Unemployment to rise in 2020? Examining five countries and potential currency reactions

- Global employment is nearing a peak, and downfall cannot be ruled out.

- A rise in unemployment may not necessarily have an adverse impact on the local currency.

- We examine five countries and their impact on currencies, local or foreign.

Wages have become all the rage for central banks – and that is a sign that employment has ceased to be a source of concern. Policymakers are puzzled by the lack of substantial salary growth as job markets are bustling. Complaints about the quality of jobs – such as those in the gig economy – have replaced pictures of people queueing up for unemployment benefits.

As employment is at high levels – it is easier to fall than rising from this point. A slowdown in global growth in 2019 has not triggered a substantial rise in the number of the jobless, but 2020 may see a change.

How can it affect currencies? We start from the straightforward cases and move to the more complicated ones.

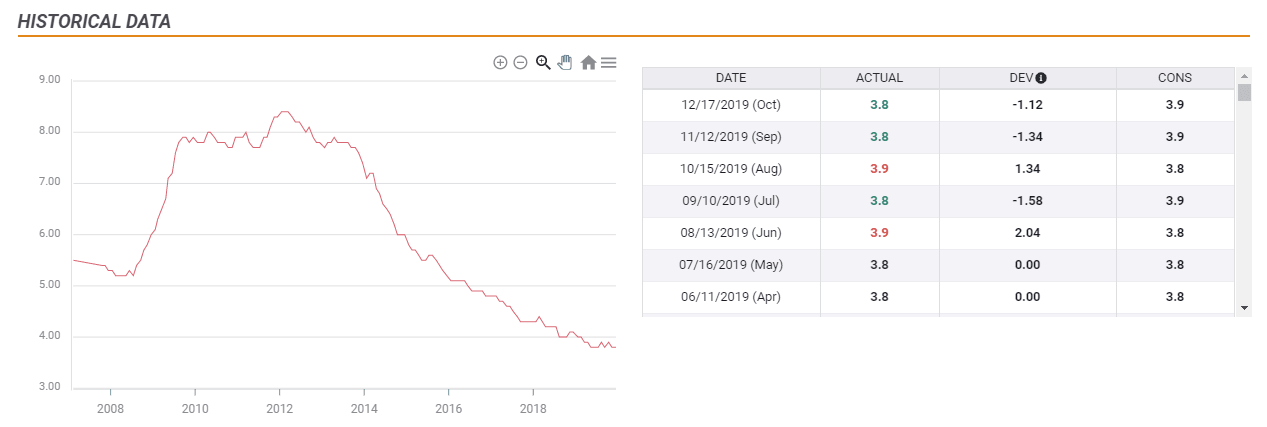

1) UK – pound negative

Unemployment rate: 3.8% as of October 2019, the lowest since the 1970s.

Uncertainty about Brexit has already weighed on the British economy. Growth has significantly slowed down and while investors are encouraged by the Conservatives’ clear victory that provides a clear path to leaving the EU, the future relationship with the old continent remains up in the air. Protracted negotiations after the official exit date on January 31 may cause a downturn that may eventually impact employment.

Worsening economic conditions may bring Andrew Bailey, the new Governor of the Bank of England, to cut interest rates. The BoE hinted that it is ready to cut interest rates, and two members voted for a cut in the past couple of meetings.

The government is unlikely to step in and help. Prime Minister Boris Johnson is focused on Brexit. Moreover, his government may wish to spend political capital on reforms and boost the economy closer to the elections, due only in late 2024. The proximity to the previous vote means that fighting unemployment is unlikely to be a priority.

All this leads to the straightforward conclusion that a rise in UK unemployment will likely push the pound lower.

