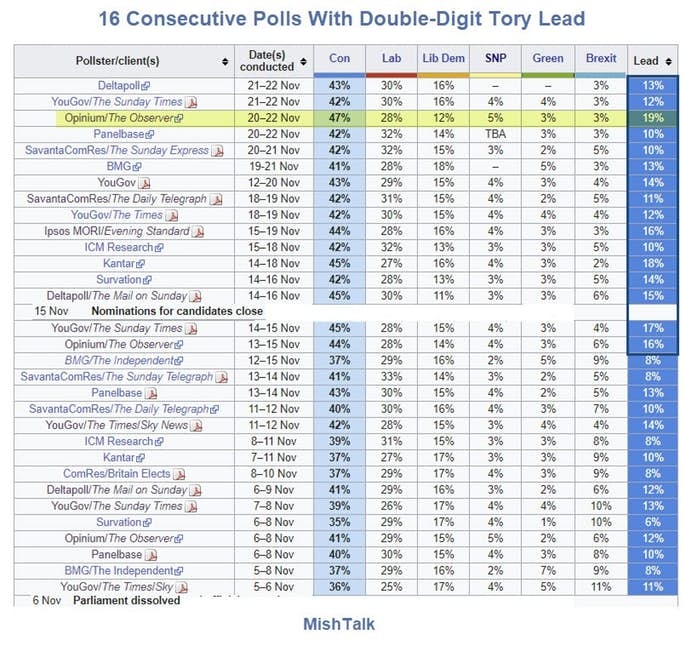

Tories Jump to Double Digit Lead in Every Poll

BMG was the last pollster holdout with a sub-10% Tory lead. BMG now has a 13% Tory lead, up from 8% on Nov 15.

I will dive into some of the more recent polls shortly, but every pollster now has a double digit lead for the Tories.

Opinium has the Tories leading by 19 points.

Any rational person should have expected this.

As noted a bit earlier, Jeremy Corbyn Goes for Broke With Last Desperate Act.

Corbyn managed to change the election from a referendum on Brexit to a referendum on Corbyn.

Labour's Radical Plan Highlights

- Increase government spending by a massive £82.9bn a year, about 4pc of GDP, all paid for by rising taxes

- A £400bn “national transformation fund”, which would “add to the government’s debt” but isn’t in the headline figures.

- Nationalisation of rail, water, energy, bus, mail, and broadband companies

- Seizure of 10 percent of the shares in every big UK company and handing the shares to workers

- Raise the corporate tax rate to 26% from 19%

- An £11bn windfall tax on the oil and gas sector

- Free broadband internet for everyone

- Free shelter for the homeless

- Super-rich tax rate

- Tax on second homes

- Raise £8bn via a Financial Transactions Tax

- Higher inheritance tax

- Force landlords to sell homes to tenants at a "fair" price as determined by Labour

No one in their right mind should vote for that.

Without a Doubt, Boris Johnson United the Tory Party

On November 21, I proposed Without a Doubt, Boris Johnson United the Tory Party

Upon further reflection, I am wondering if I have that correct.

Perhaps this is more accurate: Without a Doubt, Jeremy Corbyn has United the Tory Party.

I will crunch some possible numbers on this a bit later.

For now I will stick with my 88 seat majority for the Tories as noted in Looking Like a Tory Blowout and Complete Collapse of Labour.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc