US April Retail Sales Preview: Inflation dynamics to drive USD valuation

- Retail Sales in US is expected to continue to increase in April.

- USD outperforms its rivals following CPI inflation data.

- 10-year US Treasury bond yield remains on track to post strong weekly gains.

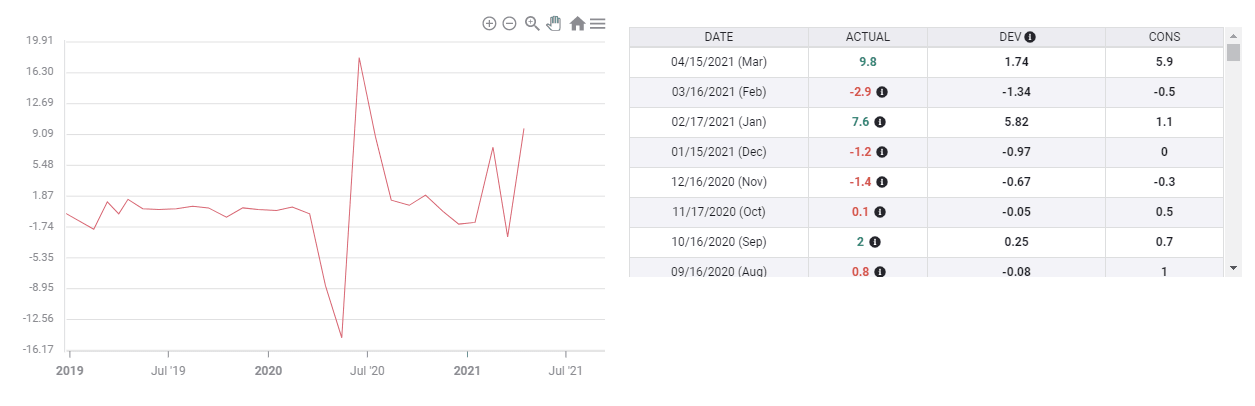

Following March’s impressive 9.7% increase, Retail Sales in the US is expected to expand by only 1% in April. The sharp upsurge witnessed in March was seen as a correction of February’s big decline that was caused by the severe weather conditions and failed to trigger a noticeable market reaction.

Investors will also be keeping a close eye on the Retail Sales Control Group, which is used to prepare the estimates of Personal Consumption Expenditures for most goods, especially after the latest inflation report from the US. Market consensus points to a 0.8% increase, compared to 6.9% in March.

US Retail Sales

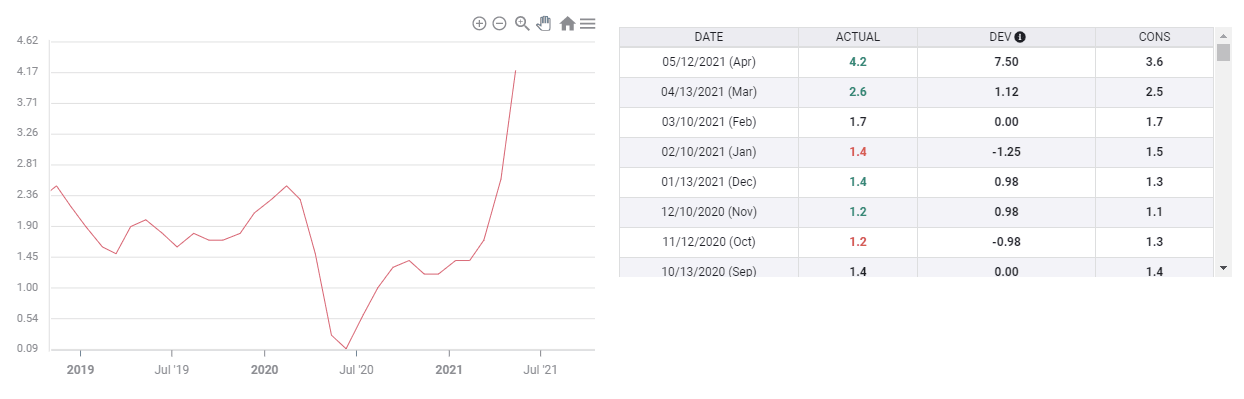

The US Bureau of Labor Statistics reported on Wednesday that the Consumer Price Index (CPI) jumped to 4.2% in April from 2.6% in March. This reading surpassed the market expectation of 3.6% by a wide margin and triggered a rally in the US Treasury bond yields. Additionally, the Core CPI, which excludes volatile food and energy prices, advanced to 3% from 1.6%. The benchmark 10-year US T-bond yield rose more than 4% on a daily basis and provided a boost to the greenback. After fluctuating in a relatively tight range above 90.00 on Monday and Tuesday, the US Dollar Index gained nearly 0.8% on Wednesday.

