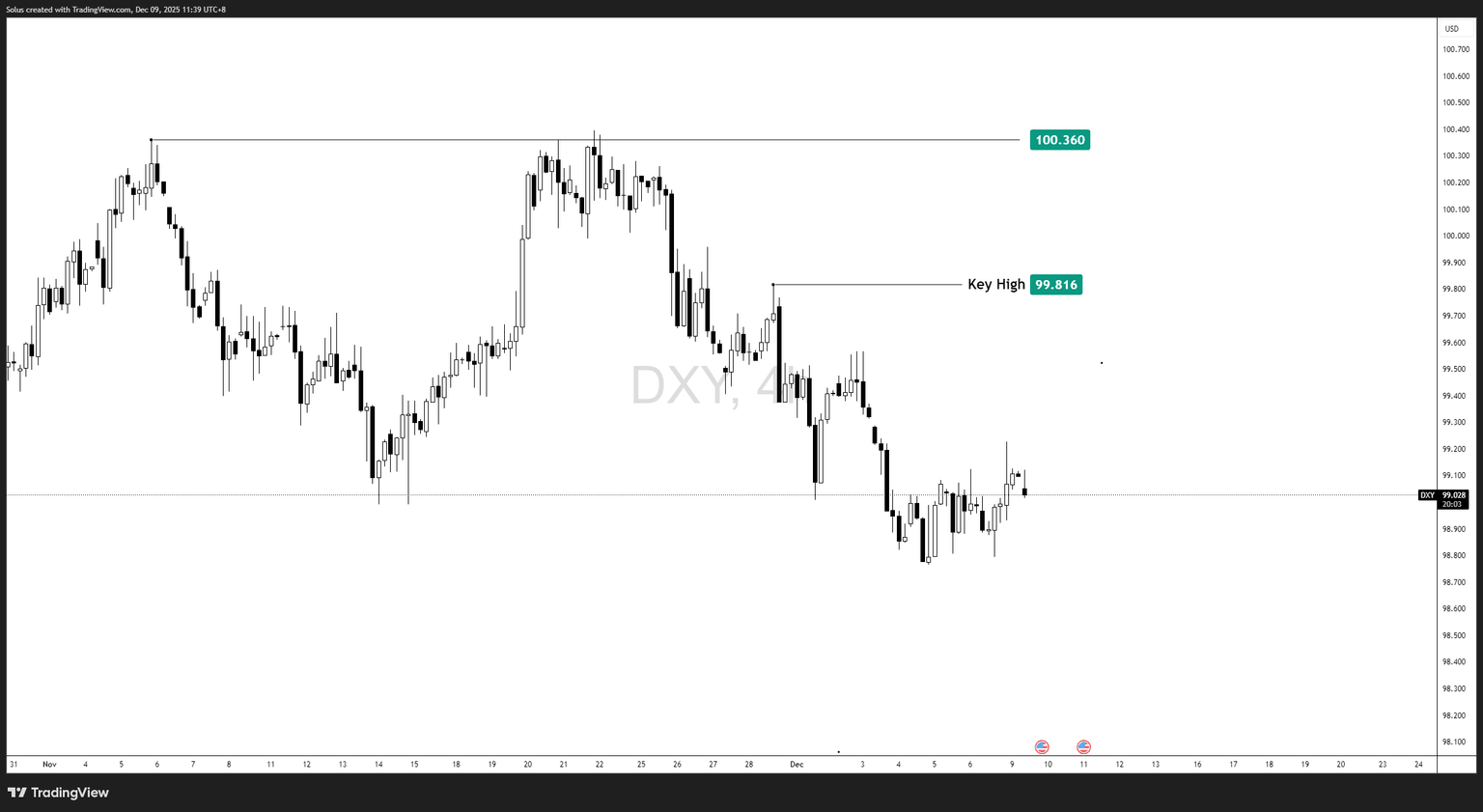

US Dollar forecast: Will Fed rate-cut expectations break DXY’s range?

