UK: Further challenges lie ahead for stricken jobs market

UK unemployment has spiked, although so far the government's Job Retention Scheme has helped avert the levels of joblessness witnessed in the United States. However social distancing constraints mean there's a risk unemployment begins to rise again later in the year.

The latest data shows the UK's official jobless rate stayed below 4% in the first three months of the year, but this masks a sharp rise in unemployment over the past few weeks.

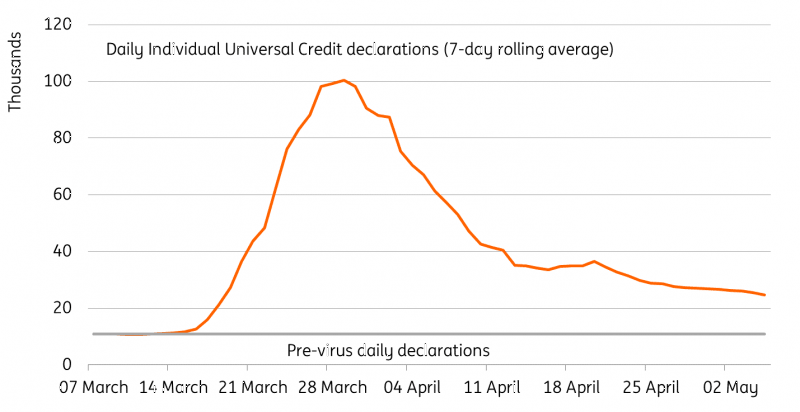

Each day, over 100,000 individuals were making declarations for Universal Credit (unemployment support) at the end of March, compared to around 10,000 on an average pre-virus day. According to the initial data for April, that has already helped push the claimant count measure of unemployment to 5.8% from 3.5%, and this will probably rise.

While claims data is not a perfect guide to unemployment, the over two million cumulative declarations we’ve seen over the past few weeks potentially points to an unemployment rate as high as 9%, which if it materialised, would be above the worst we saw following the financial crisis.

Daily Universal Credit declarations

Source: Department for Work and Pensions, ING

Whichever way you look at it, these are undoubtedly shocking figures. But they are also in stark contrast to those in the US, where the unemployment rate looks set to reach 22% in May. This is undoubtedly down to the UK government’s Job Retention (furlough) Scheme, which at the latest count is now paying the wages of 7.5 million workers, or around a quarter of total employees.

There’s little doubt that this scheme should help foster a smoother recovery. Using firms’ payroll is logistically one of the most efficient and quickest ways of channelling support to workers, while it also helps firms avoid the costly and time-consuming process of rehiring as the economy gradually reopens. The scheme will be adjusted over coming weeks to support firms bringing back staff on a part-time basis.

Recent claims and furlough data compared to historical unemployment

Source: Macrobond, Department for Work and Pensions

Universal Credit claims based on cumulative declarations from mid-March. Benefit claims are not necessarily an accurate representation of unemployment

But while the scheme is widely accepted to have been successful so far, it’s biggest challenge may still lie ahead. Covid-19 looks set to change the landscape for many businesses for the foreseeable future, with social distancing here to stay until a widely available vaccine arrives.

Many firms will be unable to operate at full capacity for some time, and this means there's an increasing risk that businesses begin to make longer-lasting changes to their business models. That, in turn, raises the risk of a second wave of redundancies depending on how and when the Job Retention Scheme is eventually phased out.

The risks are particularly acute for the likes of hospitality and retail. We know from recent ONS surveys that these sectors have the highest proportion of firms accessing the furlough scheme. These are also among the industries likely to be most affected by social distancing rules over coming months, and importantly they are also the sectors that have typically led the recovery in the jobs market in previous downturns.

Sectors with the highest usage of the furlough scheme also have lower levels of average pay - which again highlights that those at the lower end of the income scale are likely to be hardest hit.

Higher rates of furlough in lower paid sectors

Source: ONS

*Percentage of employers that are accessing Job Retention Scheme based on ONS Business Impact of Covid-19 Survey. Bubble size proportional to employment by sector. Weekly earnings in wholesale/retail an employee-weighted average of the two sectors.

Read the original analysis: UK: Further challenges lie ahead for stricken jobs market

Author

James Smith

ING Economic and Financial Analysis

James is a Developed Market economist, with primary responsibility for coverage of the UK economy and the Bank of England. As part of the wider team in London, he also spends time looking at the US economy, the Fed, Brexit and Trump's policies.