The Monetary Sentinel: The PBoC and the BI expected to hit the “pause” button

With a quiet calendar on policy moves, both the People’s Bank of China (PBoC) and Bank Indonesia (BI) are poised to sit tight in prudent mode, waiting for greater clarity on the trade‑war horizon before pulling any trigger on rates.

People’s Bank of China (PBoC) – 3.10%, 3.60%

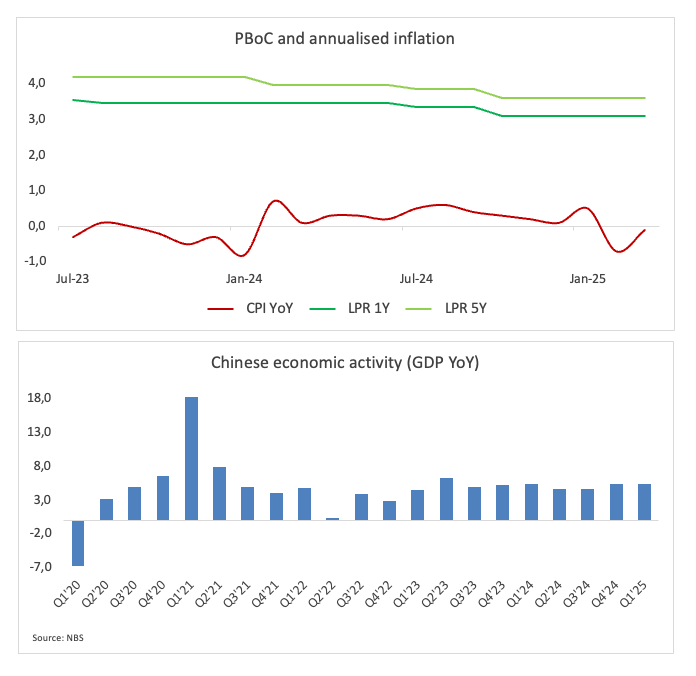

Since the turn of the year, the PBoC has quietly shifted gears, dialing up liquidity while officials have been hinting that more easing lie ahead—all in a bid to resuscitate an economy still wrestling with the hangover from COVID lockdowns.

Yet the spring data painted a study in contrasts. On one hand, Q1 real GDP roared in at a surprise 5.4% YoY, giving Beijing’s planners a welcome cushion as they march toward a roughly 5% expansion target for 2025. On the other, deflationary pressures persisted through March, with prices stubbornly stuck near zero.

Complicating the picture is the renewed fizz of US–China trade tensions, which threatens to sap export demand. Taken together, the deflation backdrop and geopolitical jitters are laying the groundwork for fresh monetary stimulus, with an extra dose of easing that could arrive as soon as the next policy meeting.

Upcoming Decision: April 21

Consensus: Hold

FX Outlook: USD/CNH appears embarked on a so-far multi-day consolidative move around 7.3000, receding from nearly 18-year tops reached earlier in the month in the vicinity of the 7.4300 level. The pair, in the meantime, is expected to almost exclusively remain at the mercy of the US-China trade developments for the time being.

Bank Indonesia (BI) – 5.75%

Indonesia’s headline inflation remains stuck at the bottom of bank’s 2–4% target band, barely budging above 2%. With consumer spending only gradually picking up, prices are forecast to drift toward the midpoint, but not fast enough to derail the central bank’s dovish swing. That breathing room gives BI the green light to chop rates further while keeping a watchful eye on the Rupiah (IDR). Tactical FX interventions will smooth out currency swings and stamp out any imported price shocks, part of a delicate balancing act to stoke growth without sacrificing price stability.

Meanwhile, Jakarta now faces a fresh headwind: Washington’s newly imposed 32% tariff on Indonesian exports. The duties threaten to crimp trade volumes and deepen IDR demand pressures, testing the central bank’s resolve to both ease monetary policy and defend the currency in equal measure.

Upcoming Decision: April 23

Consensus: Hold

FX Outlook: The Indonesian Rupiah (IDR) appears to have regained some composure after dropping to historical lows vs. the Greenback earlier in April, with USD/IDR briefly flirting with the key 17,000 hurdle. Despite this gain of traction, the IDR is widely anticipated to remain under scrutiny in light of the rising uncertainty in global trade trends.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.