Unacceptable Cures for the Days Ahead

We’ve held four Irrational Economic Summits so far. Feedback after each has always been very positive.

This year, we outdid ourselves!

George Gilder, co-founder of the Discovery Institute, literally walked onto stage, threw his arms into the air, and proclaimed: “This is the best conference ever!” And rumor has it that every morning he’d rush down to the conference hall early so he could grab a front-row seat!

And from the feedback our conference director, Amanda Klein, is reading on the evaluation forms, it’s safe to say that attendees loved this year’s conference as much as the speakers did.

Here are a few comments…

“Exceeded my expectations! Can’t wait until next year.”

“Best meeting I have ever attended. Impressed with the knowledge of the Dent team. Entire staff made me feel comfortable and important. Joining Dent Research was the best thing I have done in my 72 years.”

“This was my first IES… and I feel very fortunate to associate with the Dent organization. This was a fabulous experience for myself and my wife. We have felt for a while that the world economy was on the verge of a GIANT collapse… Fear would be the emotion of the day. But the IES meeting, along with all of the help sent out weekly on trading and market conditions, is very encouraging. We feel like we have some valuable ‘tools’ to not only avoid loss of our personal wealth… but to profit from the next ‘reset.’ We enjoyed the PGA resort… the food… the sessions… the speakers… and meeting some very fascinating people. Great experience… and thanks to all at Dent Research. See you in Nashville!!”

Really great feedback!

And there certainly was more than enough reason for it…

I kicked us off on Thursday, talking about the sale of a lifetime that’s just ahead of us. After that (a workshop presentation, book signing and panel discussion), I got to enjoy what our speakers had to offer.

The highlights for me included Dan Mitchell, senior fellow at The Cato Institute, who talked about the growing cancer of the welfare state – something we all know, but don’t fully admit.

David Walker, the preeminent expert on our government’s finances and budget deficits (federal and municipal) showed how the mandatory portion of our federal budget has taken over and we’re set for deficits to rise, even in a better economy. Not good! He presented a plan to set us on the right course, but it requires leadership, and as he said: “Leadership is this country’s greatest deficit!”

During the panel session with David and me, I had to insist that we must delay retirement by 10 years, and then continue to delay it for longer and longer to account for our increasing life expectancies. If we don’t, there’s no way to correct the ever-growing mandatory payments for healthcare and retirement.

Of course, no one liked hearing it. Unfortunately, only a major financial crisis will wake us up to the reality that there are no alternatives to these “unacceptable” cures.

Another of my favorites was George Gilder, who took a double-barreled look at how little our politicians and economists know about technologies and our free market capitalist system. It’s not about incentives – which these monkeys always manipulate. It’s about building knowledge and how our bottoms-up capitalist system so expertly leverages that if we just support it.

I’ve been following George since the mid-1990s. He’s a rare visionary for combining the logic of the new information economy into a new paradigm for economics.

Rodney gave a comprehensive case for why every attack on the dollar has failed. And Raoul Pal from Real Vision TV showed why a rise in the dollar was inevitable, as was a recession just ahead.

Then Dr. Lacy Hunt took the stage…

As I was telling Boom & Bust subscribers in their 5 Day Forecast email on Monday, he’s the only economist (outside of Steve Keen from Australia, who’s currently in hibernation in London) that I recommend you to follow.

He’s classically trained and deeply knowledgeable, and goes beyond the theoretical nature of his chosen field. He understands how debt and financial bubbles build and deleverage, a rarity among economists today. And he has possibly the best explanation of money velocity. Basically, it’s a sign of how productive investment in the economy is. Productive investment creates more profits, jobs and expansion, and hence, greater M2 velocity. Speculation, stock buybacks or empty buildings do not.

His money velocity chart was my favorite of the conference. (There were so many great ones it was a tough choice!)

With this single chart, Lacy shows the level and falling trends for money velocity across the U.S., Europe, Japan and China. And as you can see, the most unproductive investment is in China!

See, solid proof from perhaps the most competent economist in America! Building stuff for no one isn’t productive for the economy.

This is the most concrete proof yet of something that should be obvious. Despite 6-10% growth rates, China’s money velocity is even lower than Japan’s most dismal “coma economy” that is surviving solely on endless QE as they age and see exponential growth in debt levels… Do you get this? China is worse than Japan when you reflect the truth of money velocity.

You can also see why we are the best house in a bad neighborhood. Our money velocity, despite continually slowing since 2000, is 50% stronger than the euro and three times that of Japan and China.

Thank you Lacy!

And finally, the top of the conference highlights for me was being out-cycled by my close friend, Andy Pancholi of the Market Timing Report (markettimingreport.com).

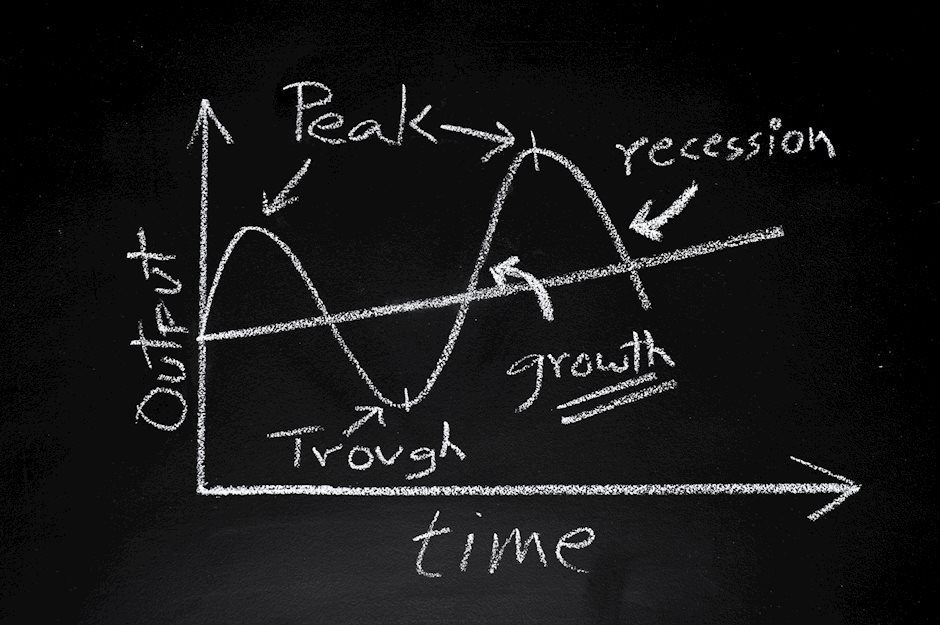

He not only had a shorter-term model for likely turning points in key markets (ranging from stocks to gold) that more than 50 attendees signed up for, but he also showed a series of surprisingly accurate (down to the year) long-term cycles for major tops or crashes.

Andy didn’t stop there. He had cycles of 45 years, 72 years, 100 years and 144 years that showed a clear convergence into – you guessed it, 2017 (and again in 2019)… right smack in the danger zone of my four key macroeconomic cycles.

He even dared to warn the audiences’ kids and grandkids that 2073 would see a major crash!

My longer-term indicators, using totally different cycles except for one, also point to the next global depression in the early to mid-2070s.

But man! Talk about cycles!

Without a doubt, this was our best Irrational Economic Summit yet.

If you missed it, get the Digital Replay Kit now (doors close again at midnight tonight). Do it now and I’ll throw in a special recording for you. It’s of the Network-only presentation I gave on why Brexit is the beginning of the end of globalization. I’m still hearing from members who got to listen about how mind-blowing that talk was for them!

Author

Harry S. Dent, MBA

Dent Research

Harry S. Dent Jr. studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of his chosen profession that he turned his back on it.