Up, Up And Away [Video]

![Up, Up And Away [Video]](https://editorial.fxstreet.com/images/Macroeconomics/CentralBanks/FED/Jerome_Powell5_XtraLarge.jpg)

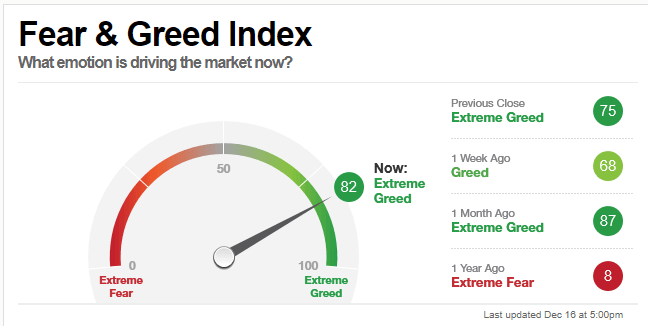

The US Stock Markets Know Only One Direction Granted, it has been a remarkable year from many perspectives but the resilience of the US stock market is maybe the most evident one. After PMI data out of the US came in good yesterday and even the homebuilder confidence jumped to its highest level in 20 years, it seems that any doubts about this ongoing rally are misplaced. But are they really? First of all the Phase 1 deal with China lacks any details and no one really knows how it will exactly look like in the end. Meanwhile, the chatter around melt-up has increased more and more while the FED is still facing oversubscribed Repo operations, meaning there is more demand for liquidity than the Fed is providing. Please keep in mind the FED is injecting 120 billion Dollars of liquidity into the markets every single day and it is still oversubscribed. So something seems fundamentally broken, but it is being suppressed by shoving more and more money into the system which is eventually finding its way into the stock markets and why they are continuously going up. The Fear & Greed Index of CNN is back in the "Extreme Greed" territory standing at 82. Nonetheless, it seems that there is no alternative and chances are that as long as the FED supplies the liquidity, risk markets will continue to go up.

PMI Data

PMI data out of Europe showed weakness again and probably surprised many market participants as it was absolutely unable to support the story of Europe'S weakness bottoming out and being back on the path of recovery. The data clearly showed it is not, in fact, the manufacturing PMI of the Eurozone saw its worst slump since 2013 "with businesses struggling against the headwinds of near-stagnant demand and gloomy prospects for the year ahead". The UK is not really looking any better meanwhile where the economy contracted for the third time in the past four months and as if it could not get any worse the latest decline was the second largest recorded over the past decade. In the US however the PMI data was solid, and a bit better than expected even showing that the US economy despite all the "red flags" is still one of the few around showing growth momentum at all which reinforces the influx of money into US markets.

USD

The currency sector was a bit quieter yesterday and any weakness the USD showed early in the day was gained back when the positive US PMIs did not show any signs of weakness. With stock markets going further up safe-haven currencies like the JPY could prime suspects to be traded vs the US Dollar and we could see USDJPY re-target the 112 area.

EUR and GBP

The EUR has moved very little within the 1.11 range and thus keeping the outlook for potential further move up in place. Watch the 1.1150 as the next main resistance level that worked well yesterday to put the EUR pack into its place. If that level can be broken to the upside a continuation 1.118-1.12 area seems absolutely doable. The Pound, on the other hand, is facing renewed troubles. After the election euphoria is fading out the price of the Pound has since only come down and warnings out Brussels that they will not budge to any pressure exercised by the UK Conservatives added to the negative UK PMIs and pushed the price of the Sterling further lower. If these dynamics remain in place the price could even go back down to as much as 1.30.

Oil

The price of WTI seems buoyed by the good data out of the US and out of China. China's fundamentals were all positive especially industrial production which contributes to the demand for oil most and could have been a major influence in the price of oil continuing to go up. Needless to say, the risk-on environment of stock markets has helped to push the price above the $60 mark. Watch for the $60.80, the July highs as the next important resistance level.

Gold

With Gold not going lower amid this fabulous risk-on market, to me it is like an alarm bell ringing. Should the price reclaim the $1,480 on a daily closing basis an attempt to take back the $1,500 round figure seems the next logical move. On the downside, a break of the $1,470 could bring a re-test of the $1,450 level and would clearly signal that even the last one in this market has switched to risk-on.

BTC

Bitcoin lost the battle of the $7k and is holding presently around the $6.8k level. With its inability to find support at the $7k chances are that we are to see more declines ahead especially looking at XRP or ETH showing strong signs of weaknesses themselves the whole crypto sector clearly shows weakness in place.

Author

Alexander Douedari

Independent Analyst

Alexander Douedari is an Award Winning Hedge Fund Manager and Selfmade 7-Figure Trader. Now Mentor for Students all around the world.