US Conference Board Consumer Confidence March Preview: Jobs are the edge not stimulus

- Consumer Confidence expected to rise to 96.9 in March.

- Nonfarm Payrolls projected to add 639,000 jobs, unemployment at 6%.

- March Michigan Consumer Sentiment at pandemic high of 84.9.

- Stimulus payment of $1400 may aid consumer outlook.

- Dollar awaiting further evidence of US recovery.

The improving US labor market, not additional stimulus payments, should provide consumers with the best reasons for optimism since last fall.

Consumer Confidence from the Conference Board is expected to rise to 96.9 in March from 91.3 in February and December’s low of 88.9.

Nonfarm Payrolls and Consumer Confidence

Employment is the most important reference for US Consumer Confidence.

Consumer confidence reached its best pandemic level in October of 101.4 after six months of job restoration had returned employment to about 12.4 million of the 22.4 million laid off in the March and April lockdown debacle.

When payrolls fell in November to 264,000 from October’s 680,000, consumer optimism plunged almost ten points to 92.9.

As the reimposed California lockdown in December shredded employment and payrolls lost 306,000 jobs, confidence dropped along with employment to 87.1, the weakest reading since August.

The unexpected gains of 166,000 in January and 379,000 in February produced commensurate increases in optimism to 88.9 and 91.3 respectively.

Reuters

Payrolls are forecast to be 639,000 in March and to bring consumer sentiment back to its highest level since October at 96.9.

Stimulus and Retail Sales

The January stimulus payment of $600 to most individuals and families drove a 7.6% jump in Retail Sales as all of the stipend was spent. But Americans did not mistake consumption, especially from free cash, for an improved labor economy and sales reversed 3% in February.

The latest $1400 gift, received by most people in March will likely spur a second consumption burst but it too will wither unless it is backed by job growth.

Retail Sales

FXStreet

Michigan Consumer Sentiment

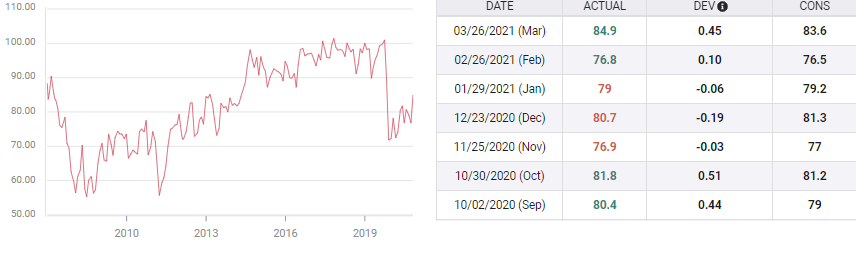

The Michigan Survey of Consumer Sentiment rose to 84.9 in March, its strongest score of the pandemic and well ahead of its initial 78.5 estimate and February’s 76.8 reading.

Michigan Consumer Sentiment

FXStreet

Conclusion and markets

Consumers have two very good reasons to assert their optimism. First, employment appears to have recovered from its December and January trough and from February has again begun to restore workers to their jobs. Nothing is more pertinent to consumer attitudes than the ability to find and keep employment.

Second, vaccination may have finally provided hope that the pandemic will be overcome in the next few months. Even the currently rising counts in several states and dire warnings from the Center for Disease Control, may not be enough to dent the sense of returning normality.

The US dollar has had a good first quarter as rising Treasury yields have anticipated a strong economic recovery. Consumer sentiment would be the latest sign that bond traders have not speculated in vain.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.