The mosquito budget

If everything was running perfectly, the Chancellor would not need to come out and prepare the ground for the budget 3 weeks in advance. Furthermore, if everything was working perfectly, the Pound would not have sank 0.88% on the day of her announcement, dropping off a sheer cliff as she gave her remarks.

The three-day performance of GBPUSD above spells it all out, yes, whilst USD is stronger off the back of Powell’s non-committal remarks last week and Trump’s trade deals, GBP is still undeniably in a bearish position.

One overlooked aspect of yesterday’s speech by the Chancellor was her refreshed commitment to lowering inflation. If even half of the rumours swirling around regarding income tax hikes, national insurance hikes, council tax changes and more are correct, this will be a heavily taxing budget with circa. £30-50bln taken out of the economy per annum.

Spending increases are generally not foreseen, although a lifting of the two-child benefit cap could be removed, but this would only return £2.5bln back into the economy, leaving a dismal net picture.

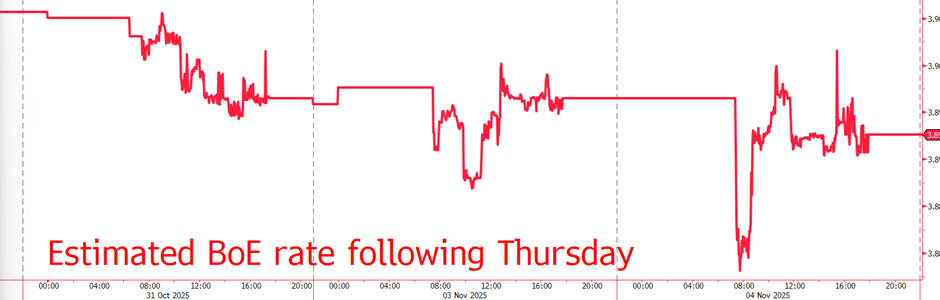

An intriguing point is that Reeves was possibly speaking in code to the Bank of England, who makes its interest rate decision tomorrow. By re-affirming the need to lower inflation and the very limited speculation regarding spending increases, she could be sending the message to Andrew Bailey “we’re doing our best to lower CPI, honest!”. This may sound remote, but estimates of a cut tomorrow raced up by 5% immediately following the statement (30% overall).

My conviction is still that the BoE will hold the line and leave rates unchanged tomorrow, but even if they do, the relief for GBP bulls may prove ephemeral as traders simply shift their expectations to increase certainty of a December cut. The weight of concern regarding the budget is such that longer term expectations of the BoE could shift, with the expected rate by September of 2026 decreasing by 13bps since this time last month.

Britain’s finances demand balancing, but with spending cuts very difficult given the politics of the Labour party, tax hikes seem the only way. But with this almost certain to drag inflation lower, alongside growth, it’s tough to see a serious opportunity for GBP into years end.

In the short term, this budget feels like a mosquito, sucking more strength from GBP with each passing day.

Author

David Stritch

Caxton

Working as an FX Analyst at London-based payments provider Caxton since 2022, David has deftly guided clients through the immediate post-Liz Truss volatility, the 2020 and 2024 US elections and innumerable other crises and events.