- The US Dollar has shifted into a tight accumulation range, unable to extend its downtrend as demand stabilizes price.

- Rate-cut expectations for December are now acting as a ceiling, preventing the dollar from recovering despite structural support.

- The key question is whether the Fed’s dovish tilt will break the range, or if stabilizing demand keeps DXY locked in consolidation.

The US Dollar enters December caught between opposing forces: technical stabilization and macro pressure. On one side, the charts show DXY establishing a base after weeks of controlled selling. On the other, markets are increasingly pricing in Fed rate cuts, which suppress upward momentum and trap the dollar under key structure.

The result is a dollar that is no longer falling—but also not rising.

Instead, DXY is locked inside a well-defined 4H range, waiting for the next policy signal to determine its direction.

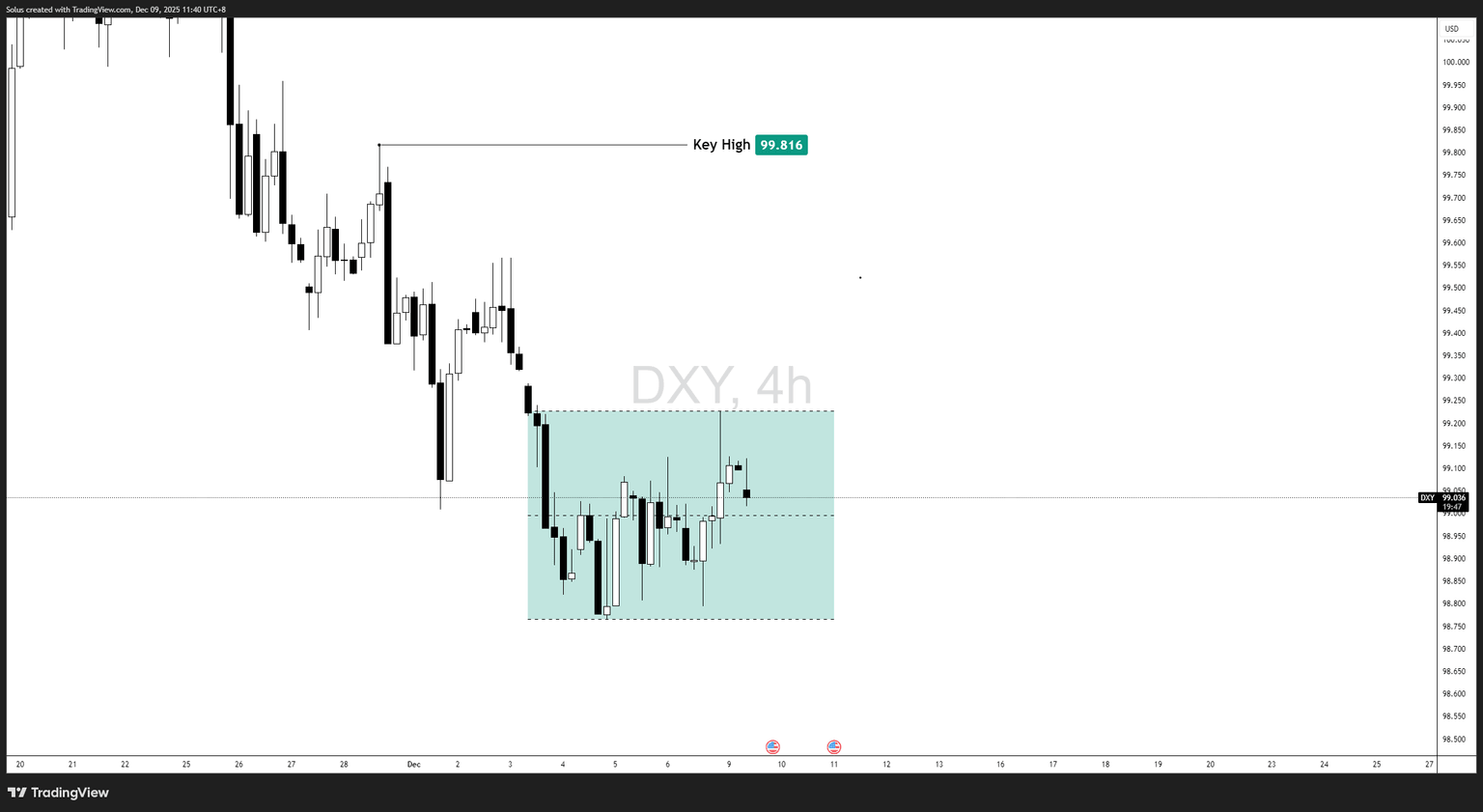

Why DXY has shifted into a range

The dollar’s downtrend has paused as price repeatedly rejects the 98.70–99.00 area. This region has acted as a short-term anchor, absorbing selling pressure and preventing continuation lower.

Key factors behind the stabilization

- Demand is forming beneath price, indicating downside exhaustion.

- Wicks and mid-range structure show two-sided liquidity.

- The market is preparing for Fed clarity, not initiating new trends.

Despite this support, there is no bullish momentum. Rate-cut bets cap the upside and prevent a breakout through 99.816.

How rate-cut expectations are containing the Dollar

Markets now assign meaningful odds to another December rate cut, adding downward pressure on the USD.

