Trussification part two

Financial thriller in progress

I had trouble turning off the show last night as going to bed during the price action after midnight felt like turning off the TV during a key scene in Margin Call, or putting down a financial thriller like The Reset halfway through, or shutting down the audio squawk of the Flash Crash midway through. US 10-year yields: 4.25 --- 4.35 --- 4.40 --- 4.50! Yeesh. You are forgiven if you feel like you are involved in some kind of exaggerated financial markets simulation game where they constantly bombard you with unbelievable headlines.

Top presidential adviser calls US Trade Policy architect a moron.

China raises tariffs on US goods to 84%.

US Treasury Yields skyrocket as USD sells off.

US bonds lose safe haven status as tariff rates hit 100-year high.

Republicans float raising tax rate on millionaires to 40%

What is even happening here? Yesterday I spoke of the Trussification Radar and the price action overnight confirms the early stages of a regime shift away from a USD driven by yields and towards a USD driven by capital flight. But attacking not just enemies but also former allies, the administration has triggered a flight of international capital away from anything labeled “Made in the USA”.

The big question is: “Where is the Bessent Put?” Retweets from Trump suggest he finds the 20% collapse in stocks of little concern and perhaps comical, and the Fed isn’t going to act yet given the precarious inflation and long bond situation, so the only put is in the bond market, not the stock market. As we saw in the UK, the bond vigilantes can only take things so far before the government intervenes.

You can see that the interventions by the Bank of England capped yields, but the relief was temporary. The crisis was in September/October 2022, and we have never traded below the low touched November 2022. The US has many, many tools to support the bond market, including Fed emergency action and SLR / bank leverage rules. There is an unlimited buyer of US bonds at some level, but where? 5.0% I suppose is the logical guess as that is where Yellen intervened and capped yields via moral suasion and some QRA skullduggery.

Fixed income volatility is skyrocketing, but I need to dial down my hysteria a bit as we have seen much bigger moves, many times. It’s the particular combination of falling stocks and rising yields and negative confidence and rising price pressure that makes this all feel kind of alarming. But there is no guarantee of a regime shift. The Trussification Index (long bonds / long USDJPY) broke lower overnight (see right side chart) but it’s hardly world shaking yet. Yet.

CNH

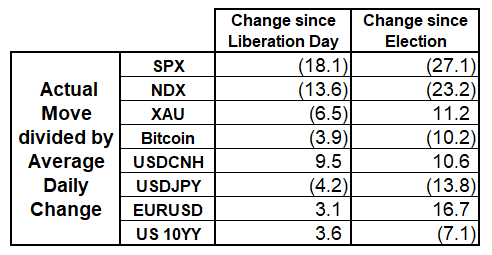

Here are the moves since election day and Liberation Day. Stocks obviously the big victims of the improvisational policy mix while EURCNH has gone to the moon. If this was an attempt to drive bond yields lower, it did not work. The calculation is (move divided by average day range). So SPX is down 22% and average day range is 0.9% = -23.2.

Final thoughts

The buy the dip mentality and mean reversion bias out there is strong. This might not be a routine selloff. Government help is not yet imminent. We are witnessing potentially Fourth Turning level events here, and while I understand that stocks are oversold and short squeeze headline risk is enormous, I am not convinced it’s all priced in. We haven’t even seen the beginning of the beginning of the economic impacts yet. Supply chain chaos, price spikes, hiring freezes, bankruptcies, and further policy escalation (capital controls, taxes on foreign investors, etc.) are all on the road ahead.

International trade deals are not struck via one phone call or meeting. USMCA took 12 months to negotiate and that was incredibly fast. NAFTA took 3 years. TPP took 8 years. EU-UK agreement took a year. Uncertainty is here to stay, and hysteresis is real. The economic data over the next few months is going to be insane as the panic buying and then sudden stop after gargantuan import tax hikes and supply chain shocks will be impossible to model. Madness ahead.

Once the retail liquidation ends, gold tends to become a safe haven again and it seems that is happening now. Nice double bottom down there at 2970/80 GCM5 after another ferocious test last night. And note that while it feels like copper has collapsed, it’s still up on the year! It went up a zillion percent for no reason.

Finally: I’m not a single name expert, and I know that TSLA is a memestock, not a car company. But 37% of their sales come from China. And the price of their cars in China basically just doubled. Hmm. Nobody is buying Teslas in Europe. Even Dan Ives can’t find a bullish storyline. At some point maybe all this matters? Or not.

Author

Brent Donnelly

Spectra Markets

Brent Donnelly is the President of Spectra Markets. He has been trading currencies since 1995 and writing about macro since 2004. Brent is the author of “Alpha Trader” (2021) and “The Art of Currency Trading” (Wiley, 2019).