January employment: Strong start out of the gate

Summary

The employment report for January was broadly encouraging. Nonfarm payrolls doubled the Bloomberg consensus forecast of 65K for January, helping to push the three-month average pace of job growth to 73K, its strongest pace since last February. The unemployment rate fell by one-tenth to 4.3%, putting back to where it was in August 2025 before the FOMC cut rates at its three subsequent meetings. Revisions to job growth over 2024 and early 2025 were sharply negative, but these changes were well-telegraphed in the previously released QCEW data. The more recent pace of job growth was less impacted by the slew of revisions in today's report.

The U.S. labor market is far from perfect, with hiring still concentrated in a handful of industries, certain demographics enduring elevated unemployment rates and cyclical demand for new labor still tepid. That said, it appears the labor market is closer to stabilization than rapid deterioration, and this will embolden the hawks on the FOMC to push for no changes to the fed funds rate for the foreseeable future. We have been saying for some time now that the window for the FOMC to cut rates is closing, and today's data suggest another rate cut under Chair Powell is increasingly unlikely. If cuts are coming this year, it appears that it will be up to a future Chair Warsh to win over the hawks on the Committee and deliver before year-end.

Recent trend in hiring improves

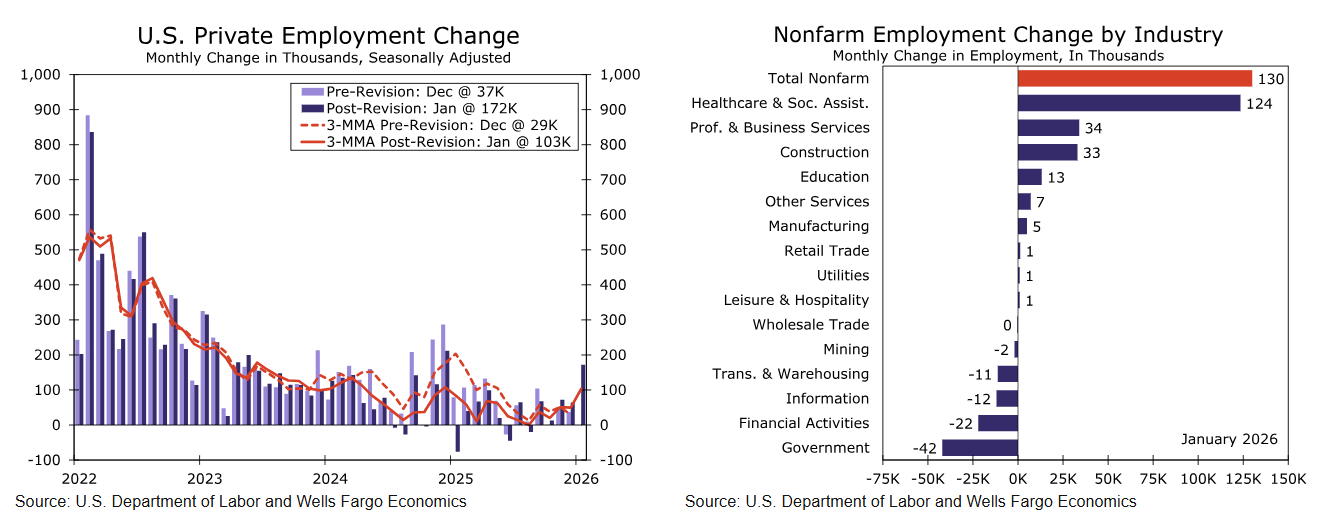

Nonfarm payrolls rose 130K in January, far exceeding the Bloomberg consensus expectation of 65K and our estimate of 80K. Data over the prior two months were revised modestly lower (-17K). Together, the three-month average pace of job growth improved to 73K, its strongest pace since last February.

Today's release brought more than the usual two-month revisions that come from late survey responses. The annual benchmark revised down the level of payrolls in March 2025 by 862K (-0.5%) marking the largest downward adjustment since 2009. Data for the "post benchmark" period (i.e., April 2025-December 2025) were also subject to revisions with the update of new seasonal adjustment factors and modifications to the birth-death model. While smaller in magnitude than the annual benchmark, payroll growth in the post-benchmark period is now reported to have increased an average of 13K per month compared to 28K as previously reported.

While revisions show materially weaker job growth for 2025 as a whole, recent monthly data suggest the trend in hiring has firmed since the summer. Private sector nonfarm payrolls jumped 172K in January, and the three-month average, at 103K, is well ahead of the flat reading registered in last August (chart). Yet, healthcare & social services remains the dominant driver of job growth, having added 124K jobs—the largest monthly change since August 2020. Job growth in other segments continue to struggle, highlighting that job opportunities are not nearly as widespread as today's headline beat implies (chart).

Author

Wells Fargo Research Team

Wells Fargo