The USD Index is getting close to technical support

It is a busy week for data release with the main focus being the Fed interest rate decision, policy statement and FOMC press conference on Wednesday.

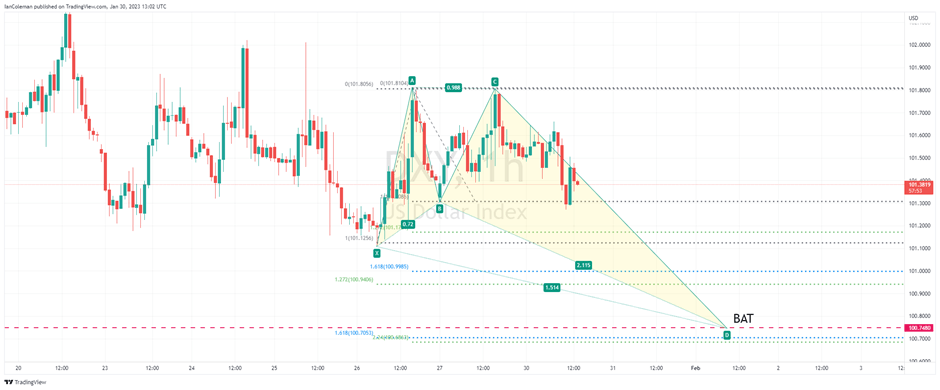

This could be perfect timing for medium-term support in the DXY (USD Index). We also have a short- term cypher pattern that could offer a confluence area close to 100.74.

It is always advisable not to try and catch the falling knife and we have seen four straight months on losses in the index but, as the great Warren Buffett once said, be fearful when others are greedy, and greedy when others are fearful. This can sometimes pay great dividends.

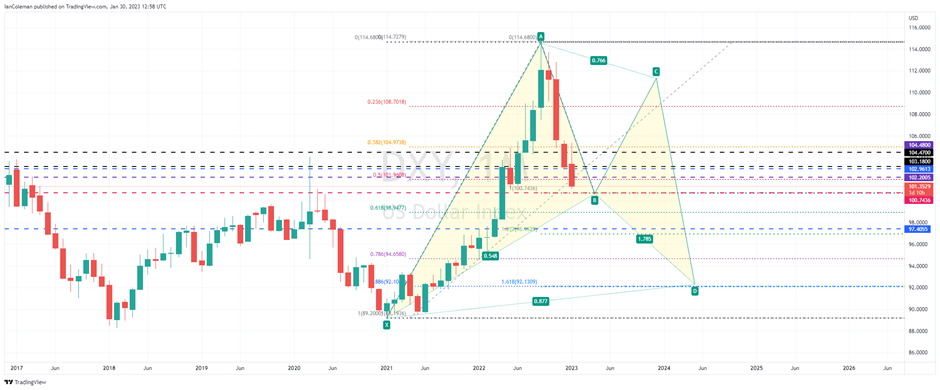

DXY monthly

The monthly chart offers projected support at 100.74. A bounce form this level could form the correct BC leg in a large Bat formation (cypher).

DXY 1-hour

The one-hour chart highlights a Bat formation completing just below the aforementioned support at 100.70-100.68.

Buying the dip could offer a great risk/reward setup.

Author

Ian Coleman

FXStreet

Ian started his financial career at the age of 18 working as a Junior Swiss Broker at Godsell Astley and Pearce (London). He quickly moved through the ranks and was Desk Manager at RP Martins at the age of 29.