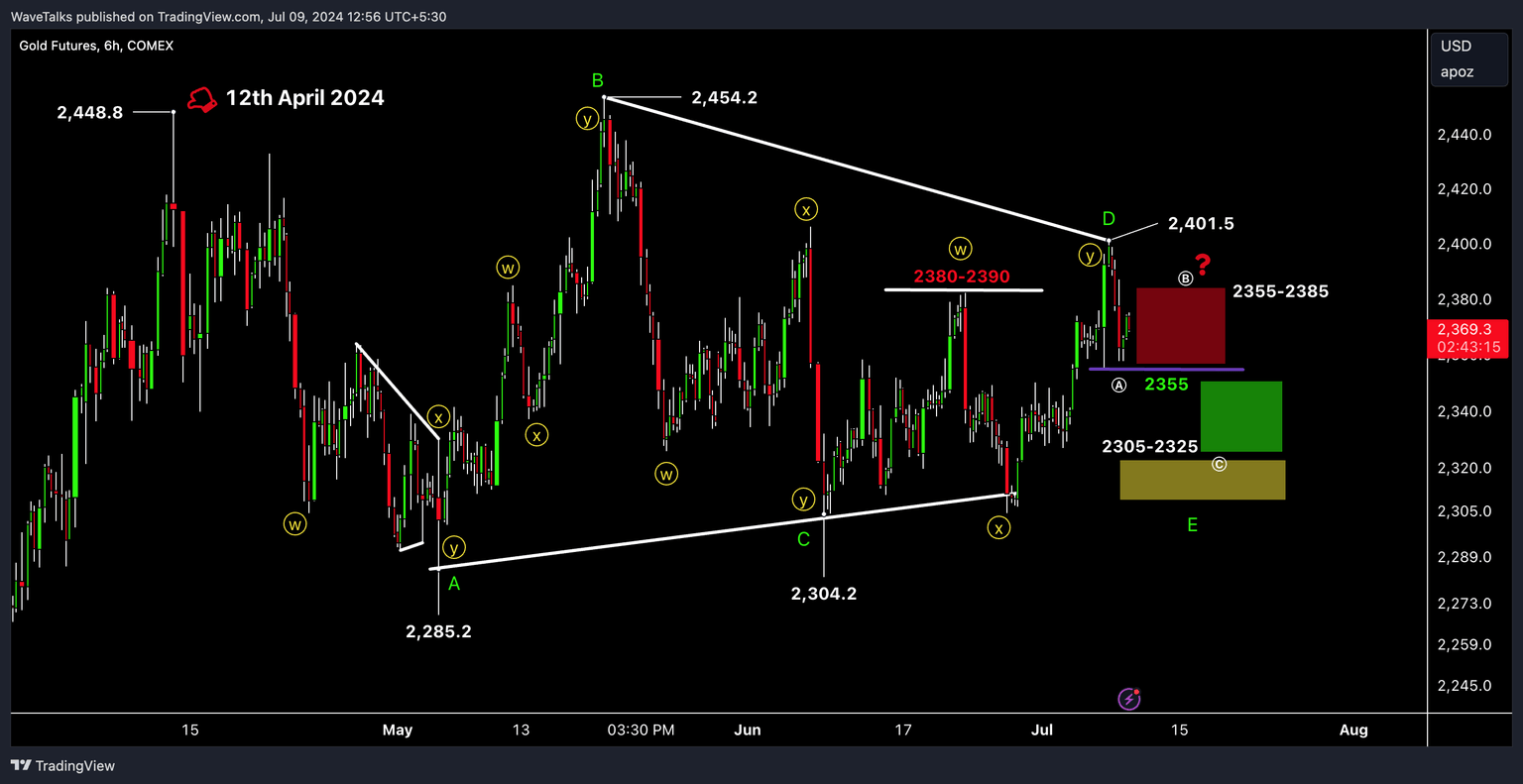

Triangle trap – Gold’s next move Elliott Wave analysis

Gold's range since April 2024

-

Upside: 2455.

-

Lower side: 2285.

Gold has been in a big range, doing a series of connecting waves, narrowing down like a tightened coil. Once coil unfolds in near future post completing Wave-E of the proposed Triangular Structure, next move could be sharp on either side of the critical zones discussed.

Irregular triangle

-

Wave-B: Surpassed highs of 2448 (starting point for Wave-A).

-

New highs: 2454 (slightly above Wave-A).

This falls into the category of an irregular structure where Wave-B surpasses Wave-A.

Higher lows

Rising lows can provide comfort to Bulls until it holds above 2285.

-

Wave-A bottomed: 2285.

-

Probable wave-C completed: 2304 (June 7, 2024).

-

Recent bounce: 2304 (June 26, 2024).

-

Key resistance level: 2401 USD (as of July 5, 2024).

Assuming Wave-D is completed, we have a key resistance at 2401.

Falling in wave-E - triangle trap

The fall has been sharp from the highs of 2401 (assuming Wave-D completed) on the first trading day of the week (July 8-12, 2024), looking to be a corrective fall taking support at 2355 USD (minor support level).

Where are we currently (9th July 2024)

Currently, Gold is within unfolding Wave-E of the structure & completed the first lower degree wave Ⓐ at 2356 lows & unfolding wave Ⓑ now & later wave Ⓒ

Zone one (Shown in red)

-

Short-term range: 2355 to 2385.

Zone two (Shown in green)

-

Short-term minor support zone: 2305 to 2325.

Move looks to be range-bound, holding the minor support level of 2355 (marked as wave Ⓐ) and can have a bullish bias towards the minor resistance level of 2385. Breaching the zone of 2350 / 2355, the minor support zone of 2305-2325 on the downside will open up.

Key support and resistance zones

-

Key & critical support zone: 2285-2305.

-

Key resistance zone: 2400-2410.

-

Critical resistance zone: 2448-2455.

Any move either side of the key & critical zones could be sharp moves & has to be reviewed once we get further price inputs.

Conclusion

Waiting for Wave-E to complete in the sideways move in which Gold has been trapped since April 2024.

Wave-E could take 1-2 weeks.

Catch me in the next episode of WaveTalks. Have a great week ahead.

Author

Abhishek H. Singh

WaveTalks

Abhishek is a seasoned financial analyst with over a decade of experience specializing in Elliott Wave Theory.