UK inflation: Cementing the rate cut or triggering a GBP/USD correction? Three scenarios

- The UK is expected to report an annual inflation level of 1.5% for December 2019.

- Odds for a rate have risen considerably, implying high volatility for the CPI figures.

- Higher headline inflation in the eurozone opens the door for a positive surprise and a GBP/USD correction.

"Do or die" – Prime Minister Boris Johnson's comment about Brexiting on October 31 is relevant for the upcoming UK inflation figures. And similarly to the delay in leaving the EU – the data may push back a potential rate cut by the Bank of England.

GBP/USD volatility is set to rise regardless of the outcome.

Why these inflation figures are critical

The stakes are high for the January 15 publication of Britain's Consumer Price Index figures. Politics overshadowed economic figures throughout most of 2019 as Brexit uncertainty dominated. However, after the Conservatives' landslide victory in December's elections, the focus shifts back to the data.

More importantly, the BOE also lifted its head from the shadows. The bank has ended its wait-and-see mode and is now ready to cut interest rates. Mark Carney, the outgoing Governor of the Bank of England, said that the "Old Lady" will react "promptly" to further weakness.

Gertjan Vlieghe, external BOE members, said that unless data improves, he would vote for a cut. Vlieghe would join two other Monetary Policy Committee members that have already opted for slashing borrowing costs in late 2019. Silvana Tenreyro, another MPC member, also expressed concern about current conditions.

And the economy is indeed struggling – it contracted by 0.3% in November, worse than expected. The pound has already dropped in response to central bankers' comments and the Gross Domestic Product data.

And now comes the data that the BOE targets – inflation.

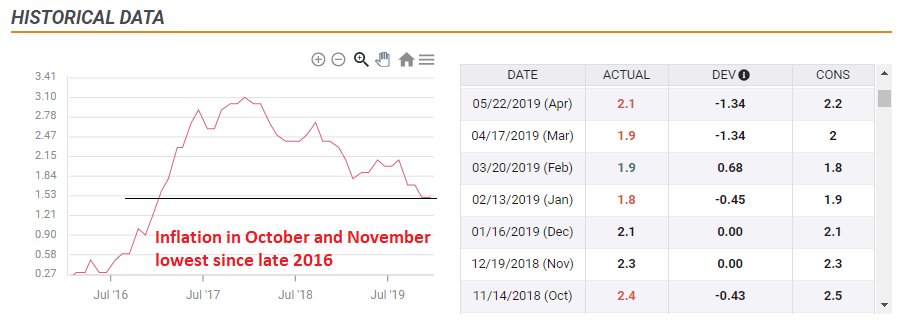

The bank aims for an annual CPI of 2% yearly, and it has been missing its target in the past few months. Economists expect headline inflation to stay at 1.5% for the third consecutive month in December, matching the lowest levels since late 2016.

Surprises are common and given high anticipation, it could be a substantial market mover for GBP/USD.

The three scenarios below have equal chances, given contradicting forces.

1) Exactly as expected – GBP/USD recovery

In this scenario, yearly CPI meets projections at 1.5%. During 2019, estimates hit the nail on the head twice out of 11 times and diverged by only 0.1% on seven other occasions. Overall, an "as expected" figure has decent changes.

Given the recent BOE dovishness and weak GDP statistics, markets are likely bracing for a miss and the lack of disappointment could be seen as a positive surprise.

After the significant falls, such an outcome may allow for a rebound. Traders who took short positions on sterling will have the chance to cover in this case, pushing GBP/USD higher in the short term.

2) Above expectations – GBP/USD shoots higher

Headline eurozone inflation jumped from 1% yearly in November to 1.3% in December with the main driver was higher energy prices. Despite producing oil in the North Sea, the UK is far from immune to changes in imported goods.

A rise to 1.6% or even 1.7% would diminish chances for an imminent rate cut on January 30, and even push the odds for a move to May's decision – the next time the BOE releases its Monetary Policy Report (MPR).

With short positions already stretched, such a positive surprise could trigger a substantial bounce, far more significant than in case inflation meets economists' estimates.

3) Below expectations – Pound falls

As central bankers have learned in recent years, inflation can always go lower. The reasoning for this possibility stems from the rise of the pound in December, pushing prices of imported goods lower. The exchange rate would overcome energy prices in this scenario.

If CPI decelerates to 1.4% or 1.3% – a new 2+ year low – markets would begin gearing up for a rate cut at the end of the month. Bringing forward such projections may exacerbate sterling's sell-off.

Conclusion

The release of UK inflation figures for December 2019 will likely be consequential for GBP/USD – considerably more than all other publications for the past year. The pound has room to edge up if CPI hits 1.5%, to shoot higher if the figure beats expectations, and to plunge if inflation falls to a new trough that would be the lowest since 2016.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.