Three good reasons to not lose faith in green bonds

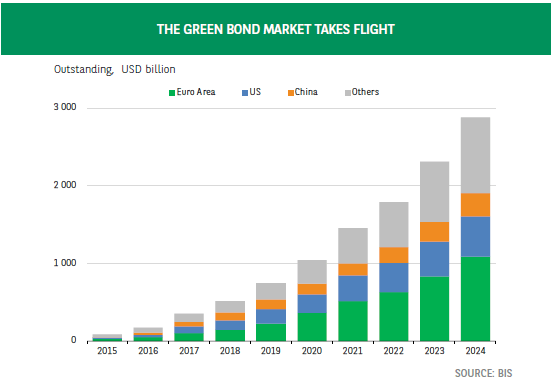

Since the Paris Agreement (2015), the green bond market has been on the rise. Although still modest on a global scale (USD 2,900 billion, which is barely 2.5% of total bond outstandings), its size has more than quintupled over the last five years. The eurozone has been the driving force behind this take-off, followed at a distance by the United States and China (see chart).

However, the geopolitical backdrop of the war in Ukraine, the rearmament race and Donald Trump’s return to business raises questions about whether this expansion can continue. Is there not a risk that governments’ backlash against climate and environmental issues will stop the previously promising green bond market in its tracks? In our view, this is unlikely, as sustainable finance is set to play an increasingly important role in the future, for at least three reasons.

A fundamental trend. The progresses of environmental, social and governance (ESG) factors is part of a major trend that is not dictated solely by governments. ESG criteria are already part of “business as usual” for many companies on the ground1; on the investor side, they continue to influence investments, particularly since the European Green Bond Standard (EuGBS) has made it possible for investors to benefit from greater transparency and a stronger regulatory framework. A recent study by the Bank for International Settlements (BIS, 2025)2 shows a strong statistical correlation between taxonomy and sustainable investment.

An effective tool in the fight against climate change. Without disputing the existence of windfall and greenwashing effects, the same study shows that the green bond market is nevertheless making a significant contribution to the decarbonisation of companies. Companies that use it reduce their unit greenhouse gas (GHG) emissions by an average of 21% after one year, with the most significant progress being made in energy-intensive sectors3.

Financial benefits for governments. If public decision-makers wanted to curb the expansion of the green bond market, they would benefit very little from doing so. Increasingly, rating agencies are including CO2 emission reduction trajectories in their assessment of government debt, with the best performers minimising the risk of a disorderly transition and, therefore, getting better ratings (Capiello & al., 2025)4. At a time when the question of the sustainability of public finances is resurfacing, betting on “green“ rather than “brown“ energy could prove very profitable in the long run.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.