Rate-cut impacts on DXY

- Cuts reduce yield attractiveness, softening USD demand.

- Traders avoid building long-dollar exposure ahead of dovish meetings.

- Even supportive technical zones struggle to generate momentum.

This fundamental backdrop explains why DXY’s attempts to rise are repeatedly rejected—policy expectations outweigh structural signals.

The accumulation box defines December’s tone

Across multiple charts, DXY trades cleanly inside a rectangular consolidation zone:

- Range high: ~99.40.

- Range low: ~98.70.

- Midline behavior: Frequent, low-momentum oscillations.

Instead of directional expansion, the dollar is compressing.

This box is the market’s “holding chamber” while traders wait for confirmation on whether the Fed cuts again—or delays easing into 2026.

The key high at 99.816 is the macro pivot

Your chart identifies 99.816 as the crucial swing high defining the boundary between consolidation and larger recovery.

- A break above 99.816 signals rejection of dovish pricing.

- Staying below it reflects continued belief in Fed easing.

- Price hovering beneath it shows market hesitation.

This is the line that rate-cut expectations are defending.

Technical outlook

DXY currently sits near the midline of its accumulation block after failing to sustain an impulsive upswing. Each test of premium range levels encounters resistance, suggesting lack of initiative buying.

Technical features visible on chart

- Steady rotations inside the boxed range.

- Failed breakout attempts toward 99.40.

- Lower-wick rejections forming a soft floor.

- No displacement in either direction.

The chart structure reflects a market waiting—not trending.

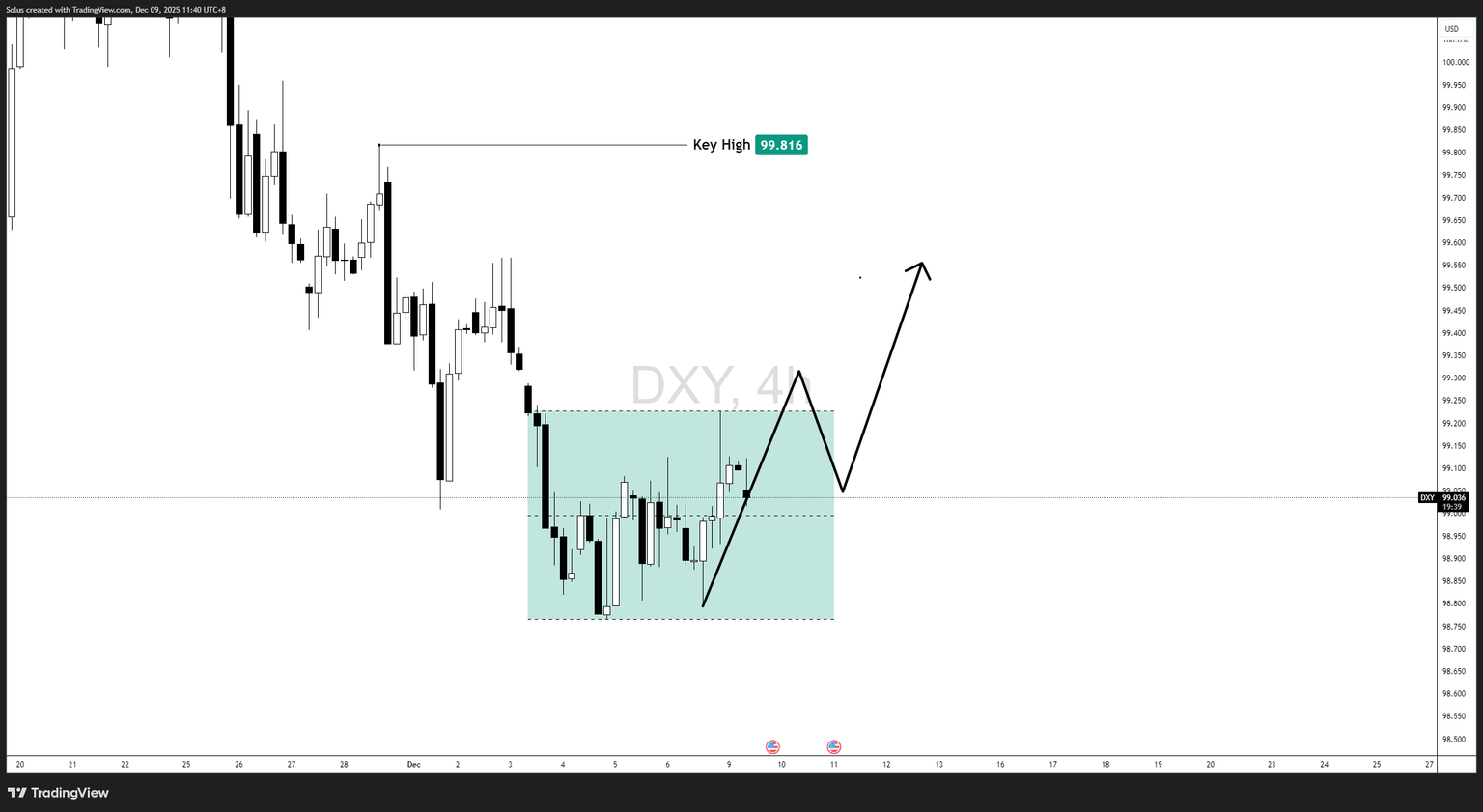

Bullish scenario

A bullish resolution unfolds if:

- The 98.70–99.00 range floor continues to hold

- Buyers form a higher-low inside the accumulation zone

- DXY breaks and stabilizes above 99.816

A reclaim of 99.816 shifts momentum, neutralizes rate-cut expectations, and opens space toward 100.36.

This outcome suggests the market believes the Fed will hold off on aggressive easing.

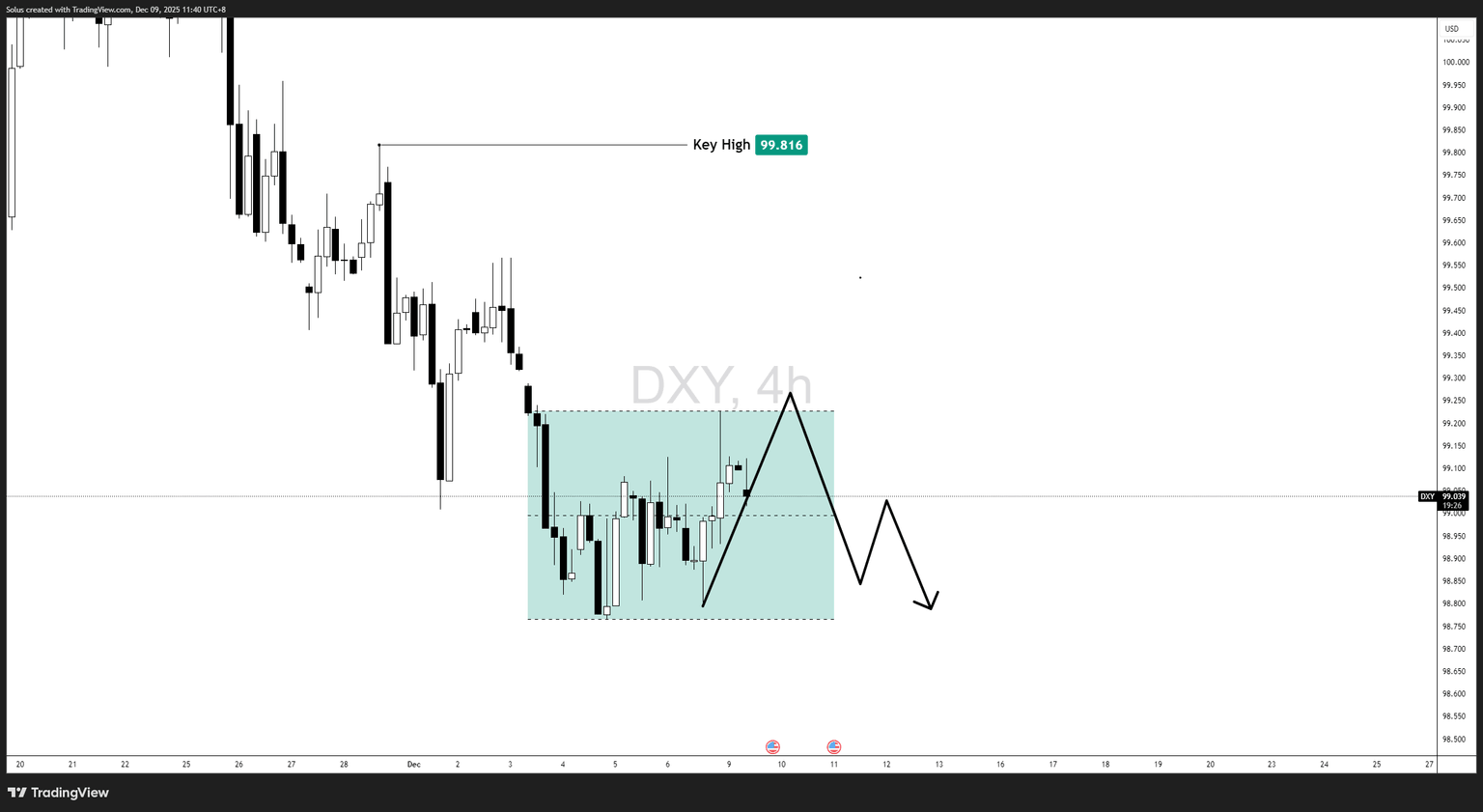

Bearish scenario

A bearish outcome takes shape if:

- The range low at 98.70 breaks with displacement

- Sellers regain initiative after dovish Fed communication

- Markets strengthen expectations of multi-cut easing in early 2026

Below the range, liquidity draws lie near 98.30 and deeper inefficiencies.

This scenario aligns with markets embracing a full rate-cut cycle, not just a tactical adjustment.

Final thoughts

The US Dollar is no longer trending—it is waiting.

Technical structure shows balance; fundamentals show pressure. December rate-cut expectations have pinned DXY into a holding pattern, forcing consolidation instead of continuation.

The market has drawn its boundaries:

- Bullish breakout – requires a rejection of rate-cut pricing.

- Bearish breakdown – requires reinforcement of dovish expectations.

Until the Fed provides clarity, the dollar remains suspended inside its range—stable, compressed, and primed for expansion once the next catalyst arrives.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.