The PLN market - Weekly overview

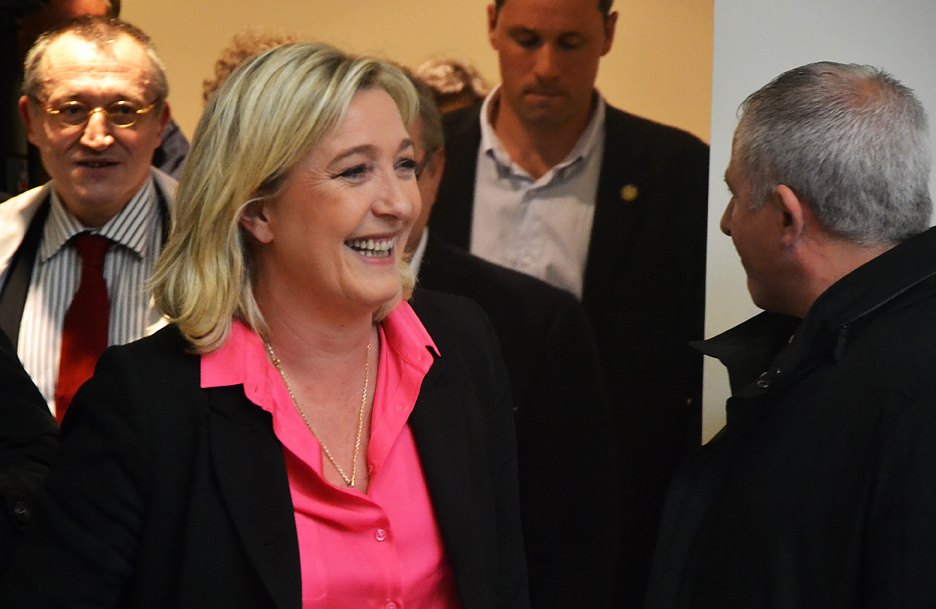

The French presidential elections are coming up this weekend. This event has been and it will be driving markets in the near future. Traders fear Marine LePen (National Front) and it seems she is a strong candidate. At this moment, nobody can say for sure who will win. The four candidates (LePen, Melenchon, Fillon and Macron) are in a tight race to the presidential palace. The increased risk and that accompanies the French election is seen on the markets. Volatility is high but on Monday we should expect really big movements. The Polish Zloty has been depreciating but rather in a stable manner. This past week the published macroeconomic data proved again that inflation might be increasing at a faster pace than the central bank is forecasting. Average wages increased by 5.2% while the PPI index grew by 4.7% in March (both yearly basis), more than expectations. Also, the economy has experienced a big jump in industrial production, which increased by 11.1%. Those numbers are the next one in a series of pro-inflationary data. I wonder what the MPC will say about them by the end of this quarter. Till then, we need to focus on Paris.

As we see on the daily chart, the EUR/PLN is climbing and currently testing the resistance at 4.28 (23.6% retracement level of this year’s downward move). It is hard though to forecast what can happen next. If LePen wins in the first round of the French elections, risk will increase and the Zloty should depreciate. At the same time, the EUR will get hit badly. Still, more probable will be the scenario of the EUR/PLN breaking the resistance and targeting 4.32. If LePen gets second place or worse, risk aversion will decline. The EUR will gain in value along with emerging market currencies. The stochastic oscillator shows the market is overbought. In this case, the market should rebound from the resistance and head towards the 4.24 level.

Pic.1 EURPLN-ECN D1 Source: MT4 Supreme Edition, Admiral Markets

It seems the USD/PLN is easier to analyze. In the case of increasing risk aversion on Monday, the market should break the 3.99 resistance and attack 4.04. The opposite will happen if risks are reduced - the USD/PLN is expected to test 3.94 and even try to target the 3.90 level.

Pic.2 USDPLN-ECN D1 Source: MT4 Supreme Edition, Admiral Markets

Author

Adam Narczewski

Independent Analyst

Independent analyst and trader. Adam holds the CFA (Chartered Financial Analyst) and the PRM (Professional Risk Manager) titles.