Today's data is unlikely to take the Dollar off the track

Outlook: Today is the last trading day of the month, the quarter and the half-year. Everybody who was paring positions and closing up shop for those calendar periods has already done so, even if that doesn’t mean a totally clean slate. Nobody can say whether this has had an important effect this time, although the return of the dollar might suggest it.

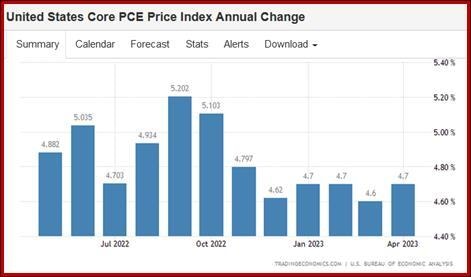

Ahead of US personal income and spending, and the PCE inflation numbers, it's actually a bit slow out there in terms of narratives shaping sentiment. The most exciting thing that has happened is the markets finally starting to believe Mr. Powell when he says probably two hikes this year and probably more than a full year of higher rates to 2025 before respite will arrive. “Higher for longer” finally sank in. His remarks at Sintra contain an unspoken appreciation for lag, too.

Expectations for personal income and spending incorporate a drop in spending that bodes ill for the coming quarters and implies analysts expect the consumer to weary of going hog-wild. We are not so sure—remember our many references to the endlessly greedy and materialistic American consumer.

The key number will be the headline deflator, forecast at 3.8-4% from 4.4% in April and core at the same 4.7%. That’s the consensus forecast, meaning nobody sees a rise in core as we have seen in other countries. A surprise on that front can drive bond yields even higher.

Forecast: The dollar is on a roll and it’s not likely that today’s data is going to shove it off the track. In fact, it might reinforce the move if core is higher than expected. That would highlight the already rising confidence in “higher for longer.” Still, it’s a Friday ahead of an important holiday in the US, so we must expect a certain amount of position paring. As usual, we advise against trading the news, but if you must, get out by noon.

Tidbit: A pending surprise may well be from Japan. At the Sintra central bank conference, Mr. Ueda said that the BoJ will update its forecasts for inflation at the next meeting (July 28) and if it changes from the current forecast of 2% in 2024 and 1.6% in 2025, the BoJ will act accordingly. This is interesting from several angles, including a central bank acting on forecasts instead of actuals. Talk about the traditional long view! If the market comes to expect a change in policy, carry-traders need to keep their powder dry. A reversal in dollar/yen is not out of the question.

Tidbit: Reuters has one of its re-based charts, this time of GDP among them major economies with the starting gate just ahead of the beginning of the Q1 2020 pandemic announcement. It’s what you might expect—the UK at the bottom and the US at the top, with Japan and France about the same and Italy above both.

Tidbit: The WSJ story on the stock market says “Any number of things could have derailed markets in the first half of the year. Investors kept buying risky assets anyway.

“Stocks burst out of a bear market, with the Nasdaq Composite up 30% and on course for its best first half of a year since the 1980s. Bitcoin surged more than 80%, despite the U.S. Securities and Exchange Commission suing the world’s biggest cryptocurrency exchanges. Bonds enjoyed some reprieve, too. Indexes tracking everything from Treasurys to junk bonds have posted modest gains following their historic selloff last year.

“Why did markets keep rising, despite a banking crisis, the threat of a U.S. default and more interest-rate increases from the Federal Reserve? The simplest answer: Time and time again, investors’ worst-case scenarios failed to materialize.

Well, no. Sentiment can’t be boiled down to one thing and a double negative is a lousy excuse for a positive when it comes to markets. Granted, buyers may have refused to accept the recession story, or that the regional bank crisis would get out of the Fed and Treasury’s control, but it’s really simpler than that—what Keynes called animal spirits and the less charitable name herd behavior. They saw earnings doing well and the chart showing a bottom at the 50% retracement line in October, and they believed the chart.

This is not to say some valuations are not ridiculous. Apple is worth nearly $3 trillion, more than the GDP of many economies. Can that be realistic in any sense?

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat