Trump Tweets “Manufacturing Blowout”: What's the Real Story?

President Trump quickly hopped on the GM strike-end surge in jobs. Let's have a look.

Manufacturing Blowout

“This is a blowout. Look at these manufacturing numbers, a blowout.” @MariaBartiromo

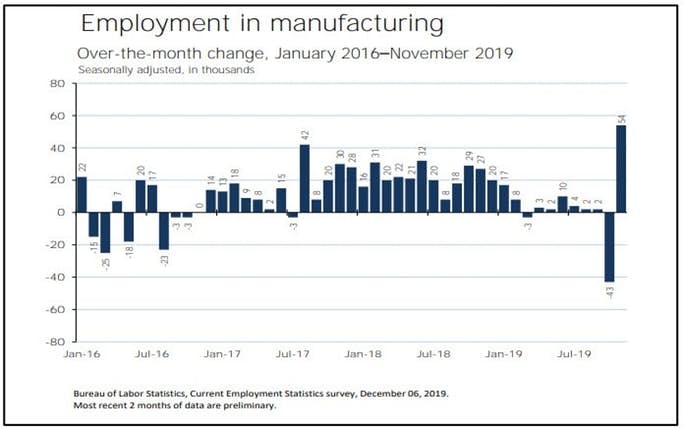

Manufacturing Employment

The last two months average +5.5. there is no surge in manufacturing employment.

Employment in Motor Vehicles and Parts

Average out the last two months and you get an impressive -1 in October and an equally impressive -1 in November. That's a small decline in 7 of the last 9 months.

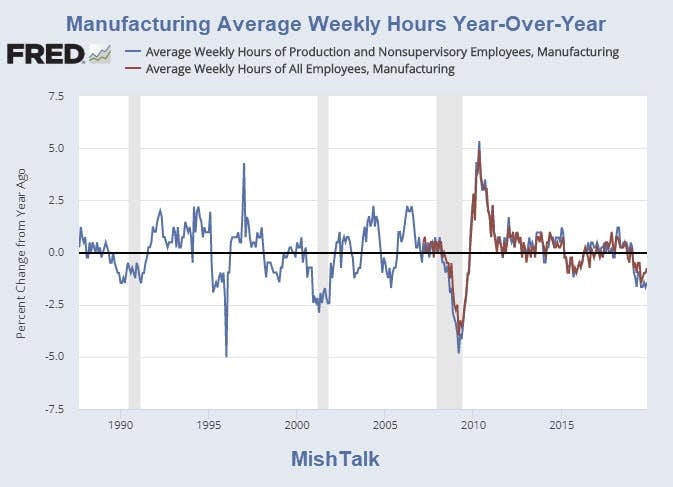

Manufacturing Average Weekly Hours Year-Over-Year

Manufacturing Average Weekly Hours Year-Over-Year Detail

That chart is the most telling of the lot.

Despite the end of the strike there is no improvement in manufacturing hours of actual production workers!

Seasonal Adjustments

Much of that rebound is related to the GM strike that ended on October 25.

Some of it is a calendar-related seasonal adjustment.

BLS sampling started within days of the strike ending. Then, Thanksgiving came into play giving an additional seasonal boost.

Yet, manufacturing hours of actual production workers did not even budge.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc