Unintended consequences

S2N spotlight

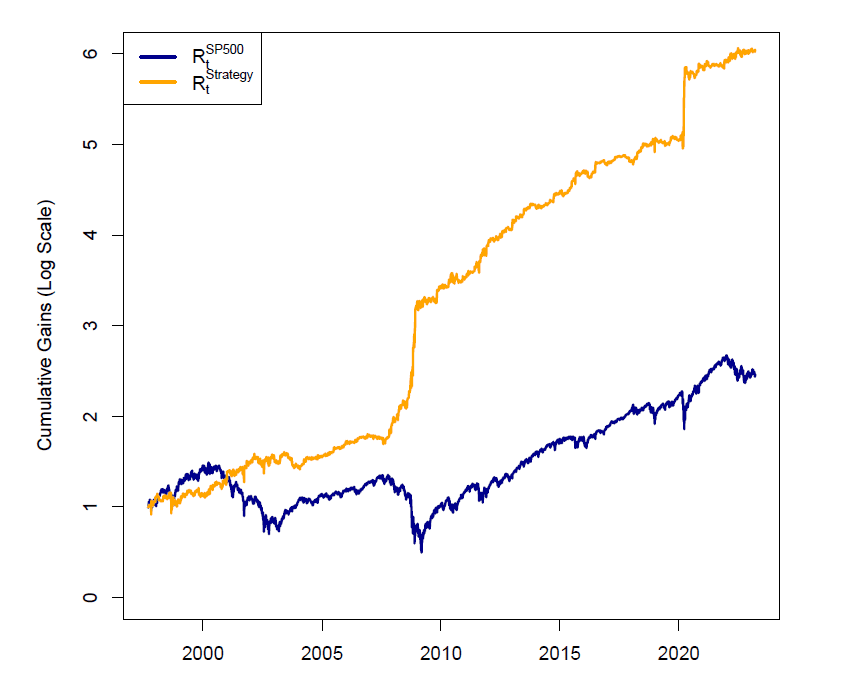

We usually focus on macro things in this newsletter. Today we will focus on a micro strategy that is a great example of how the efficient market hypothesis fails due to structural forces, despite these inefficiencies being well known.

One of the great finance professors, Campbell Harvey, and colleagues Michele Mazolleni and Allesandro Melone wrote a brilliant paper, “The Unintended Consequences of Rebalancing.”

I was planning on recreating the paper for today's letter, but it requires more time and effort. Institutional investors like pension funds are often required to keep a fixed allocation, say 60% stocks / 40% bonds. There are products like ETFs and structured products offering fixed weightings.

If stocks go up a lot, the portfolio might become 65% stocks / 35% bonds—now it's overweight equities. To fix this, the fund must sell stocks and buy bonds to get back to 60:40. This process is called rebalancing, and many funds do it at predictable times, like the end of the month.

That predictability creates an opportunity. Basically trading around these calendar rebalancing dates provides consistent opportunities. I bring this subject up as a reader following yesterday’s letter asked me about my philosophy about the efficient market hypothesis (EMH).

