US Brief: top Trade Setups in Forex – BOC Monetary Policy Decision Ahead!

The USD/CAD climbed 0.5% to 1.3138, the highest level since December 25. Bank of Canada held its benchmark rate unchanged at 1.75% as expected. The Central Bank's governor Stephen Poloz said: "I am not saying that the door is not open to an interest rate cut. It is, it is open." Meanwhile, government data showed that Canada's CPI grew 2.2% on year in December (+2.3% expected).

Later today, the U.S. Labor Department is expected to report initial jobless claims at 214,000 for the week ended January 18. The Conference Board U.S. Leading Index is anticipated to decline by 0.2% on month in December.

USD/JPY - Fibonacci Retracement In-Play

The USD/JPY pair was closed at 109.834 after placing a high of 110.099 and a low of 109.827. Overall the movement of the USD/JPY pair remained bearish throughout the day.

The pair USD/JPY dropped on Wednesday amid the rising demand for safe-haven, which came in along with the worries about whether the spread of coronavirus would hurt the global economy. The Dollar Index, which measures the value of the greenback against a basket of six major currencies, was flat at 97.534 on Wednesday.

It was reported that the confirmed cases of coronavirus in city Wuhan increased to 540, and the death numbers due to that virus increased to 17. This urged the need for closing transportation networks of the city and citizens to stay at home to limit the spread of contagion.

However, the fears of investors related to the global outbreak of coronavirus were somehow lightened because of the fact that China handled the epidemic of SARS in 2002-2003 very well, and it reassured that China would respond the same in current circumstances.

USDJPY - Daily Technical Levels

|

Support |

Pivot Point |

Resistance |

|

109.56 |

109.83 |

109.99 |

|

109.40 |

110.26 | |

|

109.13 |

110.42 |

USD/JPY - Daily Trade Sentiment

The USD/JPY is trading bearish at 109.600, crossing below 50 periods EMA which was supporting the USD/JPY at 110. Recently, the Japanese yen has formed three black crows and has already completed a 23.6% Fibonacci retracement level at 109.600.

Considering the bearish crossover of EMA and the bearish RSI is suggesting chances of further bearish trends in the USD/JPY. On the lower side, the USD/JPY can lead its prices towards 38.2%, which is 109.620. I will consider taking a sell position 109.92 until 109.300.

