate remained unchanged at 5.7% while industrial production remained unchanged at 4.8%. The production data was lower than the 5.1% analysts were expecting. The fixed asset investments dropped by 1.6% in July while house prices rose by 4.8%. These numbers show that the Chinese economy recovery is continuing after it expanded by 5.3% in the second quarter.

The euro was little changed during the Asian session ahead of the second preliminary Eurozone GDP numbers. Analysts expect that the Eurozone’s economy contracted by 12.1% in the quarter and by 15% on an annualised basis. This decline will be better than the 32% contraction in the US but worse than the 5.3% growth in China. The statistics bureau will also release the preliminary employment change data for the second quarter. Other important numbers from Europe will be the French CPI and Portuguese GDP data.

The US dollar is little changed ahead of the important retail sales numbers from the US. Analysts polled by Reuters expect the data to show that retail sales increased by 1.9% in July, which will be lower than the previous growth of 7.5%. They also see the core retail sales rising by 1.3%. Other important numbers from the US will be industrial production, manufacturing production, and Michigan consumer sentiment. These numbers will come a day after the Bureau of Labour Statistics released relatively strong data. The initial jobless claims in the previous week were 963K while the continuing jobless claims dropped from the previous 16 million to 15.4 million.

EUR/USD

The EUR/USD pair is trading at 1.1807, which is slightly below yesterday’s high of 1.1866. On the four-hour chart, the price is along the 50-day exponential moving averages. It is also slightly above the 100-day EMA. Also, the Average True Range (ATR), which is a good measure of volatility, has dropped to the lowest level since July 21. The price is also between the channel shown in blue below. Therefore, the pair is likely to remain in the current channel today.

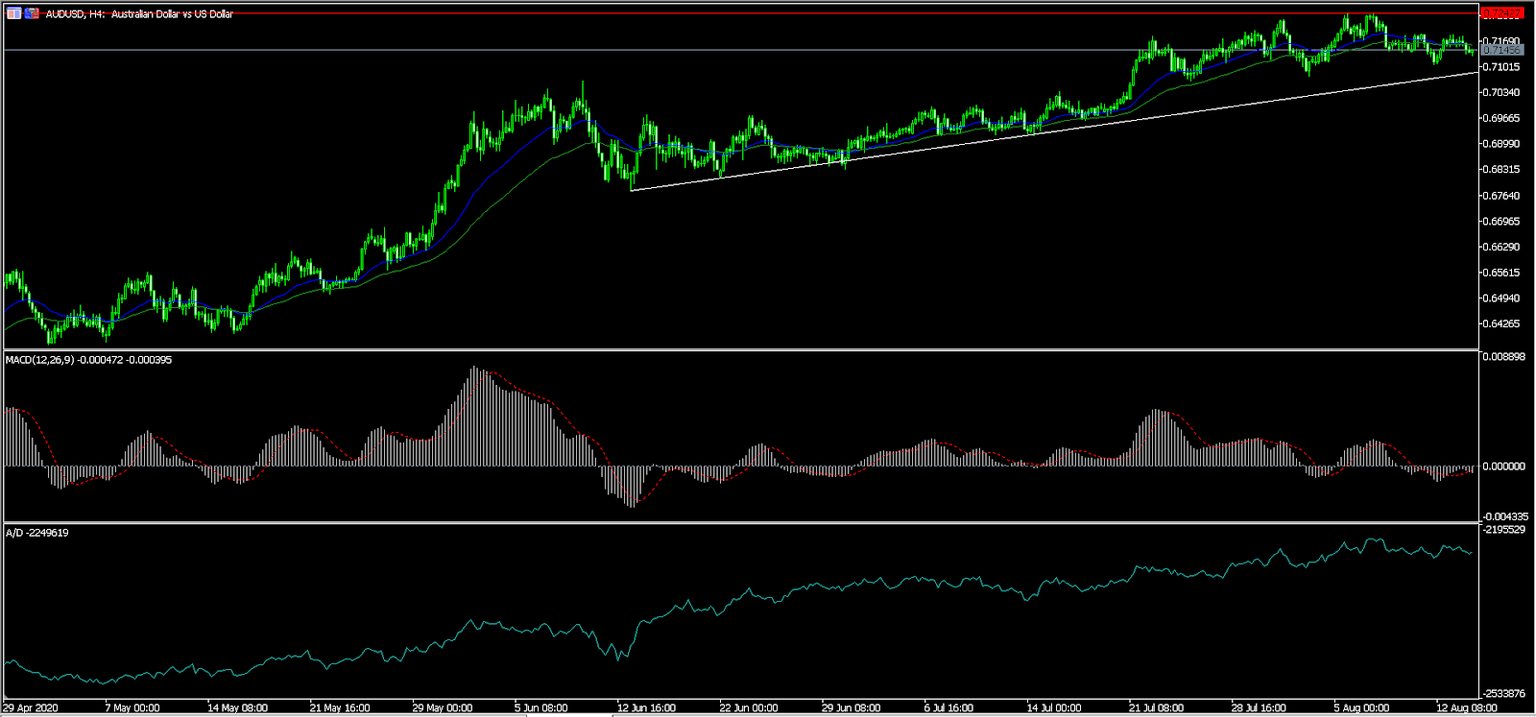

AUD/USD

The AUD/USD pair is trading at 0.7142, which is slightly below yesterday’s high of 0.7192. On the four-hour chart, the price is a few pips below the short and medium-term moving averages. Also, it is a few pips above the ascending trend line that is shown in white. The signal and main line of the MACD is slightly below the neutral line. The accumulation and distribution line has moved relatively lower. The pair is likely to remain in the current range.

NZD/USD

The NZD/USD pair declined to an intraday low of 0.6530 during the Asian session. The four-hour chart shows that the price has formed a triple top pattern since the final week of July. The price is also below the 50-day and 100-day exponential moving averages. Also, the signal and main line of the MACD are below the neutral line. It is also slightly above the August 12 low of 0.6525. Therefore, the pair is likely to continue falling as bears target the next support at 0.6500.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.