US Annual CPI

Stronger-than-expected sales figures are likely to help the USD continue to outperform its major rivals. On the other hand, a disappointing print could limit the greenback’s upside. Nevertheless, inflation dynamics remain the primary driver of the USD’s market valuation and it wouldn’t be surprising to see the initial reaction to the Retail Sales report fade quickly.

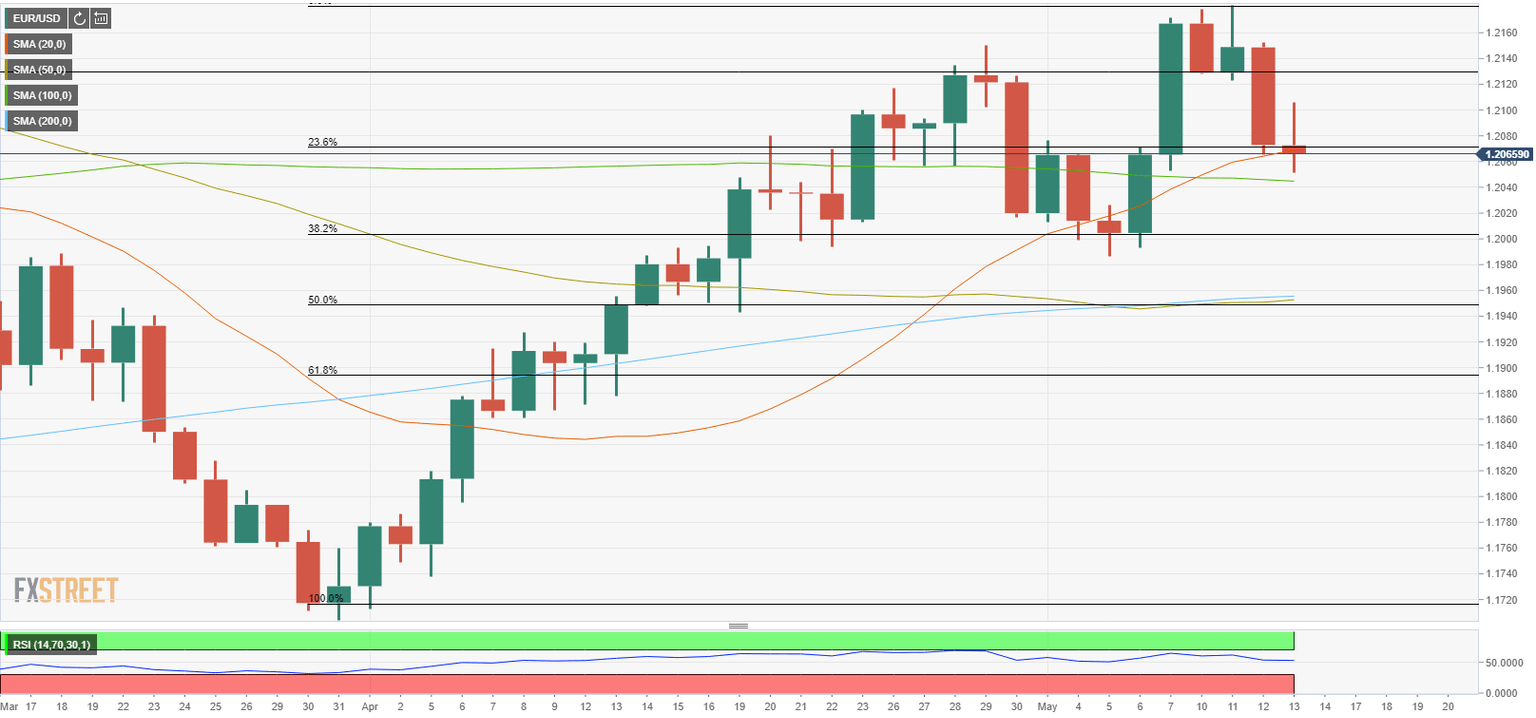

Major pairs to watch for

Following Wednesday’s steep decline, the EUR/USD pair is staying in a consolidation phase above mid-1.2000s. On the downside, the 100-day SMA seems to have formed key support at 1.2040. A break below that level could trigger a technical selloff and drag the pair toward 1.2000 (psychological level, Fibonacci 38.2% retracement of the latest uptrend) ahead of $1.1960 (200-day SMA). On the other hand, the pair could regain its traction if US T-bond yields turn south ahead of the weekend and advance toward 1.2100 (psychological level). Above that hurdle, resistances are located at 1.2130 (static level) and 1.2180 (May 11 high).