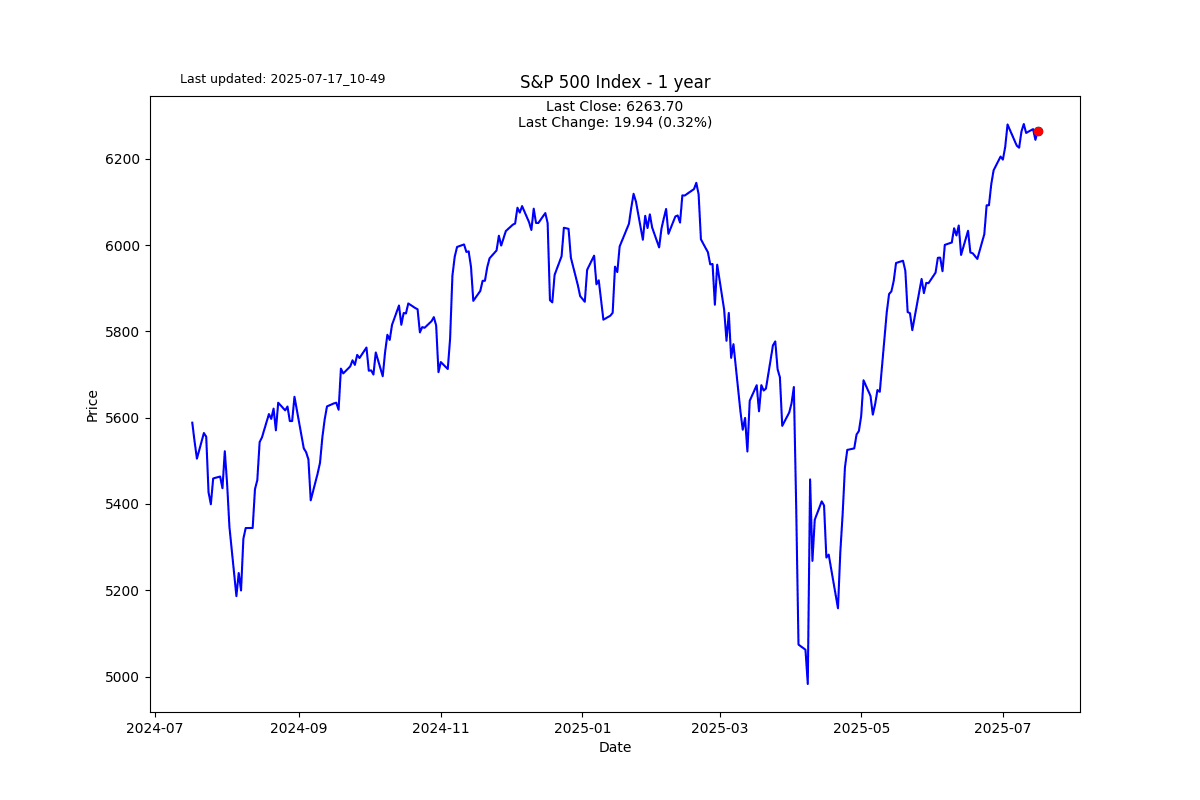

I have come across enough of these types of anomalies to know they are a thing and are persistent. The strategy achieves a Sharpe Ratio of 0.94 versus the SP500 of 0.51.

