US Brief: top Trade Setups in Forex - Dollar Mixed Sentiment In Play!

The U.S. indices closed the last trading session of the year higher on Tuesday. The Dow Jones Industrial Average rebounded 76 points (+0.3%) to 28,538, the S&P 500 bounced 9 points (+0.3%) to 3230, and the Nasdaq Composite added 26 points (+0.3%) to 8972. Shares in the Materials (+0.8%), Energy (+0.7%), and Technology Hardware & Equipment (+0.7%) sectors gained the most.

Regarding U.S. economic data, the Conference Board Consumer Confidence Index unexpectedly slipped to 126.5 in December (128.5 estimated) from 126.8 in November. Later today, traders will start the year with weekly initial jobless claims expected at 220,000 (down from 222,000 from the prior week).

USD/JPY - 23.6% Fibonacci Retracement Done

The USD/JPY closed at 108.658 after placing a high of 108.884 and a low of 108.467. Overall the trend for USD/JPY remained bearish throughout the day.

At 7:00GMT, the House Price Index (HPI) from the United States for October was released, which showed a decline of 0.2% from the expectations of 0.4%and weighed on the U.S. dollar. The S&P/CS Composite-20 HPI for the year came in as 2.2% more than the expectations of 2.1%.

At 8:00 GMT, the closely watched Conference Board Consumer Confidence doe the month of December was released from the United States. It showed a decline to 126.5 from the forecasted 128.0 and added in the pressure of the U.S. dollar on Tuesday.

Weaker than expected macroeconomic data and decreased confidence of consumers weighed heavily on the greenback and dragged the USD/JPY pair to a low of 108.4. However, Japanese markets closed on that day.

On the other hand, the U.S. President Donald Trump announced on Tuesday in his tweet that Washington and Beijing would sign on the agreed Phase-one deal on January 15. He added that he would head to Beijing to initiate the phase-two of a trade deal with China.

This news gave a more optimistic view of the developments of Sino-US trade relations and decreased the appeal for the safe-haven greenback, which resulted in the downward movement of the USD/JPY pair that day.

Furthermore, the escalated tensions between the U.S. and the Middle East after the U.S. airstrike continued weighing on the U.S. dollar. The protestors stormed the U.S. Embassy compound in Baghdad in response to the U.S. military action in Iraq & Syria.

Donald Trump, in reply, said that in case of any loss of life or damage to U.S. personnel, Iran would be held responsible and will have to face the consequences. He added that it was not a warning but a threat.

The tensions raised the demand for Yellow metal and reversed the demand for the U.S. dollar to weigh on USD/JPY prices.

USD/JPY - Daily Technical Levels

|

Support |

Pivot Point |

Resistance |

|

108.69 |

108.74 |

108.81 |

|

108.61 |

108.86 | |

|

108.48 |

108.99 |

USD/JPY - Daily Trade Sentiment

The USD/JPY has completed 23.6% Fibonacci retracement around 108.750, and below this, it is very likely to drop until 108.560 today.

The 50 periods EMA is likely to extend resistance around 108.700. On the 4 hour chart, the pair has closed a Doji candle and a bearish engulfing, which is suggesting chances of a bearish turn in the USD/JPY pair. Let us look to stay bearish below 108.74 to target 108.450 today.