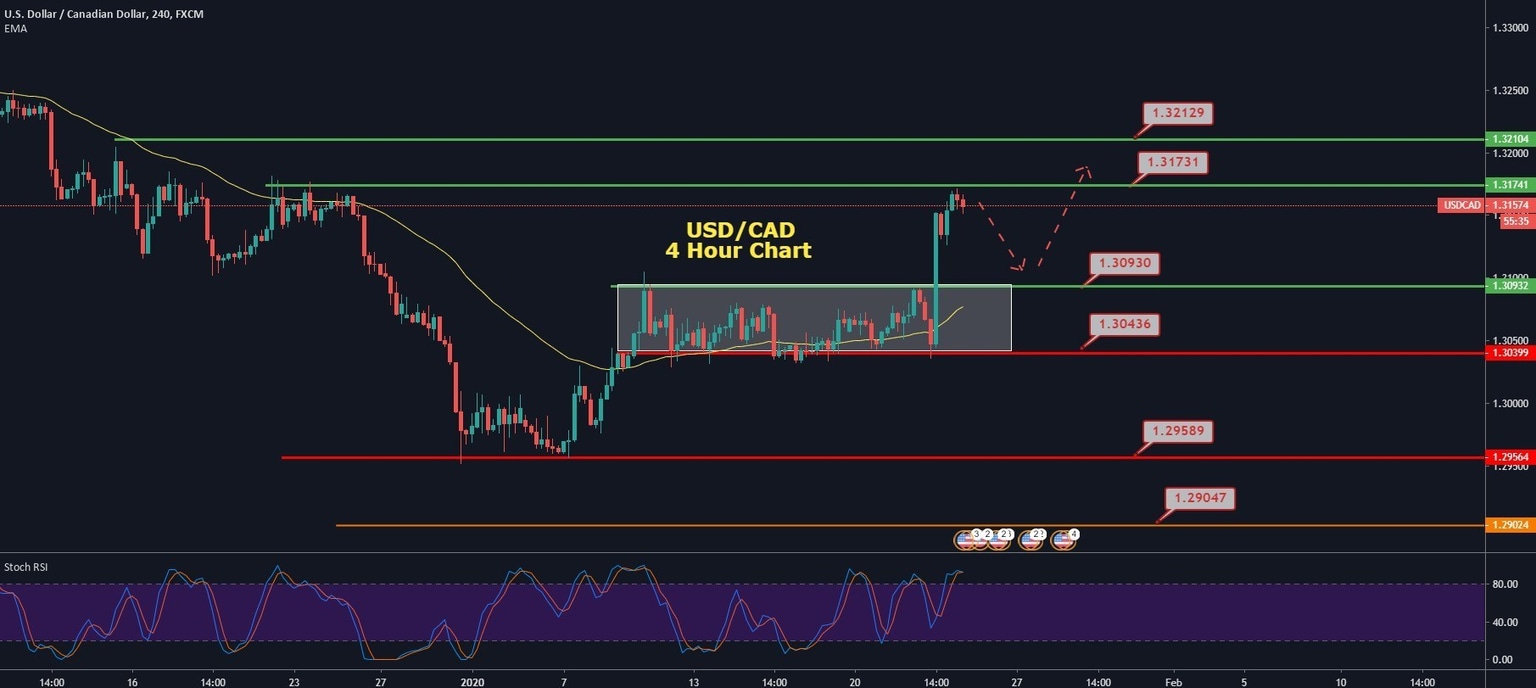

USD/CAD - Overbought Pair, Is It Going to Retrace?

The USD/CAD pair was closed at 1.31344 after placing a high of 1.31522 and a low of 1.30357. Overall the movement of the USD/CAD pair was strongly bullish that day. The USD/CAD pair rose on Wednesday and posted a fresh four weeks high at 1.315 level, which is the highest since December 26 amid the dovish comments from Bank of Canada.

The Bank of Canada maintained its interest rates on 1.75% on Wednesday as expected but opened its door for a possible rate cut if the recent slowdown in Canadian economic growth persisted.

The Bank of Canada is the only bank that did not change its interest rates last year and held its rates unchanged since October 2018. The governor of BoC Stephen Poloz said that the doors for an interest rate cut were open.

The central bank of Canada decreased the expectations of the economic growth of the country in its latest meeting on Wednesday. The forecast for the 4th quarter of 2019 was declined to 0.3% from 1.3% in October. The annualized growth expectations for 2020 were also dropped by the BoC to 1.3% from 1.7% in October.

The future path for interest rate policy by the bank would be determined by watching closely to see if the recent slowdown in the country's economic growth remains persistent than the forecast or not. Particular attention will be paid by the bank on economic data to decide further steps related to the interest rate cut.

On the data front, the Consumer Price Index for December from Canada remained flat with the expectations of 0.0%. At 18:30 GMT, the Common Consumer Price Index (CPI) for the year was increased to 2.0% from the expected 1.9% and supported the Canadian Dollar.

The Median CPI and the Trimmed CPI for the year both dropped to 2.2% and 2.1% from the expectations of 2.4% and 2.2%, respectively. However, the New House Price Index (NHPI) for December from Canada exceeded the expectations of 0.0% and came in as 0.2% to support the Canadian Dollar.

The Wholesale Sales in the month of November from Canada showed a decline of 1.2% from the expected decline of 0.2% and weighed on the Canadian Dollar. At 18:32 GMT, the Core Consumer Price Index for the month of December also showed a decrease of 0.4%, which was declined by 0.2% in November.

