Tunisia: Gloomy outlook

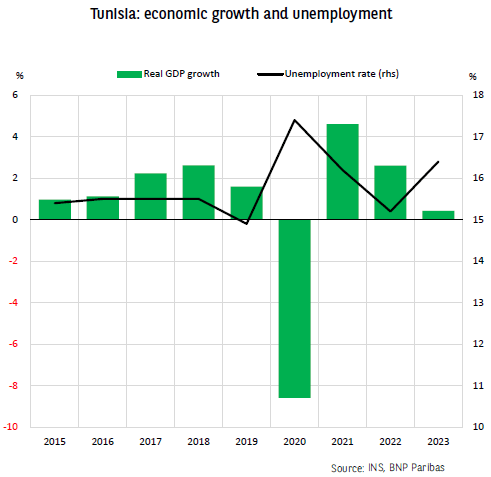

Tunisia is going through a serious economic crisis. Real GDP contracted again in the fourth quarter, falling by 0.2% year-on-year after a decline of 0.3% in the previous quarter. Estimates suggest that full-year growth was 0.4%, its lowest level for more than a decade (barring the Covid crisis). As a result, the unemployment rate is now 16.4%, up from 15.2% at the end of 2022 and 1.5 points more than its pre-pandemic level. Worryingly, youth employment is running at 40.9%.

There are various reasons for the economy’s poor performance. Agricultural GDP fell 11% last year because of a severe drought. Growth also slowed sharply in the other parts of the economy. Despite a good tourist season, non-agricultural GDP growth reached only 1.8% in 2023. Several sectors saw output fall, particularly mining and hydrocarbon extraction, where the decline seems to be hard to stop. Retail trade also fell for the first time since 2020, coming in down 0.4% last year.

The outlook remains gloomy. Despite a favourable base effect thanks to a rebound in the agricultural sector, it will be difficult for growth to exceed 2% in 2024. Inflation is a long way from being tamed, since it is running at an annual rate of 7.8%, among the highest in the region. Above all, the fragility of Tunisia’s macro-financial situation will continue to affect investor confidence, unless the authorities reach an agreement with the IMF. This looks unlikely in the near term given this year’s busy election schedule.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.