US ADP Employment Change October Preview: The labor market plays second fiddle

- ADP private payrolls forecast to increase by 400,000 in October.

- Correlation with Nonfarm Payrolls has been weak for six months.

- Market response to ADP will be minimal with the FOMC pending.

- Federal Reserve is expected to announce its bond program taper on Wednesday.

The US labor market should continue its middling improvement in October, adding jobs at a fraction of the pace in the early summer and remaining a long way from full employment.

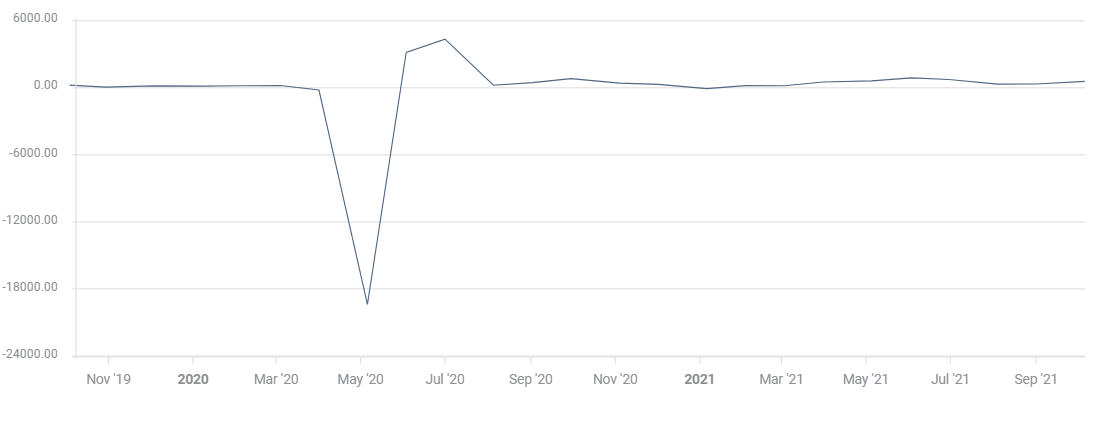

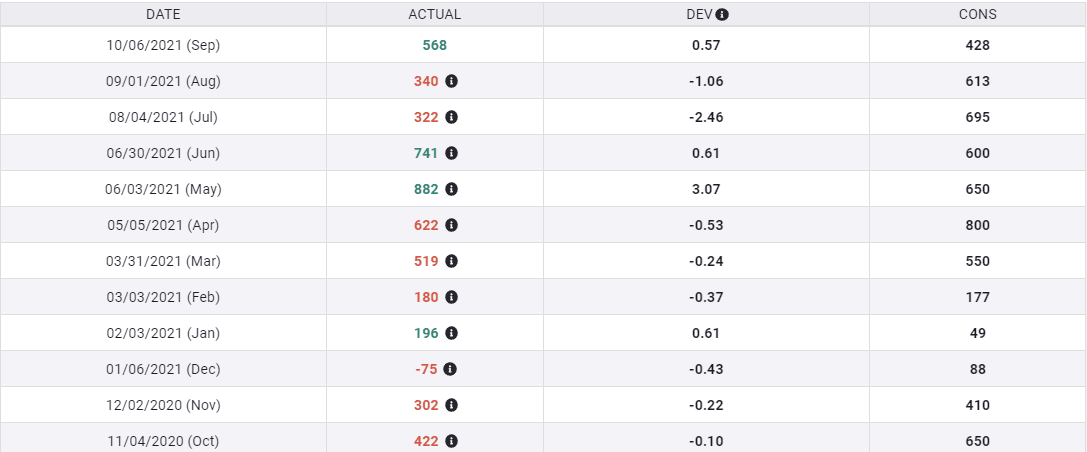

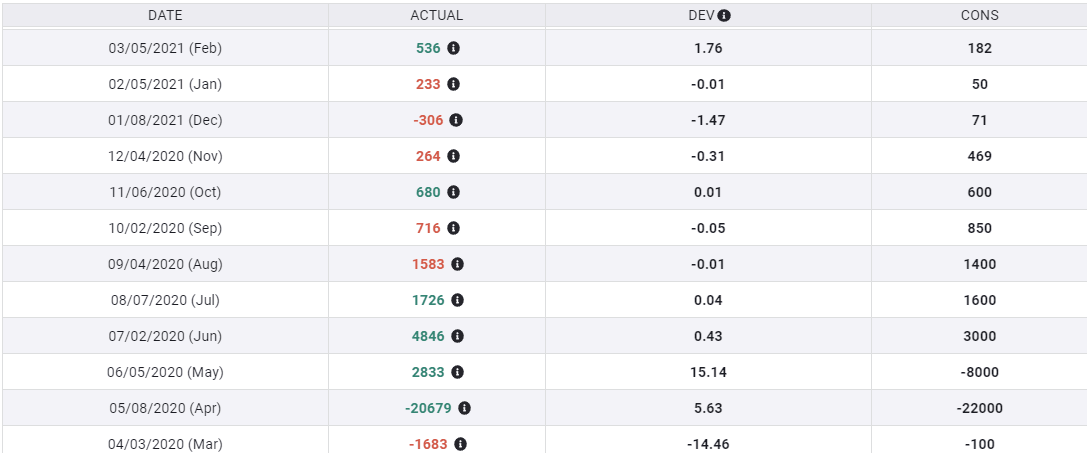