The dovish comments from Bank of Canada and the mixed data put heavy pressure on Canadian Dollar on Wednesday and supported the USD/CAD prices. The pair rose to its 4-weeks highest level amid weakness of Canadian Dollar.

Furthermore, the weakness of the Canadian Dollar was also supported by the fall of crude oil prices on Wednesday. The WTI Crude oil prices fell 2% on Wednesday amid the surplus forecast by International Energy Agency (IEA) for crude supplies. The fall of crude oil added in the fall of the Canadian Dollar and support of the USD/CAD pair.

USD/CAD - Daily Technical Levels

|

Support |

Pivot Point |

Resistance |

|

1.3055 |

1.3068 |

1.3083 |

|

1.3039 |

1.3096 | |

|

1.3011 |

1.3124 |

USD/CAD - Daily Trade Sentiment

A day before, the USD/CAD violated the narrow range of 1.3095 - 1.3040 to place a high of around 1.3173. On the 4 hour timeframe, the pair has from a substantial bullish candle, which is suggesting chances of bullish trend continuation.

For the time being, the USD/CAD pair is holding at 1.3157, forming Doji candles below a resistance area of 1.3173. The chances of a bearish trend remain soild. On the higher side, the breakout of 1.3173 can open further room for buying until 1.3212. While on the lower side, the support will be around 1.3095.

AUD/USD – Triangle Pattern

The AUD/USD was closed at 0.68438 after placing a high of 0.68559 and a low of 0.68267. Overall the movement of AUD/USD pair remained unclear that day. The pair AUD/USD on Wednesday showed almost null movement as it ended its day at the same price; it started its day with 0.68438.

At 4:30 GMT, the Westpac Consumer Sentiment for January dropped by 1.8%, which was previously dropped in December by 1.9%. At 20:30 GMT, the CB Leading Index from Australia also fell by 0.3% in the month of November in contrast to the increase of 0.2% of October.

The pair AUD/USD was affected by the virus outbreak in China as the Australian Dollar has a relationship with the Chinese Yuan amid Australia being the largest trading partner of China. Fears emerged in the market related to the outbreak of a new virus which can be transmitted from person to person, gave pressure to the Chinese economy.

The Chinese economy was already under pressure due to the ongoing trade war with the United States and anew virus outbreak added in that. The China-proxy Aussie also suffered, and hence, the pair AUD/USD dropped on Wednesday near 0.68260 level.

However, the fact that in 2002-2003 China handled the outbreak of the SARS virus very well and contained the virus from the further global spread eased some of the fears from the investor's mind and helped to recover some losses of the day.

The AUD/USD pair started to rise and recovered its early losses on Wednesday and ended its day at the same level it was started with. Hence, the daily candle for AUD/USD pair's movement was seen as a line on the charts.

On the other hand, the chances for a cut in interest rates from Reserve Bank of Australia are increasing, and the Jobs data to be released on Thursday will be key drivers for these speculations. If job data exceeds the expectations, then the chances for a rate cut would decrease and vice versa.

However, the bushfires have cost the Australian economy at the end of last year as the country faced troubles in controlling the fires. The AIG services index showed contraction for the first time in 5 months proved that the economy had been affected by the fires. Therefore risks for an interest rate cut by the Reserve Bank of Australia in its next meeting still persist in the economy until data suggest otherwise.

AUD/USD - Technical Levels

|

Support |

Pivot Point |

Resistance |

|

0.6856 |

0.6872 |

0.6889 |

|

0.6839 |

0.6905 | |

|

0.6806 |

0.6939 |

AUD/USD - Daily Trade Sentiment

The AUD/USD is trading at 0.6875 after testing the strong support level of 0.6825. At the moment, the 50 periods EMA and bearish trendline are extending resistance around 0.6880.

Closing of candles below trendline resistance is signaling the chances of bearish bias. Today, I will be keeping a close eye on 0.6880 as below this; we can see a continuation of a bearish until 0.6825. Conversely, the bullish breakout can extend buying until 0.6920.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and