Trading silver over Thursday’s US Core PCE print

Silver could be set to outshine when the US CORE PCE print is released on Thursday. The rationale is that the recent inflation focus means the market is sensitive to any signs of peak inflation. Furthermore, the edging higher of the gold/silver ratio means that silver is cheap relative to gold. So, here is the potential outlook.

The calendar for the US Core PCE

Here is a look at Financial Source’s calendar which has the minimum and maximum expectations on it. The low expectation for the core y/y reading is 5.1% and the prior reading is 4.9%.

The trigger

The trigger for a potential silver long will be if the y/y reading comes in at 5% or below. Markets will breathe a sigh of relief that perhaps peak inflation has passed and the Fed will not need to be so aggressive. Yields can move lower, the USD can move lower and that should lift silver, gold, and the EURUSD. However, if the print comes in at, or above expectations, then there is no obvious trade outlook. High inflation is the norm and the bets opportunity is far more likely to come from the first signs of peak inflation.

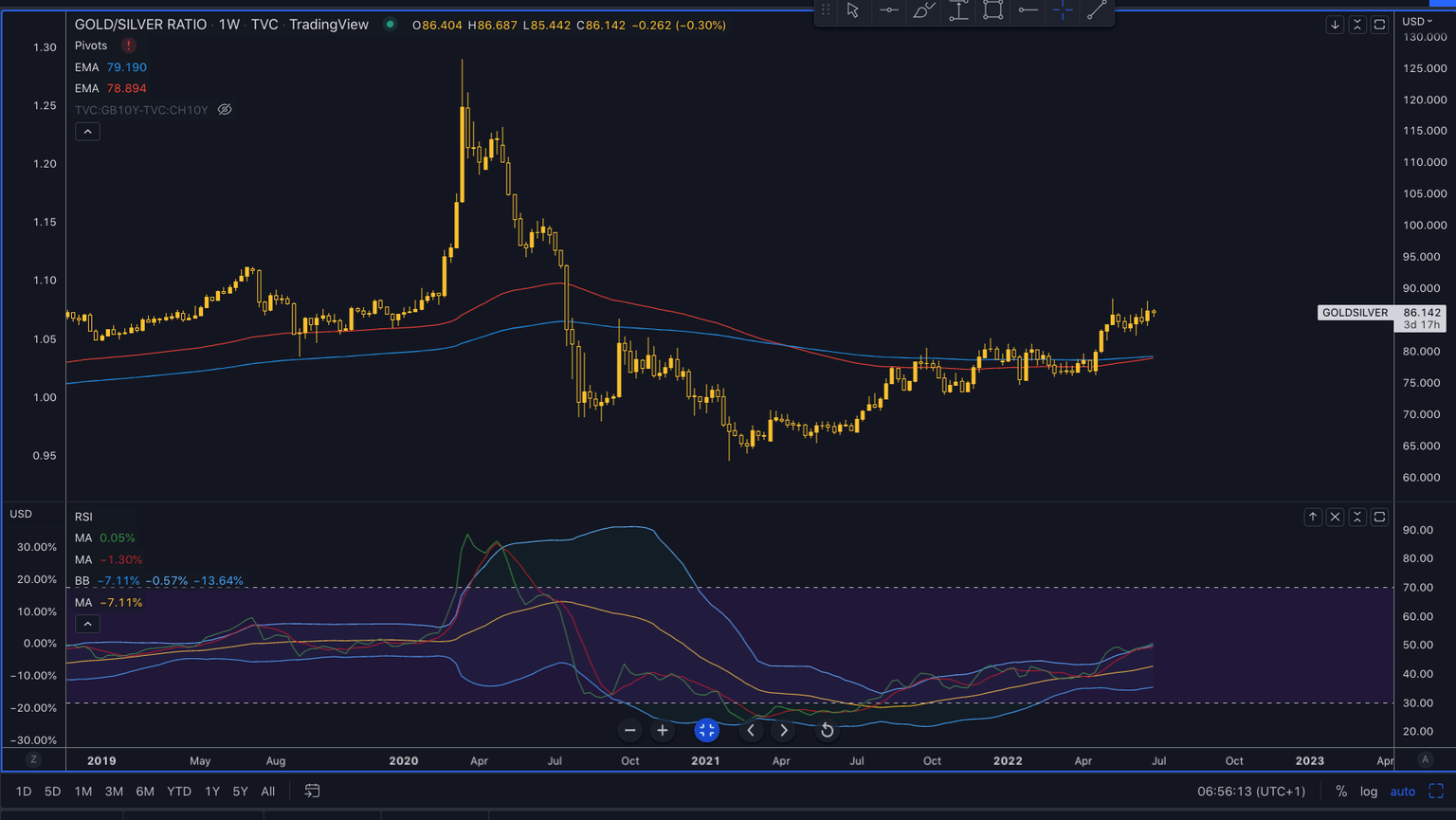

The gold silver ratio

In the event of a US CORE PCE miss silver looks more attractive than gold in the near term since the gold silver ratio is moving higher. This means that if there is any reason for precious metals to gain, then silver can outperform gold.

The target

The target Looking for a move higher into the next daily pivot point would be logical.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.