The nascent re-positioning away from the dollar is grinding to a halt

Outlook:

The universal market rally was a stunner after Iran said it was done and Trump seemingly accepted it. The S&P reversed from a 10-day low to a new record high. Today WTI crude oil is quoted at $59.68—from over $65 at one point yesterday. In currencies, the single biggest mover was dollar/yen, which tanked to 107.64 on the original news of the assassination but then rallied to 109.45 overnight as the risk of war seemingly dissipated. This is just shy of the recent highest high, 109.73 from Dec 1.

Dollar/yen today is one of the single clearest cases of a currency move driven by geopolitical events. The pound after the referendum in June 2016 is another. The euro during Grexit was less dramatic and more spread out over time, if not smaller. Those who say it's okay to ignore politics in formulating FX forecasts are not paying attention.

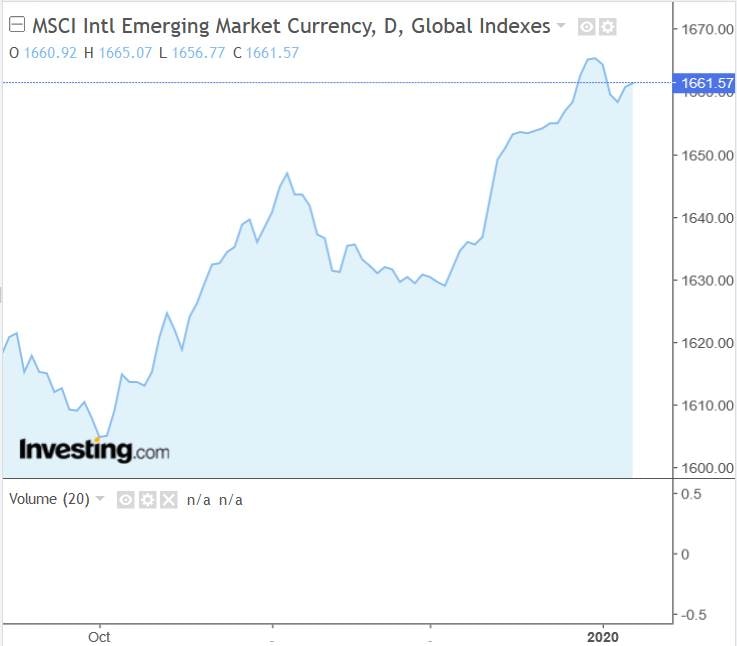

The US-Iran truce allows the emerging markets to come into their own, as we suspected. See the EM index chart. Notable is the Chinese renminbi but also some others, especially the Mexican peso, which refuses to follow the rules and decline on the prospect of a central bank rate cut. Mexico reported Dec CPI today, down to 2.83% from 2.97% in November (if higher than the market forecast for 2.76%). It's still the lowest inflation rate since August 2016, Meanwhile, the official target rate is 7.25%, generating a gigantic real return. This high level, even if cut 50 bp sometime soon, may be needed to prevent outflows given the economy is still fairly weak and Pemex is still inefficient and falling short.

In other words, relative real return is still a determining factor in FX, if not always obvious. Lousy data and a lousy outlook for the UK and Germany, implying no improvement in real return and in the UK, likely a cut in return, are behind the current move down in the pound and euro. The nascent re-positioning away from the dollar is grinding to a halt. So far. We still think the dollar is overbought and "should" pull back, but don't hold your breath.

US Politics: Among the stupid, misleading and false remarks by Trump yesterday was the lie that former Pres Obama "gave" the money to Iran to build/buy the missiles to attack US bases in Iraq. This is not true. The $150 billion was Iran's money in the first place that the US quarantined—i.e., seized and froze—before the nuclear treaty came along. Releasing the money was court-ordered and the US even negotiated a lower interest payment. This has been repeated many MANY times in the mainstream press. It's very annoying that the Liar in Chief is still pushing the false narrative. However, some 45% of poll respondents approve of Trump's performance, as high as he has even gotten. That means some 45% of Americans are ignorant of facts, if not anything worse. If we expect a normal distribution of brainpower with average in the center and dummies in the tail, the US stupid tail is far too fat. Maybe they are confusing patriotism with uncritical support of the most incompetent president of all time. To be fair, the 538 compilation of polls yesterday shows an overall approval rating of 41.9% and disapproval, 53.3%.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a free trial, please write to [email protected] and you will be added to the mailing list..

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat