UK flash Q3 GDP growth may not be a game changer for pound

Flash GDP growth figures for Q3 will be out of the UK on Thursday at 06:00 GMT, likely displaying waning economic dynamics in the face of fading base effects and global supply crunches. A growth slowdown, however, is already priced in, and unless a significant upside surprise in the data plays into rate hike expectations, the pound could find little support to build on this week’s mild upturn.

BoE keeps the door open for higher interest rates

Investors had been growing confident during the month of October that the Bank of England (BoE) would be one of the few major central banks to raise interest rates in November only to see their expectations dashed at the last minute. Despite the hawkish talk over the past two months, the central bank kept all its policy settings unchanged during last week’s policy meeting, squeezing government bond yields and the pound to monthly lows against the US dollar and the yen.

The Bank’s intention, however, was not to entirely exclude the case of higher interest rates but to prevent an aggressive pricing of policy tightening in markets. It actually sent a clear message that a rate hike is imminent in the coming months “to meet sustainably the 2% inflation target in the medium term”, though it also cautioned that some time will be needed to assess the outlook for economic growth and employment as supply bottlenecks continue to restrain business activities and recruitment difficulties persist at a time when consumption is witnessing a continuous deterioration for the fifth consecutive month.

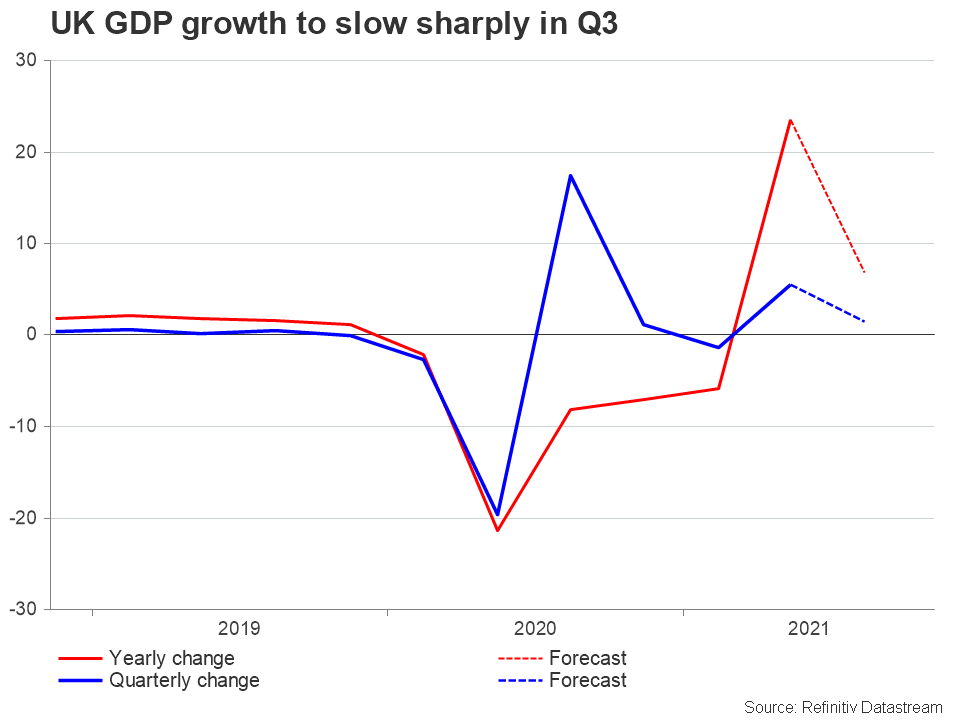

UK GDP growth to slow sharply in Q3

On Thursday, preliminary GDP figures are expected to show an expansion of just 6.8% year-on-year in the three months to September compared to the extraordinary annual boom of 23.6% in Q2, while the quarterly growth rate is also projected to fizzle to 1.5% q/q from 5.5% previously. If materialized, that would still be a robust outcome and not necessarily a negative warning for the UK economy as the blame for the moderation can easily be put on the basis of comparisonas the 2020 dip drops out of the calculations.

Still, the slowdown cannot be ignored either since that emerges at a time when inflation spikes call for a departure from stimulative policies, while the mounting post-Brexit bickering with the EU have been lately increasingly threatening Britain’s abandonment from the withdrawal agreement which was signed last December.

Pound may shrug off GDP data

Hence, the BoE has probably made the right choice of adopting a wait-and-see mode this month, but the longer it stands pat and the more persistent inflationary pressures get, the stronger downside risks could become for the pound. Currently, overnight indexed swaps give a probability of 52.3% for a 25 bps rate hike in December, which reflects some confusion among investors about the next rate decision.

Perhaps a pullback in GDP growth figures may not affect rate sentiment because weak monthly GDP prints in the past two months have already painted a gloomy picture for Q3. Nevertheless, should the stats come in worse-than-expected, traders will keep a close eye on the 1.3411 level in pound/dollar. A break below that floor could cause a sharp decline towards the 1.3300 number.

On the other hand, for pound/dollar to stretch this week’s soft rebound above the 1.3600 resistance, a significant upside surprise in the data will need t0 positively play into rate hike expectations. However, that is currently seen the least possible scenario, as in the case of the Fed, the BoE has clearly stated that changes in employment and wage growth figures will determine the path of interest rates. Therefore, next week’s jobs number could be a bigger market mover for the pound, while trade tensions between the EU and the UK may also be a source of volatility for the pound ahead of the BoE policy meeting in December.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.