Moderate change in trend US stocks, T-bonds, US Dollar

12/06 Recap: - The S&P opened with a 10 handle gap up and then steadily moved up 65 handles into a 2:03 PM high of the day. From that low, the S&P gradually decline 14 handles into the close.

12/06 – The major indices, closed with a strong up day. The 12/06 closes are as follows: The DJIA + 646.95; S&P 500 + 53.24; and the Nasdaq Composite + 139.68.

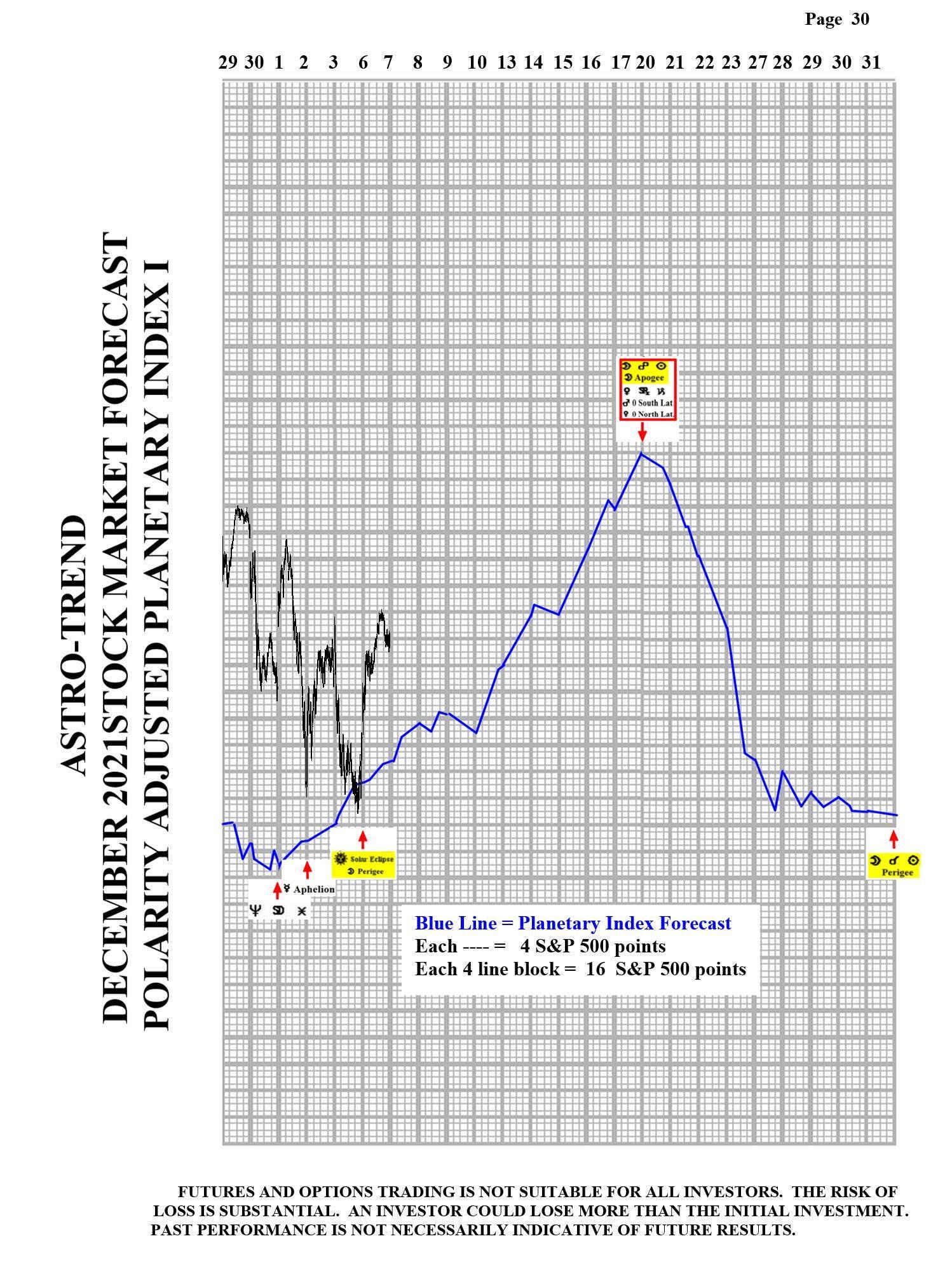

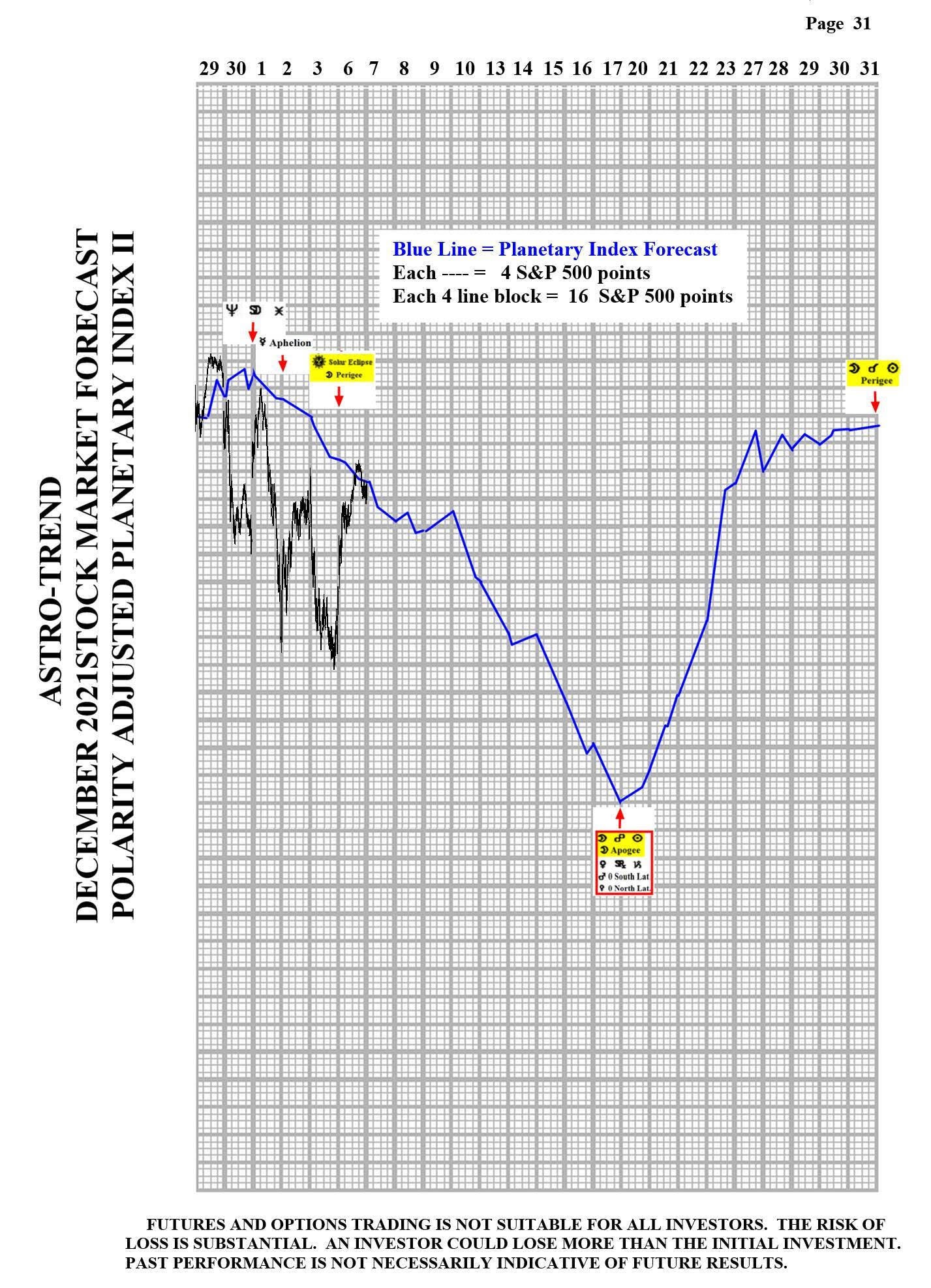

Looking ahead – Looks we the S&P put in its Solar Eclipse low late Friday. Now, the Astro picture is relative quiet for the next two weeks. Newton's First Law of Motion states that a body at rest will remain at rest unless an outside force acts on it, and a body in motion at a constant velocity will remain in motion in a straight line unless acted upon by an outside force. With that in mind, whatever trend is established by Tuesday, and that currently is looking like an uptrend, is likely to be the trend into about 12/17, which is the next major change in trend window. However, with Geo Mars changing signs over the 12/10 weekend, there may be a brief correction.

The NOW Index is in the BUY ALERT ZONE. This is a cautionary indication for the bears that there is a moderate imbalance of too many shorts.

Coming events

(Stocks potentially respond to all events).

2. A. 12/10 AC – Geo Mars enters Sagittarius. Important change in trend Oats.

B. 12/12 AC – Jupiter 45 US Part of Fortune. Moderate change in trend US Stocks, T-Bonds, US Dollar.

C. 12/15 AC – Jupiter 135 US Sun. Moderate change in trend US Stocks, T-Bonds, US Dollar.

Stock Market Key Dates –

Market math

12/26 – 676 Days (26^2) from the 2/19/2020 major high.

12/28 – 15,54 (112^2) from the 8/25/1987 major high.

DJIA – 12/13, 12/22, 12/29, 12/31 AC.

Fibonacci – 12/10, 12/16, 12/20, 12/28, 12/30.

Please see below the S&P 500 10 minute chart.

Support - 4541 Resistance – 4613.

Please see below the S&P 500 Daily chart.

Author

Norm Winski

Independent Analyst

www.astro-trend.com