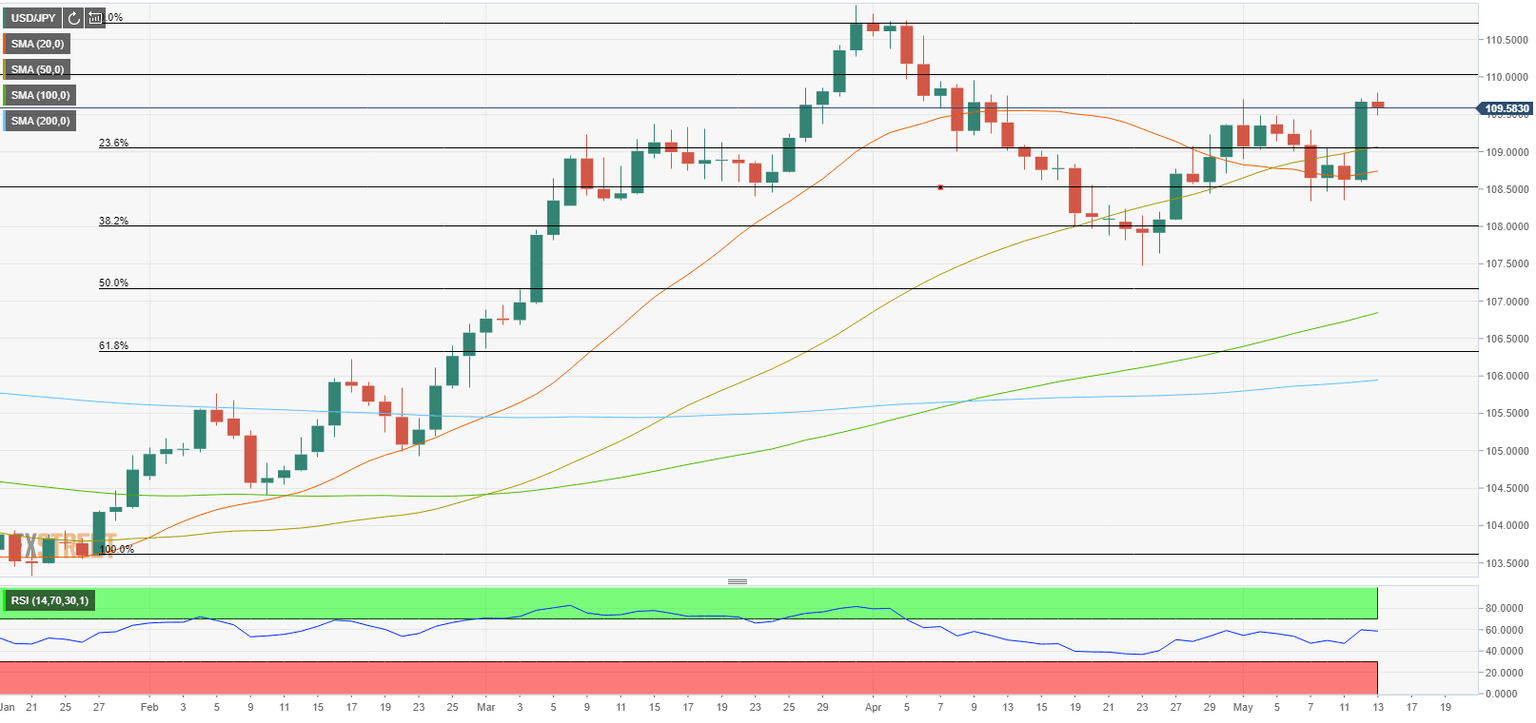

The USD/JPY pair registered its biggest one-day percentage gain on Wednesday as it rose 1% on the back of surging US T-bond yields. The next target for USD/JPY lines up at 110.00 (psychological level). With a daily close above that key resistance, the pair could aim for 111.00 (psychological level, March 31 high). On the downside, the first support could be seen at 109.00 (psychological level, 50-day SMA, Fibonacci 23.6% retracement of February-April uptrend) ahead of 108.70 (20-day SMA) and 108.50 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.