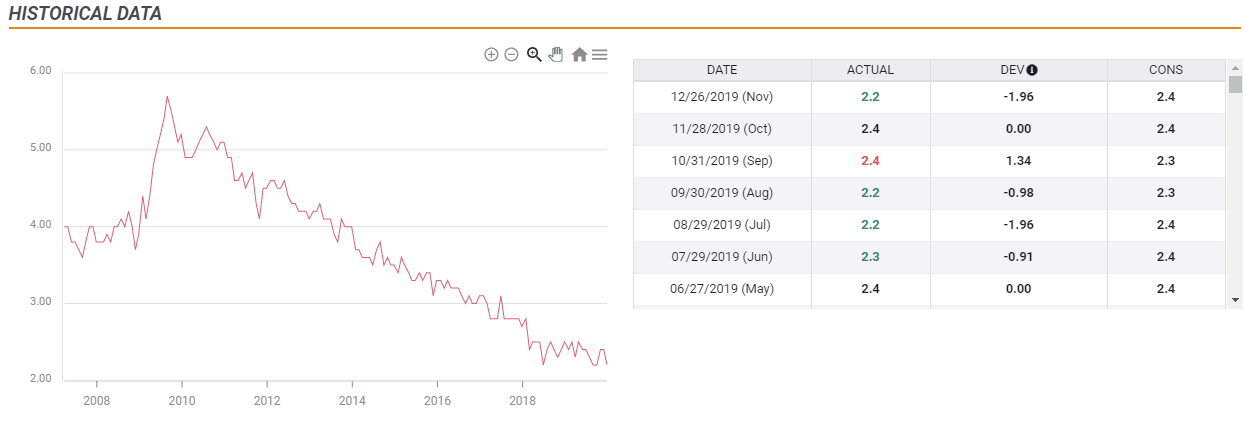

2) Japan – yen negative

Unemployment rate: 2.2% as of November 2019, the lowest since the mid-1990s.

The world’s third-largest economy may have had a hard time battling low inflation, but nobody complains about its rock-bottom jobless rate. The job-to-applications ratio stands at 1.57 – a healthy rate as well.

Japan is affected by the trade wars – either directly from US tariffs or indirectly as collateral damage from the Sino-American spat. If the economic situation deteriorates and unemployment rises, the government is likely to step in and help. However, Prime Minister Shinzo Abe already announced a fiscal stimulus plan and the Bank of Japan is reluctant to cut the interest rates. The negative -0.10% rate is hurting bank profits.

Overall, rising unemployment in Japan may result in a weaker yen and little room for policymakers to turn the ship around easily.

In this scenario, the yen’s path is likely to be down.

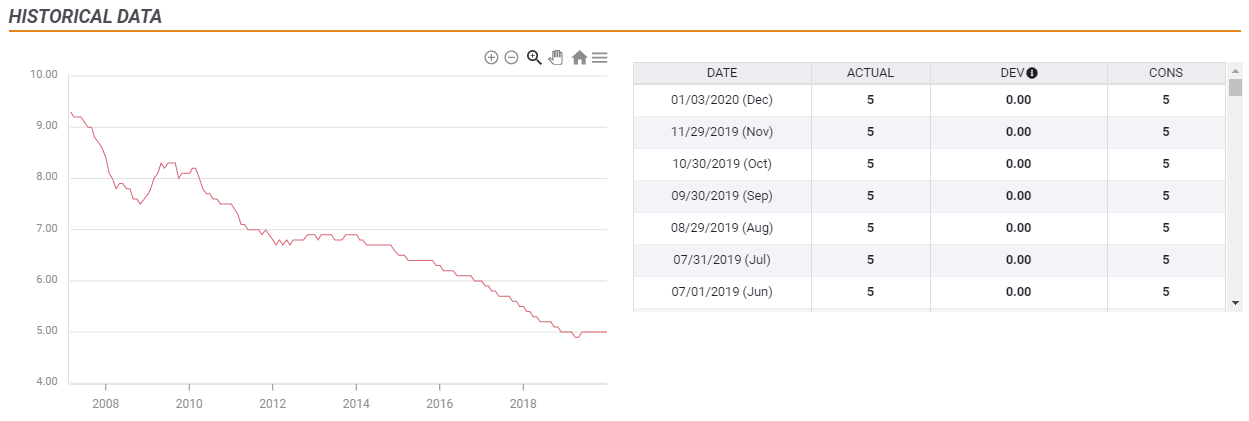

3) Germany - may eventually turn positive for the euro

Unemployment rate: 3.1% seasonally adjusted as of October 2019, the lowest since the early 1980s.

The euro zone’s largest economy enjoyed several years of falling unemployment as exports to China – and more recently upbeat consumption – have pushed the economy forward. However, the “locomotive” of the euro-zone has been suffering a manufacturing slump in 2019, and the country barely escaped a recession.

The labor market has also shown worrying signs, with occasional monthly increases in the number of the unemployed, albeit within an upbeat trend.

If the industrial downturn continues or worsens, the jobless rate may lift off from the historic lows. While the initial reaction would be a lower euro in expectation for further monetary stimulus, the common currency could later rebound.

How? Rising unemployment could sharpen the minds of politicians such as Chancellor Angela Merkel’s CDU and also her junior coalition partner SPD to introduce fiscal stimulus. The rising popularity of the Green Party may trigger investment in environmental technologies.

