Top Astro events for the US dollar in June

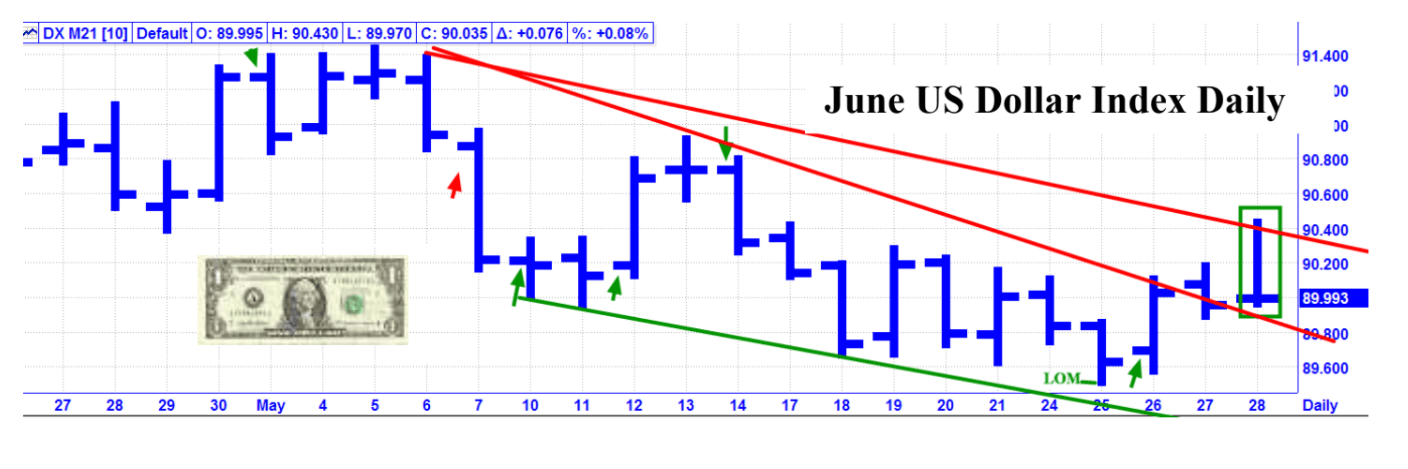

May Review – “The US Dollar had a strong and steady down trend for almost all of April. The one exception was on 4/30 with a strong reversal to the upside, which may have broken the down trend. The top Astro events for the Dollar this month are: 4/30 AC – Neptune 180 US Neptune; 5/03 AC – Saturn 0 US MC; 5/25 AC – Lunar Eclipse at Perigee; and 5/26 AC – Uranus 120 US Part of Fortune.

Astro Dates – 5/3, 5/7, 5/10, 5/12, 5/14, 5/26, 5/28 AC”

Results – 5/3 was a one day high. 5/7 was not effective. 5/10 was very close in price and one day ahead of a good low. 5/12 was very close in price and one day past a good low. 5/14 was very close in price and one day past a very good high. 5/26 was very close in price and one day past the low of the month. Score – 5 out of 6 good dates = 83.33%

June Update – The US Dollar was in a down trend for most of May. However, toward the end of the month, it was showing some signs of strength that could indicate a reversal to the upside. Some of the top Astro events for the US Dollar in June are: 6/11 AC – Saturn 0 US MC; 6/16 AC – Saturn 90 US MC; and 6/17 AC – Saturn Contra-Parallel US Mercury.

Astro Dates – 6/1, 6/7, 6/10, 6/14, 6/18, 6/25, 7/2 AC

This is an excerpt from the Astro Trend newsletter. Astro-Trend covers about thirty futures related markets including the major Financial Markets, such as the Stock Market, T-Bonds, Currencies, and most major commodities. We also offer intra day data which identifies potential change in trend points to the minute.

Author

Norm Winski

Independent Analyst

www.astro-trend.com