US CPI expected to be delayed as government shutdown extends

- The US October CPI report, originally scheduled for Thursday, November 13 at 8:30 AM ET, is now expected to be delayed as the government shutdown continues to restrict data operations.

- The prolonged funding deadlock leaves the Fed and markets without a crucial inflation benchmark heading into the final weeks of the year.

- Dollar momentum weakens amid uncertainty; equities stabilize but remain data-sensitive; volatility likely to rise once a new release date is confirmed.

Macro narrative: CPI delay adds to shutdown fallout

The U.S. October CPI release—the most anticipated data point of the month—appears likely to be pushed back following extended government shutdown disruptions. With no resolution in Washington, the Bureau of Labor Statistics (BLS) remains under restricted operations, meaning critical data compilation and verification processes cannot be completed in time for the original November 13 release.

This development compounds existing data paralysis across U.S. agencies. The Nonfarm Payrolls and retail sales reports have already faced interruptions, leaving investors and policymakers without reliable metrics to assess growth and inflation dynamics.

In effect, the absence of CPI strips the market of its primary inflation compass, forcing traders to rely on fragmented indicators such as market-implied breakevens and Fed communications. With liquidity thinning ahead of the year-end, this uncertainty amplifies volatility across currencies, bonds, and equity indices.

Policy blind spot: Fed left without guidance

The CPI delay arrives at a critical juncture for the Federal Reserve, which had been depending on this report to calibrate its tone for the December meeting. Inflation data not only guides rate policy—it also anchors forward guidance and market expectations.

Without CPI confirmation, the Fed’s decision-making now leans heavily on lagging or incomplete data. Several officials, including Cleveland Fed’s Beth Hammack, have noted that the shutdown limits access to essential economic indicators, making it difficult to justify policy shifts with confidence.

As a result, the Fed is likely to maintain a neutral or data-dependent stance in the near term. Markets are already pricing a higher probability of no rate changes through early 2026, while yields have eased modestly in response to the growing data void.

Market implications: Uncertainty dominates trading tone

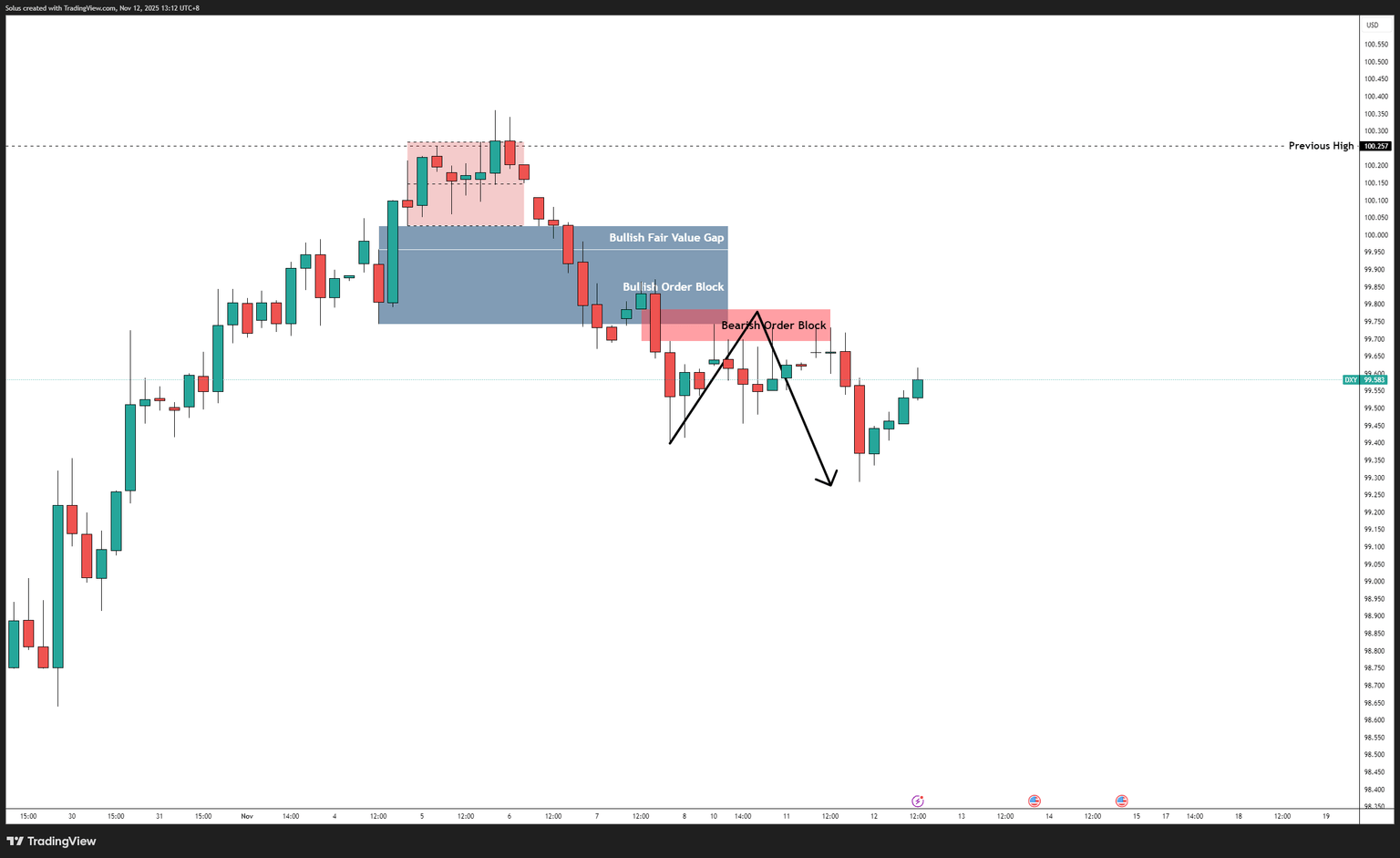

US Dollar (DXY)

The dollar has softened slightly as the market reduces hawkish positioning. With no CPI to confirm inflation persistence, yields have lost directional momentum, keeping the DXY range-bound between 105.00 and 106.50.

Treasury yields

Long-end yields are stabilizing near recent lows as investors rotate into bonds for safety. The absence of new inflation data reduces the likelihood of another rate spike this month.

Equities

U.S. indices remain resilient but indecisive. The Nasdaq and S&P 500 have consolidated near recent highs, underpinned by the assumption that the Fed will not tighten policy further while data remains unavailable.

Gold

Gold prices continue to hold near the $4,000 region, supported by safe-haven demand and falling yields. The metal’s resilience signals investor caution over prolonged uncertainty.

FX landscape: Currencies await direction

- EUR/USD: Gradual upward bias as USD weakens on lack of inflation confirmation.

- GBP/USD: Consolidating near 1.28–1.29; gains capped by broader risk aversion.

- USD/JPY: Still tracking yields; potential retracement toward 149 if risk-off mood deepens.

- AUD/USD / NZDUSD: Range-bound, waiting for risk sentiment clarity once U.S. data resumes.

- USD/CAD: Direction tied to oil and USD behavior; limited volatility until CPI rescheduling.

Shutdown scenarios and market outlook

Scenario | Status | Market Implication | Likely Outcome |

|---|---|---|---|

Shutdown persists through November | CPI delayed indefinitely | Fed forced to pause, USD softens | Range-bound dollar, higher volatility |

Temporary funding deal next week | CPI rescheduled | Short-term risk-on rally | Equity upside, mild USD correction |

Full reopening before Thanksgiving | Normal data flow resumes | Fed regains policy clarity | Market repricing based on actual inflation |

Until an official resolution or CPI update is confirmed, market sentiment will remain fragile and reactive to any new policy or fiscal headlines.

Conclusion

The expected delay of the US CPI release marks a new stage in the market’s data drought. With critical inflation information unavailable, traders are left navigating sentiment rather than substance. The Fed, meanwhile, is operating under partial visibility, reinforcing the case for policy caution through year-end.

- A short-term delay could be manageable, but an extended one risks compounding uncertainty across asset classes.

- If the shutdown extends further into November, the lack of reliable inflation data could distort market pricing and hinder monetary policy communication.

Until clarity returns, global markets will continue to trade on speculation rather than confirmation—an uneasy equilibrium sustained by hope for political resolution rather than economic evidence.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.