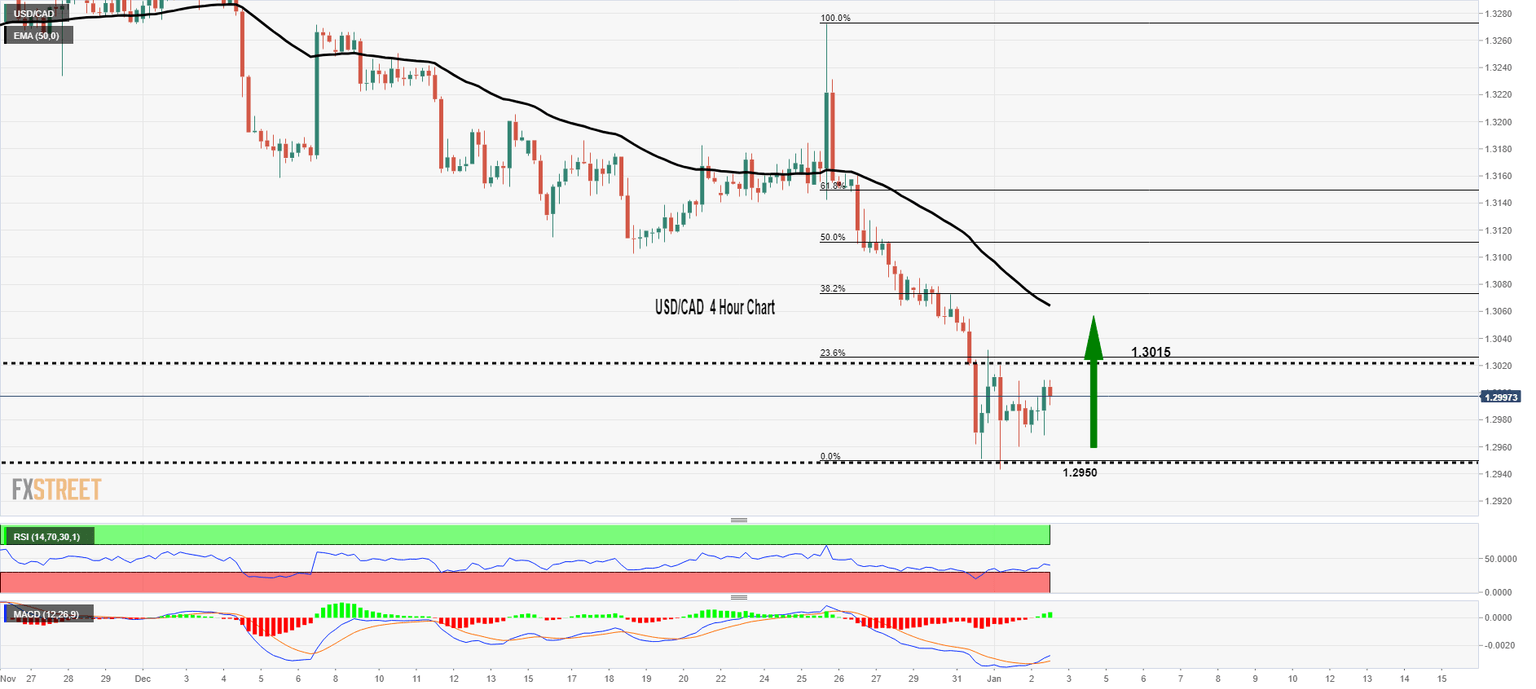

USD/CAD - Sideways Trading Session

The USD/CAD closed at 1.29843 after placing a high of 1.30684 and a low of 1.29511. Overall the movement of USD/CAD remained strongly bearish that day.

At the ending day of the year, USD/CAD dropped to its lowest level of the year at 1.295, which is also the weakest since October 2018.

The Canadian Dollar won the award of the Best Performing Currency of 2019. The prize was in the category of major G-10 currencies compared to the U.S. dollar.

Throughout the 2019 Canadian dollar gained 4.4% and held the first position while British Pound was in the second position with 4.0%. Australian Dollar remained unchanged throughout the year, and the Euro was the only currency to lose its ground and fell 1.9% in 2019 due to weak economic growth and low-interest rates.

The strength of the Canadian Dollar derived from the Bank of Canada's neutral monetary policy stance. The central bank of Canada was widely expected to lower its overnight rates in October, but it remained flat. While all other central banks of the world, including ECB and Federal Reserve, cut its rates in 2019.

Increased Crude Oil prices also helped commodity-linked Loonie to gain strength this year. Other external factors like the phase-one deal between the U.S. & China improved the outlook for 2020 global economy and helped Canadian Dollar to rise against the U.S. dollar.

On Tuesday, the decreased Consumer Confidence from the United States added in the weakness of the U.S. dollar and helped Canadian Dollar to outperform even in the absence of macroeconomic data from Canada.

USD/CAD - Daily Technical Levels

|

Support |

Pivot Point |

Resistance |

|

1.2984 |

1.2986 |

1.2988 |

|

1.2981 |

1.299 | |

|

1.2977 |

1.2994 |

USD/CAD - Daily Trade Sentiment

On Thursday, the USD/CAD continues to trade in a sideways trading range of 1.3015 - 1.2950. The pair went oversold, and now it is trying to bounce off to come out of the oversold range. On the upper side, the pair has completed 23.6% Fibonacci retracement until the 1.3015 level.

The RSI and MACD are crossing into the bullish zone, with values lingering above 50 and 0. The 50 periods EMA is still proposing selling bias, but it is too far around 1.3060. Let us stay bearish below 1.3015 to target 1.2955 today.

AUD/USD – 50 EMA to Support AUD/USD

The AUD/USD closed at 0.70158 after placing a high of 0.70315 and a low of 0.69900. Overall the trend for AUD/USD pair continued to trade bullish throughout the day. The Aussie placed gain for the ninth consecutive day at the ending day of the year to the highest level since July above 0.700 level.

At 6:00 GMT, the Caixin Manufacturing PMI from China showed a minor increase to 50.2 from expected 50.1 for December. The manufacturing sector remained in line with the expectations at the end of the year. However, the Non-Manufacturing PMI from China showed a decline in the activity in December to 53.5 from expected 54.2.

Aussie showed almost no response to the PMI from China on Tuesday and continued to rise on the end of the weak U.S. dollar.

U.S. dollar remained weak at the end of the year due to weaker than expected macroeconomic data from the United States. At 7:00 GMT, the House Price Index for the month of October was released, which showed a decline to 0.2% from expected 0.4% and weighed on the U.S. dollar.

Adding in the pressure of the U.S. dollar was the closely watched Consumer confidence from the Conference Board of the United States on Tuesday, which also declined to 126.5 against the forecasted 128.0. Decreased consumer confidence in the month of December weighed on the U.S. dollar and helped AUD/USD to move in an upward direction.

On the other hand, Trump announced the date for the signing ceremony of the Phase-one deal between Beijing and Washington as of January 15. He also said that he would personally head to Beijing for the discussion of the phase-two trade deal.

This raised the bars for better trade relations between the world's two largest economies and a possible end to the ongoing 18 months-long trade war, which helped Aussie to remain positive at the New Year's Eve.

AUD/USD - Technical Levels

|

Support |

Pivot Point |

Resistance |

|

0.7013 |

0.7016 |

0.702 |

|

0.7009 |

0.7023 | |

|

0.7002 |

0.703 |

AUD/USD - Daily Trade Sentiment

The AUD/USD pair bulls got a breather as the pair drops to trade around 0.6980. It has already achieved 38.2% Fibonacci retracement around 0.6970.

Closings of the candle above this level are suggesting odds of a bullish recovery in the AUD/USD pair. Alongside this, the 50 EMA is also supporting the bullish bias for the AUD/USD pair today. We would consider taking staying bullish over 0.6990 level to target 0.7030.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and