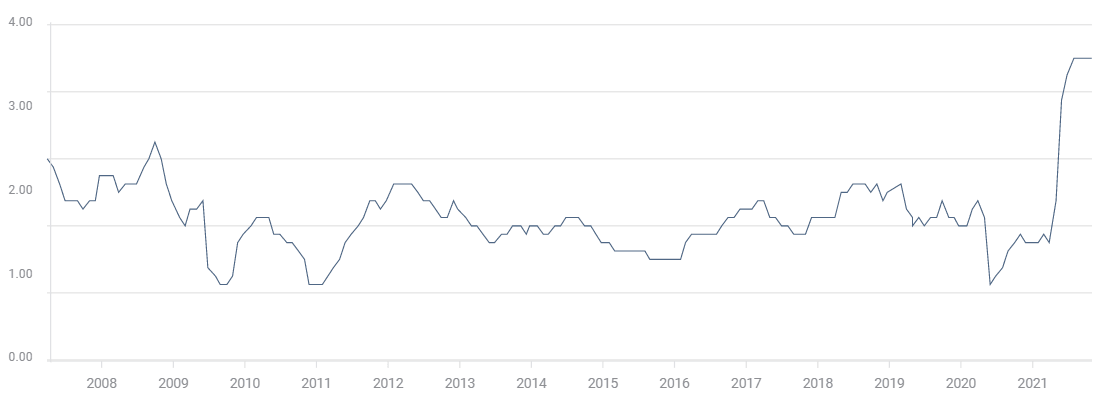

Private payrolls from Automatic Data Processing (ADP) are projected to add 400,000 workers following September's gain of 568,000.

ADP

FXStreet

The hiring decisions of ADP’s corporate clients are considered an indicator for the national employment figures of the Nonfarm Payrolls (NFP) report, the most-watched US economic statistic, released two days later. Payrolls are predicted to rise 425,000 in October.

NFP

ADP and NFP

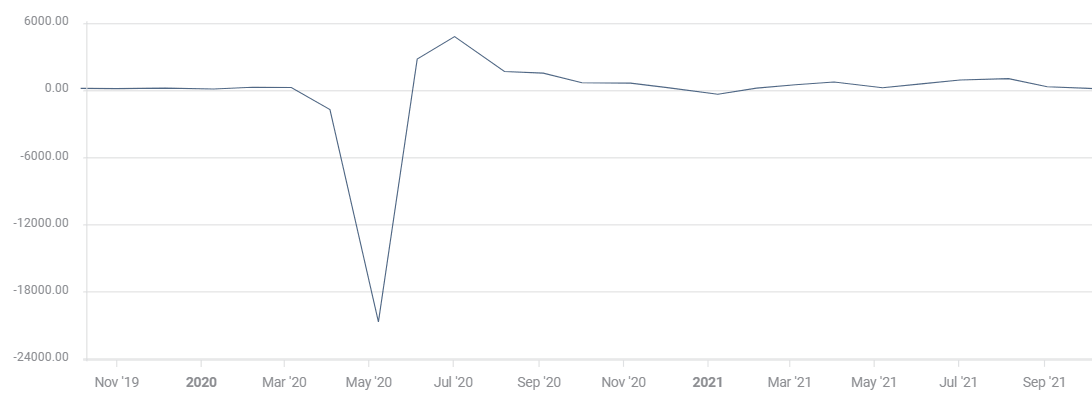

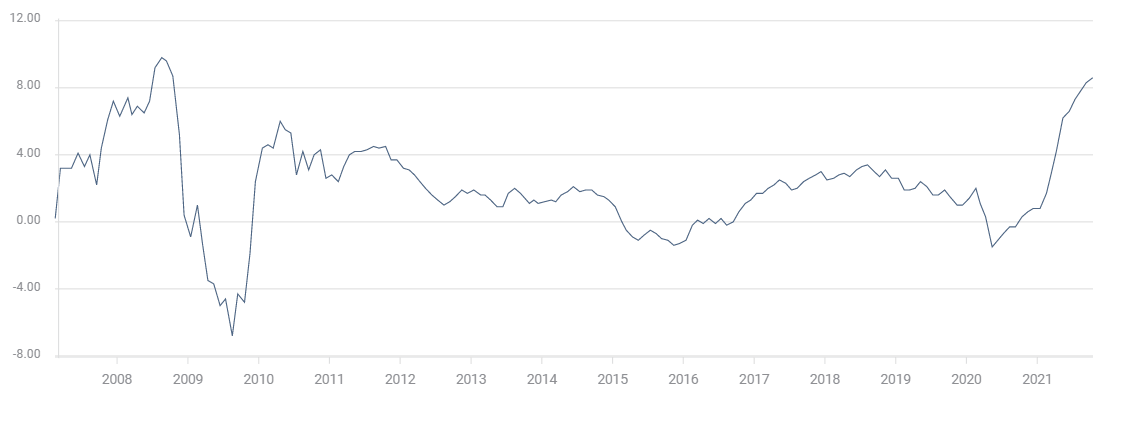

Over the past six months variation in ADP has been a poor predictor for NFP.