S2N observations

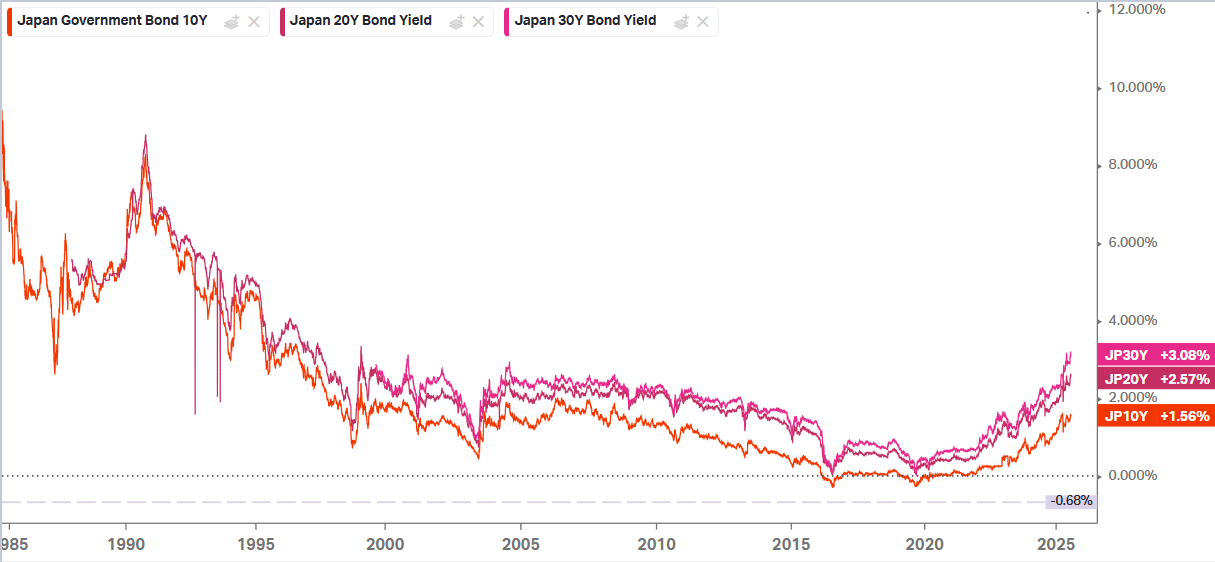

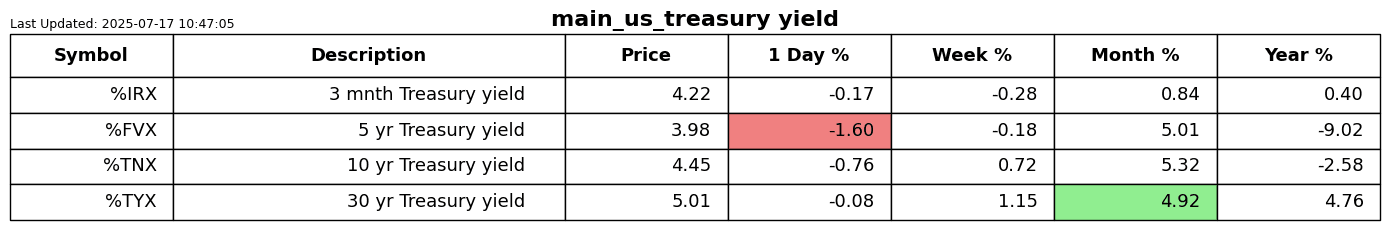

One of the biggest stories getting little coverage at the moment is the rising Japanese bond yields. The 30-year is over 3%; if you think the US has a debt problem, try Japan’s 235% debt-to-GDP. What could possibly go wrong?

This has to be one of the most classic own goals. During a typical Trump rant, he brutally criticised Fed Chair Jerome Powell. Trump then says, forgetting that he appointed him, "I'm surprised he was appointed. I was surprised that Biden put him in." Trump nominated him in 2017. There is nobody quite like The Donald. How does he get away with it? I actually found the moment quite cute.