Germany has been leading the old continent’s austerity policy and has been clinging onto its “Schwarze Null” – minimal fiscal surplus – policy. If Berlin abandons its constitutional debt-brake and sets an example for a change at the European level, the common currency could rise. It would relieve the European Central Bank from pushing the economy forward on its own.

Overall, a rise in German unemployment will likely send the euro lower – only to rise later on.

4) China - Fears of a global slowdown may boost safe-havens

Unemployment rate: 3.61% as of July 2019, the lowest since at least 2002.

The ongoing trade spat between the world’s largest economies has hurt China more than the US. Growth has slowed down to the lowest levels since the early 1990s but the jobless rate remains low.

The one-state party carefully manages its economy and would intervene to mitigate any potential increase in people seeking jobs. The regime is afraid of discontent and would also like to continue growing in global influence.

Nevertheless, any bounce in unemployment would be an ominous sign for the entire world. It would show that the global economy is slowing down and send stocks down. The safe-haven US dollar and Japanese yen would benefit in this case, and so would Gold.

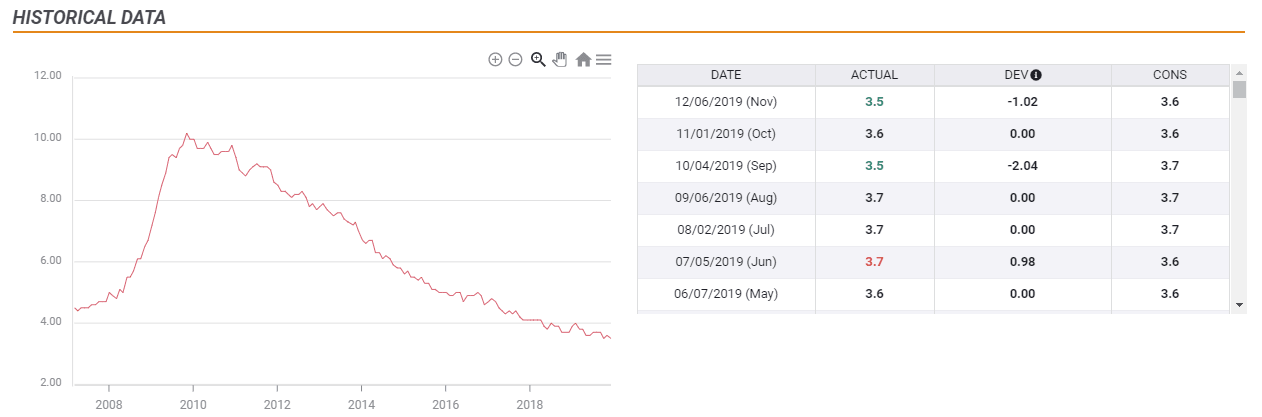

5) US - Dollar reaction depends on the Democratic candidate

Unemployment rate: 3.5% as of November 2019, the lowest since 1969.

Concerns about the labor market came and went during 2019, but central bankers see the US at “full employment.” After over ten years of growth, a slowdown in the economy cannot be ruled out, and neither can a recession.

An increase in unemployment would likely push the Federal Reserve off the fence and trigger fresh rate cuts. While that would weigh on the greenback, it may also have the counter effect. “When the US sneezes, the world catches a cold” goes the adage. Investors fearing a global downturn may make their way to the safe-haven US dollar and the Japanese yen.

Moreover, a potential increase in US joblessness in 2020 may also risk President Donald Trump’s reelection chances. In that case, the reaction of the greenback heavily depends on his Democratic rival.

If a moderate such as Joe Biden, Michael Bloomberg, or Pete Buttigieg is the nominee, markets would likely prefer a change in the White House to ease trade tensions and refrain from significant welfare spending. In that scenario, the dollar may fall amid a diminishing demand for safe-haven assets.

On the other hand, if left-leaning Elisabeth Warren or Bernie Sanders makes it through, markets would prefer Trump. The fear of a business-unfriendly president may trigger flows to the safe-haven dollar.

Overall, a modest rise in the unemployment rate would be US dollar negative, while a substantial increase would put the focus on the Democratic candidate – whose chances would rise.

Conclusion

From rock-bottom levels, there is a good chance that unemployment will begin rising in 2020. Increases in unemployment in the UK and Japan will likely be detrimental to their currencies. However, it could turn into a positive story for Germany. A rise in Chinese joblessness would likely trigger safe-haven flows, while labor issues in the US are difficult to trade given the presidential elections.

This article belongs to the 20 trading ideas for 2020 series. Check the full list of 2020 pieces.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.