Only in May did both payroll sets rise: ADP from 622,000 in April to 882,000 and NFP from 269,000 to 614,000. In every other month from April to September the reports moved in different directions.

ADP

FXStreet

In August, when NFP plunged to 366,000 from 1.091 million in July, the ADP series rose to 340,000 from 322,000. In September as NFP dropped again to 194,000, ADP rose to 568,000.

NFP

FXStreet

Federal Reserve

This month both numbers will take a back seat to the Federal Open Market Committee (FOMC) meeting on Wednesday. After six months of hints, retreats, explanations, and evasions the policy body of the US central bank is widely expected to announce a reduction in its monthly bonds purchases.The FOMC is also expected to set a timetable for bringing the $120 billion program to an end by the middle of next year.

For most of the last 20 months the Fed has insisted that its policy accommodation would remain in place until the full recovery of the labor market. More than 22 million jobs were lost last March and April, in the NFP count, and through September only 70%, 15.6 million, have been replaced.

Inflation and employment

Two developments appear to have changed the Fed’s mind about policy accommodation and the labor market: inflation and the reluctance of many millions of workers to return to employment.

Six months ago when the Fed dropped its first hint of the eventual end of the bond purchases inflation was expected to be a transitory phenomenon, keyed to the base effect of the price collapse a year earlier in months of the lockdown. That is no longer the case. The Personal Consumption Price Index and its core variant were at their all-time records of 4.4% and 3.6% in September, having more than tripled and doubled in nine months. Fed officials, including Chair Jerome Powell have acknowledged that inflation will be both stronger and longer lasting than they had anticipated and that elevated rate will last well into next year if not further.

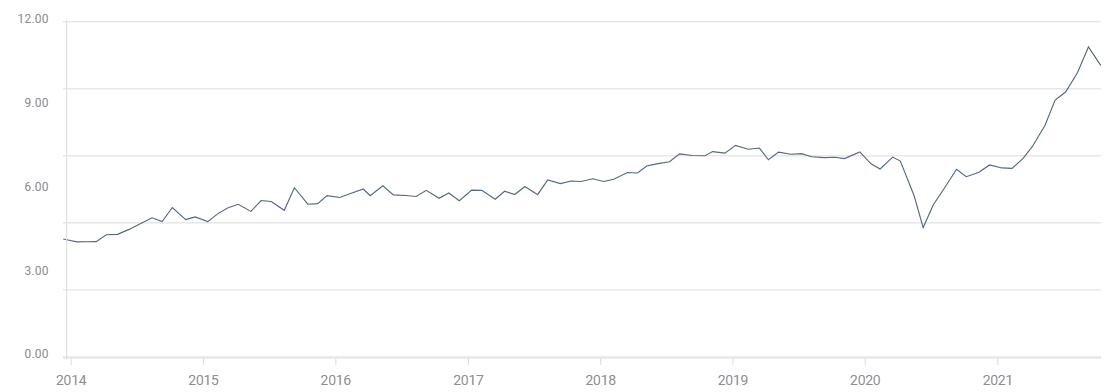

Core PCE

FXStreet

In June and July when NFP hiring averaged over one million a month, it seemed the economy was finally on its way to a quick reconstitution of the labor market. The plunge in payrolls in August to 366,000 and then 194,000 in September was wholly unexpected. Employee hesitation to return to work was especially puzzling in the face of the numbers of jobs on offer, a record 11.1 million in July and 10.4 million in August in the Job Openings and Labor Turnover Survey (JOLTS).

JOLTS

FXStreet

From the Fed’s point of view, accommodation was helping employers to create jobs, but there was little monetary policy could do to encourage workers to choose employment.

Conclusion: One month to forget

"I do think it's time to taper; I don't think it's time to raise rates," Federal Reserve Chair Jerome Powell, October 22, 2021.

The Fed has given every indication that it will announce the bond taper at its Wednesday meeting.

Economic growth in the first half of 6.5% was more than sufficient to bear higher interest. If the third quarter slowdown continues in the final three months of the year, it is probably better to initiate the taper and then adjust the amount and pace accordingly, than to delay the start for an undetermined time.

Inflation is on its way to becoming a long-term problem. Labor shortages and rising prices will keep upward pressure on wages. Workers demand higher compensation as inflation erodes their buying power.

Product scarcity and manufacturing restrictions from missing workers, components and raw materials, in the face of strong consumer demand, will let producers and retailers raise prices. The Producer Price Index (PPI) at 8.6% in October indicates months of continued consumer price increases ahead.

PPI

Market expectation is that the monthly bond purchases will be reduced by $15 billion. If an additional cut is made each month it will take eight months to eliminate the program of $120 billion. If the reductions commence in November, the final tranche would be in June 2023.

Whatever hiring the labor market produces in October, the Fed is not likely to miss its well prepared window to begin the taper, even if the economic winds force it shut next year.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.