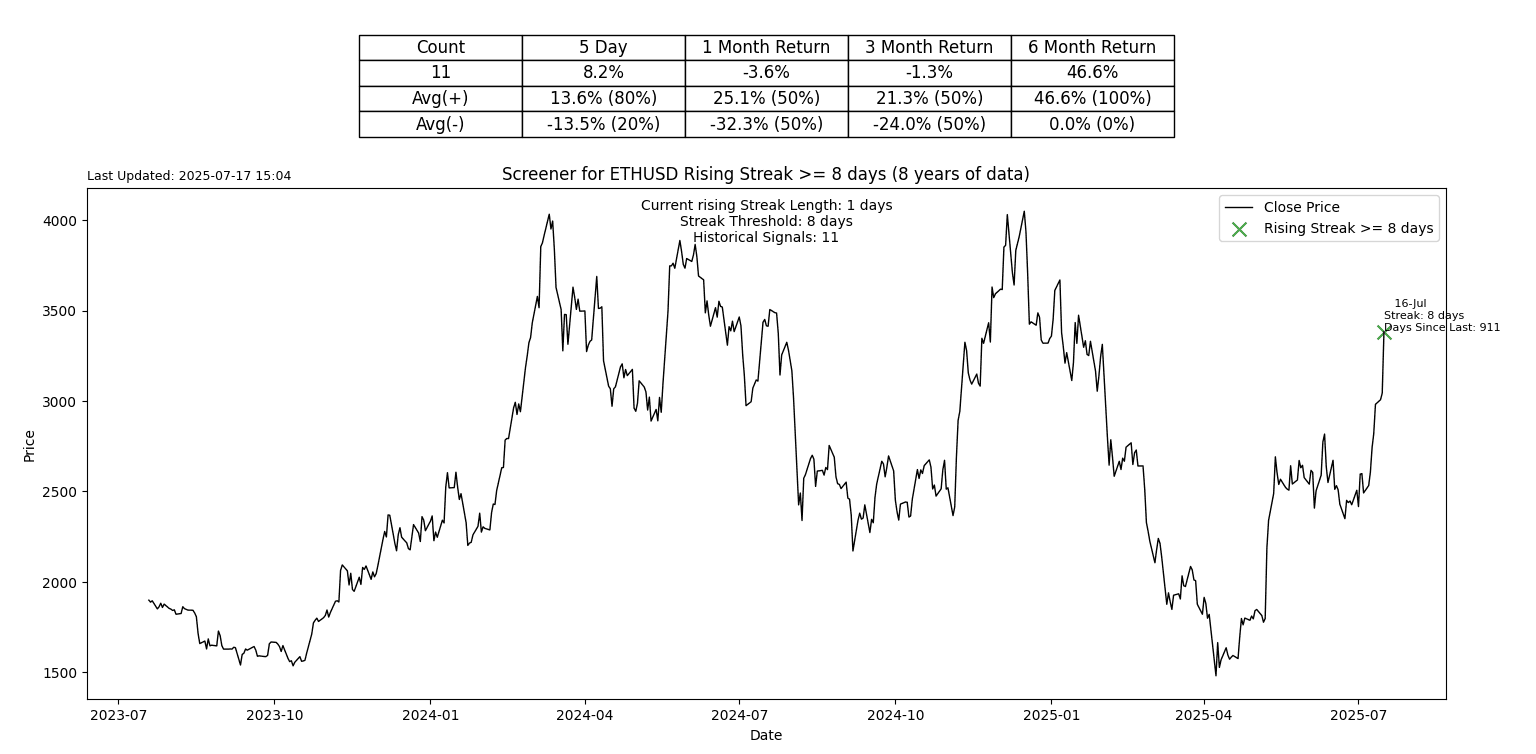

S2N screener alert

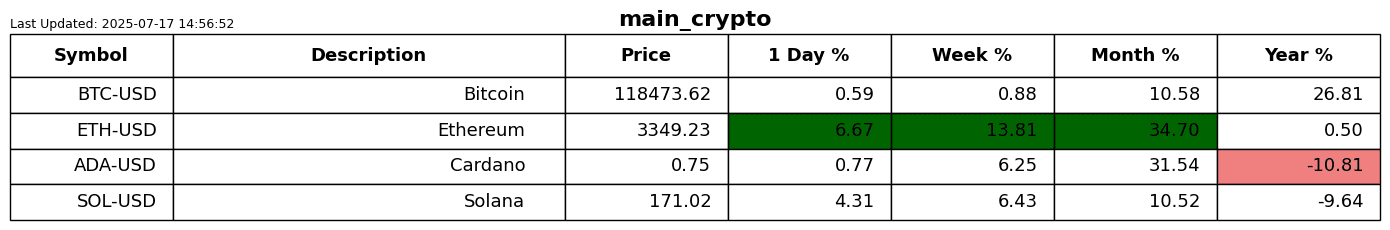

Ethereum is up 8 days in a row.

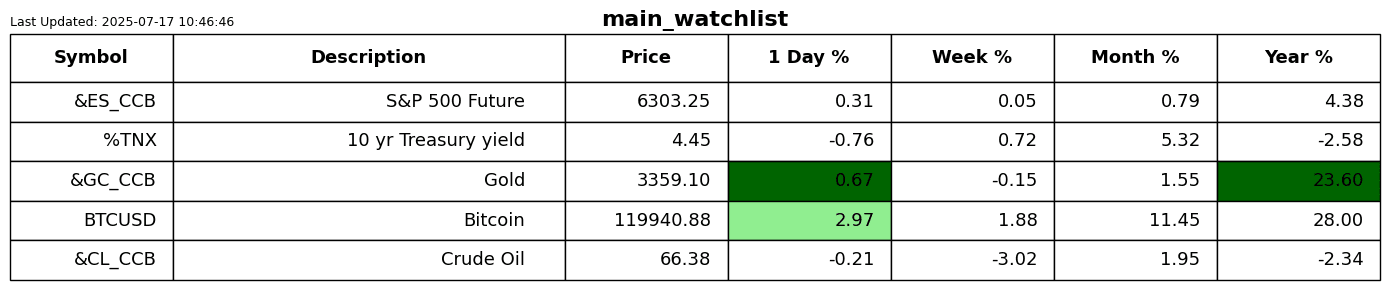

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.