Three Fundamentals for the Week: Trade, government shutdown and Powell stand out

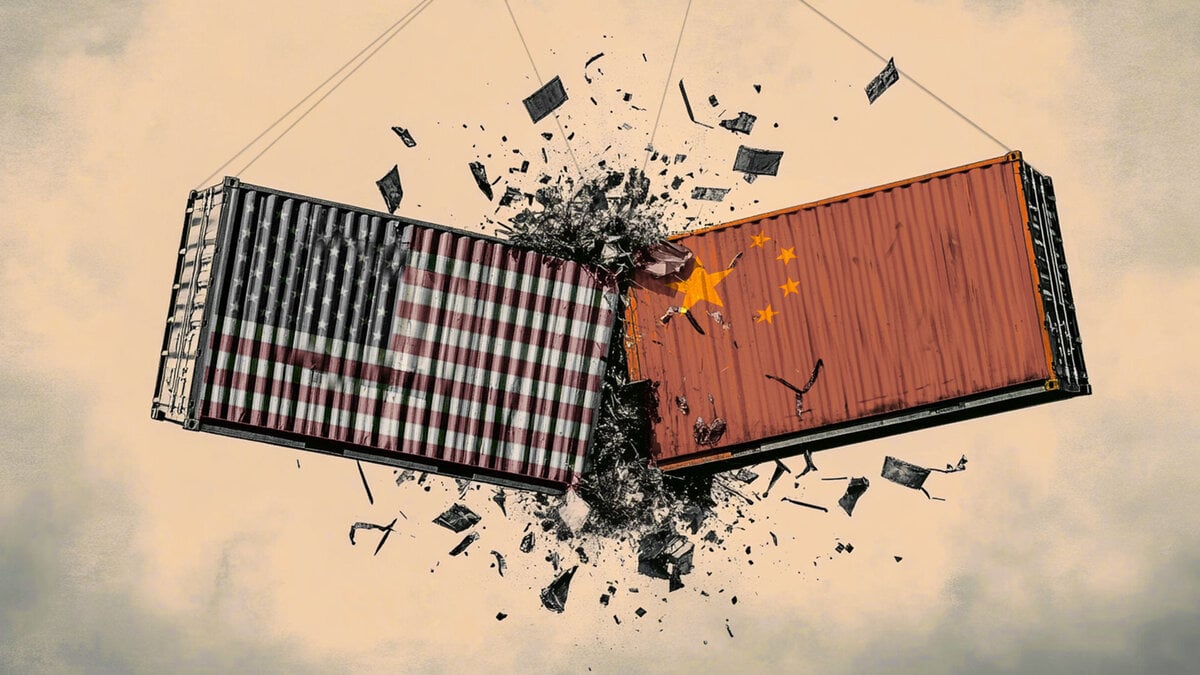

- Sino-American trade tensions are set to continue rocking markets.

- Pressure to resolve the US government shutdown is set to come to the fore later in the week.

- Fed Chair Jerome Powell will provide a fresh assessment of the US economy.

Whipsaw – trade headlines have triggered wild price action early in the week, and this is only the beginning. A US bank holiday on Monday and the lack of economic data are unlikely to stop the action.

1) Rare earths dominate tensions between the world's largest economies

Quick climbdown? Late on Friday, US President Donald Trump shocked financial markets by threatening 100% tariffs on Chinese imports to begin on November 1. The Commander-in-Chief fumed at Beijing's recent curbs on rare earth exports. The mood further deteriorated when China issued defiant comments, accusing the US of violating recent agreements.

The tune drastically changed over the weekend, when both Trump and Vice President JD Vance signaled their intent to reach a deal with China. The White House is interested in a summit between Chinese President Xi Jinping and Trump.

What's next? I expect further de-escalation in the next few days, as Trump is sensitive to market moves. However, disagreements between the world's two largest economies are related to real issues that require a resolution.

Positive comments are set to boost Stocks, Gold and also Cryptocurrencies, while adverse developments are likely to support the US Dollar (USD), which has regained its safe-haven status.

2) Congress is under pressure to resolve the government shutdown

No pay – the first US federal workers have gone without a salary, piling pressure on Democrats and Republicans to resolve the government shutdown, now entering its third week.

Monday is a bank holiday in the US, which means politicians are away, but negotiations are set to intensify immediately afterwards. A resolution would boost Stocks, while the ongoing closure supports Gold and the US Dollar.

A deal to reopen the government would also allow agencies to publish economic data.

3) Powell may provide insights about the ongoing shutdown

Tuesday, 16:20 GMT. Jerome Powell, Chair of the Federal Reserve (Fed), will speak in Philadelphia, and markets are set to listen to any fresh assessment of the economy. Investors expect the Fed to announce another interest rate cut later in October, but it may struggle to make informed decisions without government data.

Powell speaks just before the central bank enters its self-imposed "blackout" period, making the event more important.

Optimism about the US economy would boost Stocks, while pessimism would support the safe-haven Greenback and Gold.

Additional notes

Even if the government shutdown ends, economic releases originally scheduled for this week are unlikely to happen immediately.

The encouraging pictures from the Middle East have captured the world's attention, but are unlikely to move markets. The deal was announced last week and had little impact.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.