US Conference Board Consumer Confidence April Preview: Every reason for optimism

- Consumer Confidence expected to rise to 113.00 in April.

- March Nonfarm Payrolls at 916,000 bolstered Consumer Confidence.

- Initial Jobless Claims were at pandemic low for two straight weeks.

- Retail Sales in March reflect stimulus payment and positive outlook.

- Stronger than expected confidence may help the stalled US dollar.

American consumers have every reason to feel expansive. A year after the lockdowns that wrecked the US economy, the pandemic is in retreat, economic growth and hiring are strong and layoffs have fallen to their lowest level since the collapse last March.

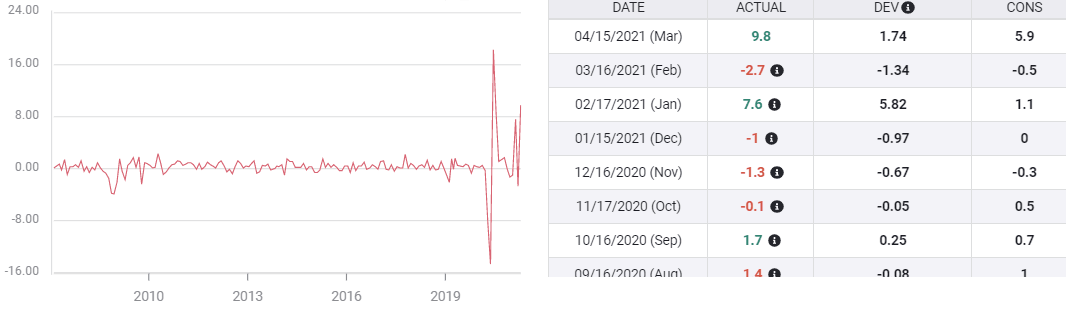

Retail Sales soared 9.8% last month driven by stimulus payments from Washington and the returning optimism that the recovery is permanent.

Retail Sales

FXStreet

Consumer Confidence from the Conference Board is forecast to rise to 113.00 in April from 109.7 prior.

In March Consumer Confidence score had jumped to 109.7 from 91.3 in February, far ahead of the 96.9 forecast. Sentiment last month was about half-way between the February 2020 score of 132.6 and the April panic low of 85.7.

“Consumer Confidence increased to its highest level since the onset of the pandemic in March 2020,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board in the statement issued with the results last month. “Consumers’ assessment of current conditions and their short-term outlook improved significantly, an indication that economic growth is likely to strengthen further in the coming months”

Nonfarm Payrolls

Help wanted signs are everywhere in the US as the economy accelerates out of the pandemic restrictions.

Job creation soared in the first quarter from 233,000 in January to 916,000 in March.

FXStreet

Through the end of the first quarter US employers had rehired about 64% of the 22.4 million workers economy leaving about 8.4 million unemployed.

The seeming contradiction of millions of unemployed while companies cannot find enough workers is due to the mismatch of skills and positions. Many of those remaining out of work are in the restaurant, hospitality and retail sectors that have had an uneven recovery at best.

In many cities restaurants are still hobbled by occupancy limits and by the change in dining habits wrought by the pandemic.

Travel and hospitality, despite improvement, are at less than half their 2019 rates, many jobs have not returned.

Manufacturing and construction are booming in many areas of the country, but that doesn't help the unemployed waiter in New York City or Los Angeles.

Initial Jobless Claims

First time unemployment claims have fallen precipitously in the last two weeks from 769,000 in the week of April 2 to 547,000 on April 16.

Initial Jobless Claims

Continuing high levels of layoffs have been one of the problems of the labor market in the first quarter. Despite the swift recovery in hiring, businesses in industries hard hit over the past year had continued to fail as they reached the end of their resources.

The more than 200,000 drop in filing over the last three weeks may be an indication that the economic recovery is finally reaching some of the last corners of pandemic damage.

Conclusion

Employment is the most important ingredient on consumer sentiment and the excellent record of the first quarter for jobs should be duplicated in April, May and June.

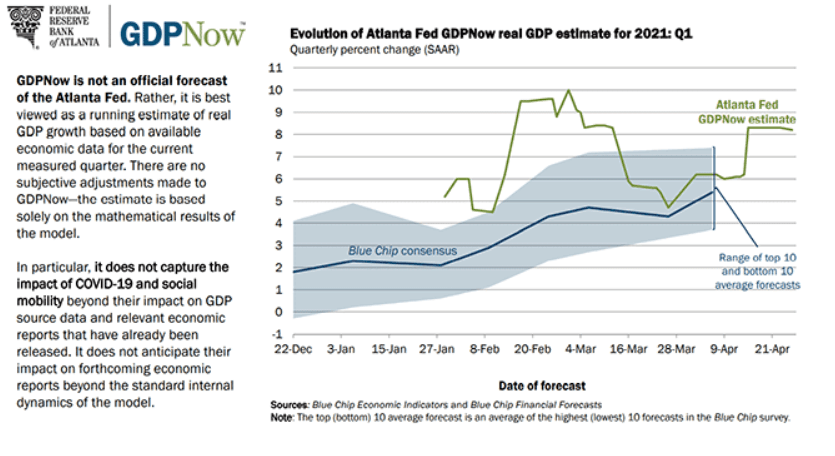

The US economy is expected to grow at a 6.5% annualized pace in the first quarter when GDP is reported on Thursday. The Atlanta Fed estimates growth will be 8.2%.

Whatever the final number, it should be more than sufficient to provide employment for anyone who wants it over the next several quarters.

The booming labor market should give Americans reason and confidence to celebrate the end of the end of the pandemic.

A few months of rapid job gains may even be enough to convince the Fed that tapering its extraordinary liquidity and rate support is the next order of business.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.